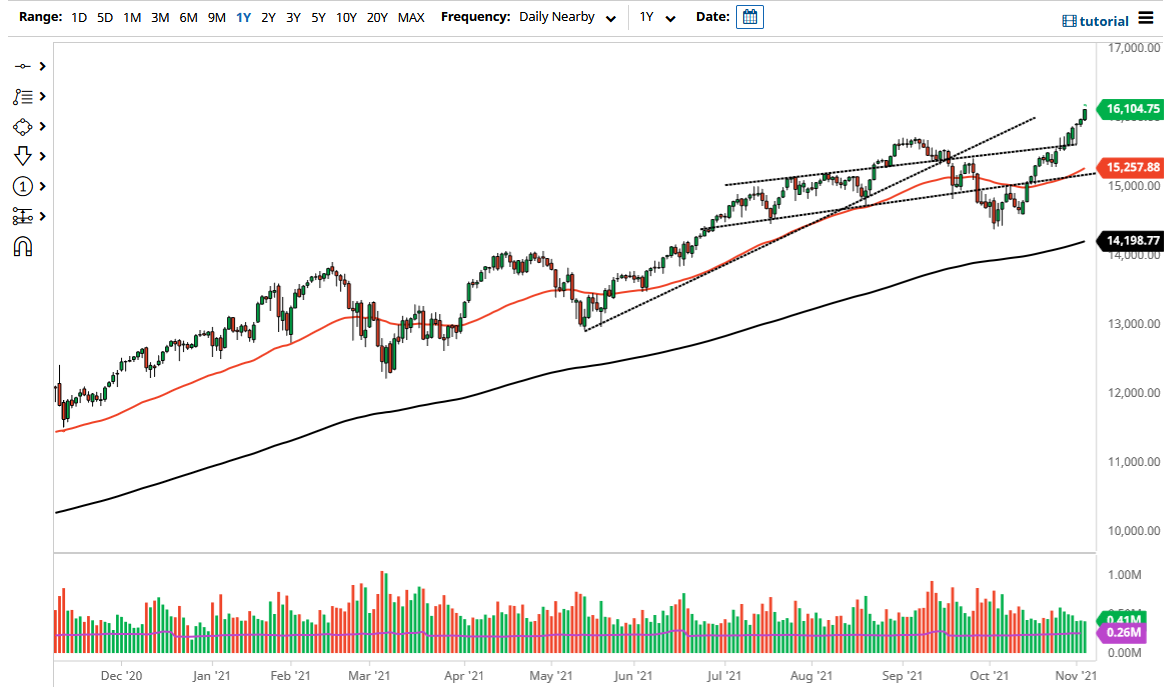

The NASDAQ 100 rallied significantly on Wednesday, especially after Jerome Powell announced basically what everybody had anticipated as far as tapering and quantitative easing is concerned. Because of this, the market is likely to see more upward pressure, and short-term pullbacks will continue to be buying opportunities. The 16,000 level should offer a little bit of psychological support at the moment, but we could pull back a little further than that and still find plenty of buyers.

The NASDAQ 100 needs to see a handful of major players out there pushing higher, including Facebook, Amazon, and others like Microsoft. As long as those continue to find plenty of interest, then the NASDAQ 100 by extension will continue to push this market higher. After all, it is not equally weighted, so there are just a handful of stocks that you need to follow.

Looking at this chart, it is obvious that there should be plenty of support underneath at the 15,600 level as well, and was the previous top of the channel, and the 50-day EMA is now sitting at the 15,258 level and is curling higher. In other words, everything at this point looks like we are going to continue to find momentum to push the markets higher, as that is what they do when you have a situation where it is all about liquidity.

It is not until we break down below the 14,500 level that I would be looking at the possibility of a significant pullback, but I do not see that happening anytime soon. If we were to have that happen, then I might be a buyer of puts, but I never short this market because of the inherent manipulation by central bankers to continue to push it to the upside. The market is nowhere near doing anything like that right now, and I think that every time we pull back at this point between now and the end of the year, traders will jump in and try to take advantage of any value that appears. Ultimately, this is a market that I think will continue to see a significant grind to the upside regardless of what happens next. In fact, we were accelerating into the end of the session.