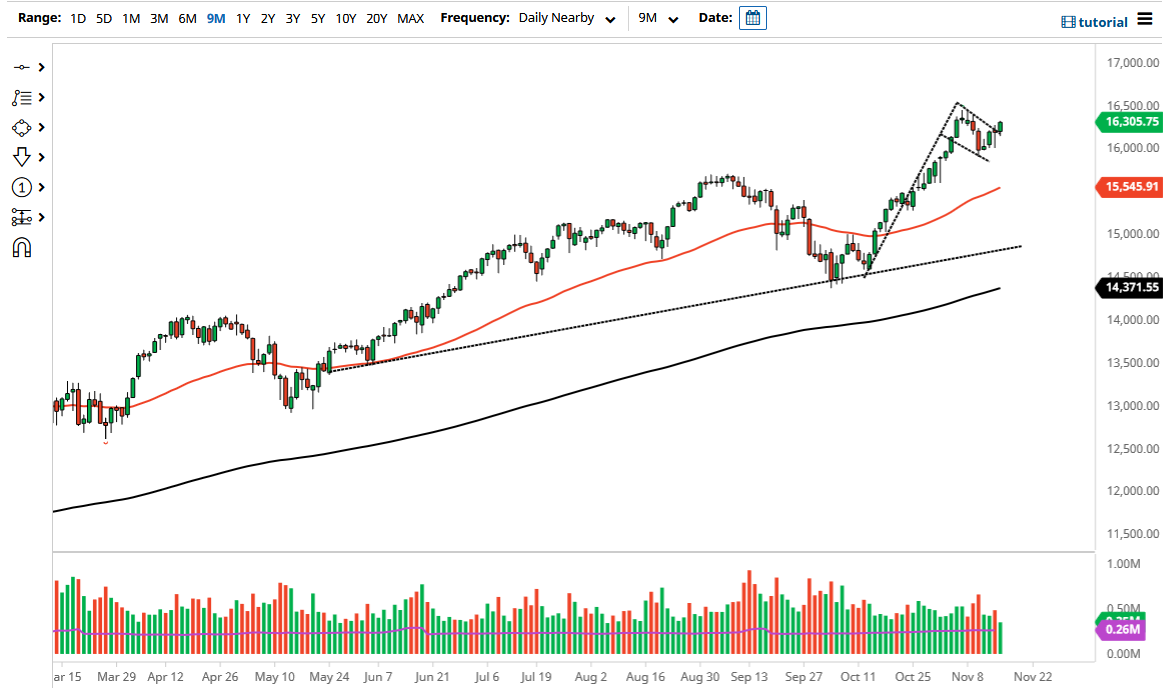

The NASDAQ 100 rallied to break above the 16,300 level, showing signs of life yet again. Ultimately, this market looks as if it is going to reach an all-time high again, probably sooner rather than later. By breaking above the top of the downtrend line that I have marked on the chart, we have kicked off the bullish flag that should send this market much higher over the longer term. With this, I think that it is only a matter of time before we try to reach towards the “measured move,” which would have the market looking at 18,300 by the time it was all said and done. That is a huge move from here, but as we have fund managers out there trying to chase returns, anything is possible.

Keep in mind that Tesla recently has been a bit of a battleground, so it should not be a huge surprise to suggest that perhaps the NASDAQ 100 has been influenced from this one particular move, and it is probably only a matter of time before that sorts itself out. Keep in mind that the NASDAQ 100 is only driven by about seven markets, and of course Tesla is one of the major ones. I think pullbacks at this point will continue to attract a lot of attention, and the 16,000 level should offer a little bit of a floor in the market currently. At this point, I think that any pullback has to be thought of as a potential buying opportunity, and I will certainly be willing to add to an already existing position.

This does not mean that you have to jump into the market with both feet, but I do think that given enough time you will be able to build up an impressive position. If you are already long of this market, there is nothing on this chart that leads me to believe it is going to continue to struggle anytime soon, so I look at every time we dip as a potential value play to take advantage of. The market almost certainly will be influenced by managers chasing returns at the end of the year as well, and earnings season has been relatively decent, so that does not hurt the situation either. As yields continue to climb in the United States, people continue to throw money at growth stocks, the forte of this index.