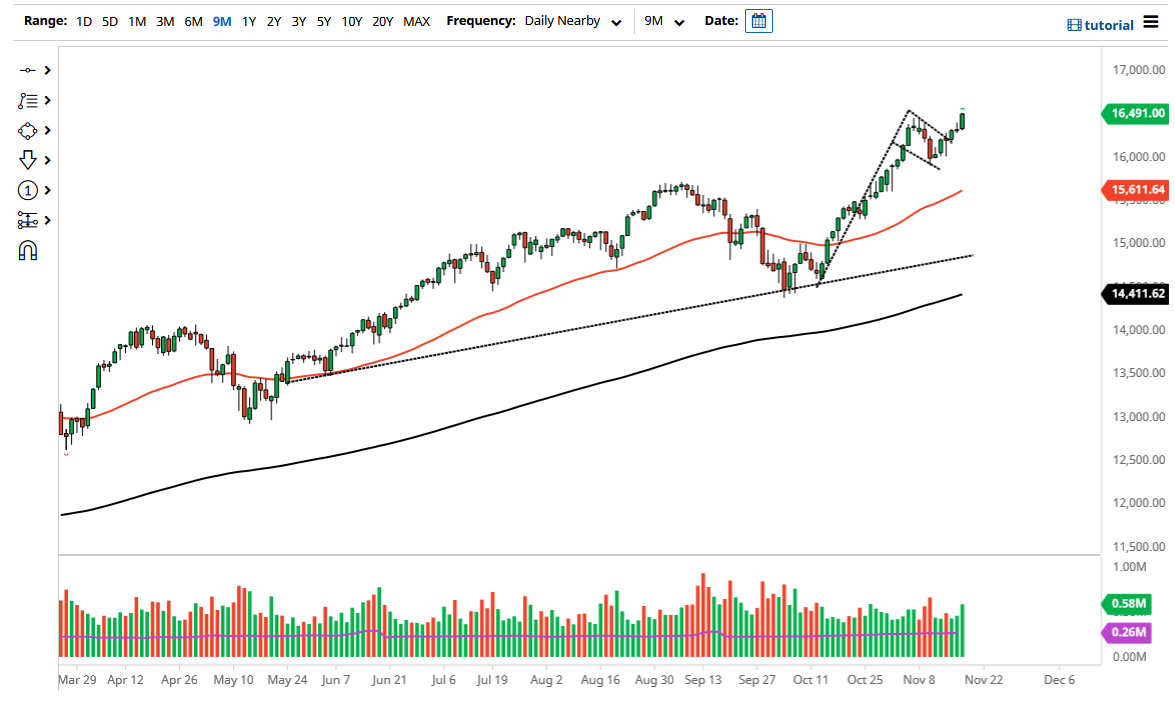

The NASDAQ 100 has rallied significantly during the trading session on Thursday to make all-time highs yet again, so at this point in time it looks like we are ready to continue rallying, and with that being the case it is very likely that we continue to find reasons to get long yet again. We have formed a massive bullish flag, and therefore I do not have any interest in trying to short this market. The length of the flag suggests that we could go looking towards the 18,000 level, but that obviously is a longer-term target.

Looking at this chart, I believe the 16,000 level will offer a significant amount of support, especially as the 50 day EMA is starting to race towards it. All things been equal, there is only a handful of stocks that move this market, and those are all the ones that everybody loves. Because of this, I think this is a market that will eventually find its way much higher, and therefore it is possible that we have to watch just a handful of “Wall Street darlings” such as Tesla, Microsoft, and the like. With this being the case, the very likely that we continue to see buyers on dips, and that is how I think we will eventually get much higher.

As we are getting ready to go through the “Santa Claus rally”, it is likely that we continue to see a line of chasing. As long as the markets are getting ready to see a lot of money flowing into it, it makes a certain amount of sense that we continue to go higher. The bullish flag itself is well known and almost everybody in the markets can see it. In fact, I do not have a scenario in which a willing to short this market, but if we were to break down below the 15,000 level, then I might be able to buy puts at that point. Nonetheless, this is a market that looks very strong, and I think it will lead the way when it comes to indices in the US. Ultimately, we will continue to see plenty of momentum here, especially as we have closed towards the very top of the range, which typically means that you are going to see quite a bit of follow-through.