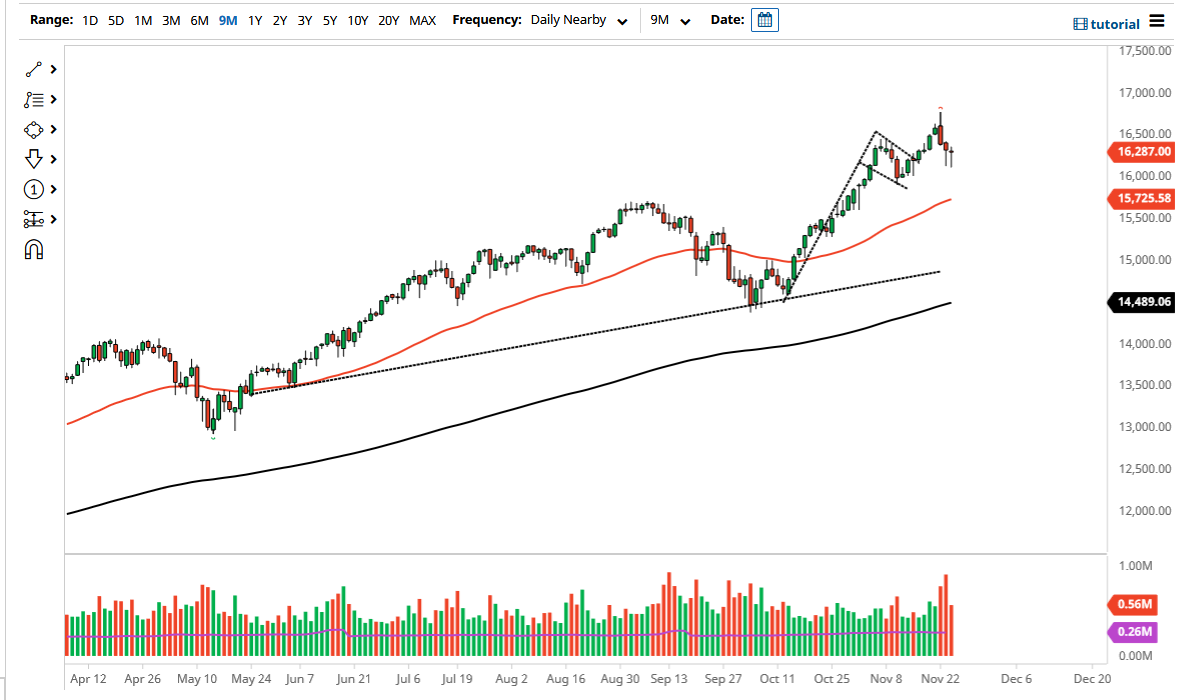

The NASDAQ 100 fell initially on Wednesday again, as it looks like the buyers are willing to come in and jump towards this market as it gives value every time it pulls back. I think that this market will more than likely see a lot of value hunters coming back into this market every time they get an opportunity. With this being the case, I look at this through the prism of buying dips as we head towards the end of the year.

Remember, this is a market that will be chasing gains all the way to the end of the year, as a lot of money managers out there will have to participate in the so-called “Santa Claus rally”, when they have to make up for a lack of returns. This is a well-known phenomenon, so a lot of traders will do what they can to take advantage of this. With that being the case, I do think that we will continue to go higher and would not be surprised at all to see this market reach the highs again sometime in the next couple of weeks. Keep in mind though that Thursday is Thanksgiving and the underlying index will be open.

The futures market will be open for a couple of hours late in the day before we roll over into Friday, and the underlying index itself will be open for about half of the day on Friday, so the conditions will be illiquid at best. I think the biggest testament to what happened towards the end of the day is that traders are not willing to go home short of this market, especially over a four-day stretch of limited trading/holiday. With this, I think the market will continue to go higher over the longer term and I look at every dip as a potential buying opportunity. I recognize that the 50-day EMA is near the 15,725 level, whch is an area that should offer quite a bit of dynamic support that people will pay close attention to as well. With all of that, I think it is probably only a matter of time before you start to load up your position going into the end of the year. I have no scenario in which I sell this market, especially this time of year.