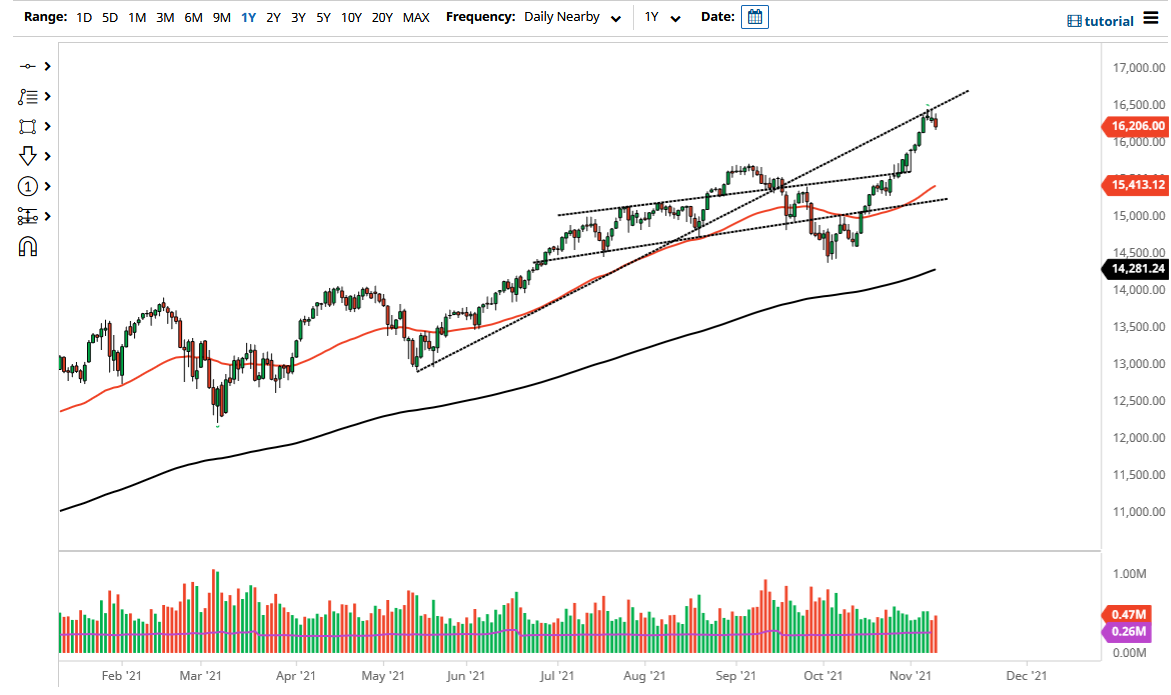

The NASDAQ 100 initially shot higher on Tuesday but gave back gains in order to show signs of exhaustion. This is something that we needed to see for some time, so I welcome this move. This is a market that I think continues to see a lot of noisy behavior, and I do think that we have further to go to the downside. This is not a sign to start selling, simply a signal that we are going to continue to see a little bit of a healthy correction.

The 16,000 level would be an interesting area to get involved, as it is a large, round, psychologically significant figure. That being said, it does not necessarily mean that 16,000 is an area where we need to see support, just an area that would make sense. Underneath there, we have a significant amount of structural support near the 15,600 level. This is an area that could offer a bit of buying pressure yet again, in what is a very bullish market. The market has plenty of traders out there willing to pick up value when it occurs, so in other words, we will go lower and simply find plenty of buyers.

After that, then we have the 50-day EMA which is of course followed by technical traders and is starting to curl higher. This is something that I am looking forward to, because tech stocks continue to be one of the best places to put money to work in the short term. If we see a massive selloff, 15,000 could be targeted, but I think anything below there would be a bit of a stretch at this point in time. After all, we have a certain amount of chasing out there by underperforming managers between now and the end of the year. If you are a large fund manager and you are underperforming your benchmark, you need to buy every dip that comes along between now and your reporting of outcome to your clients. This is what is known as the “Santa Claus rally”, which I do believe that we have already started to kick off. Furthermore, even though the Federal Reserve is looking to taper, the reality is that it is still growing its balance sheet.