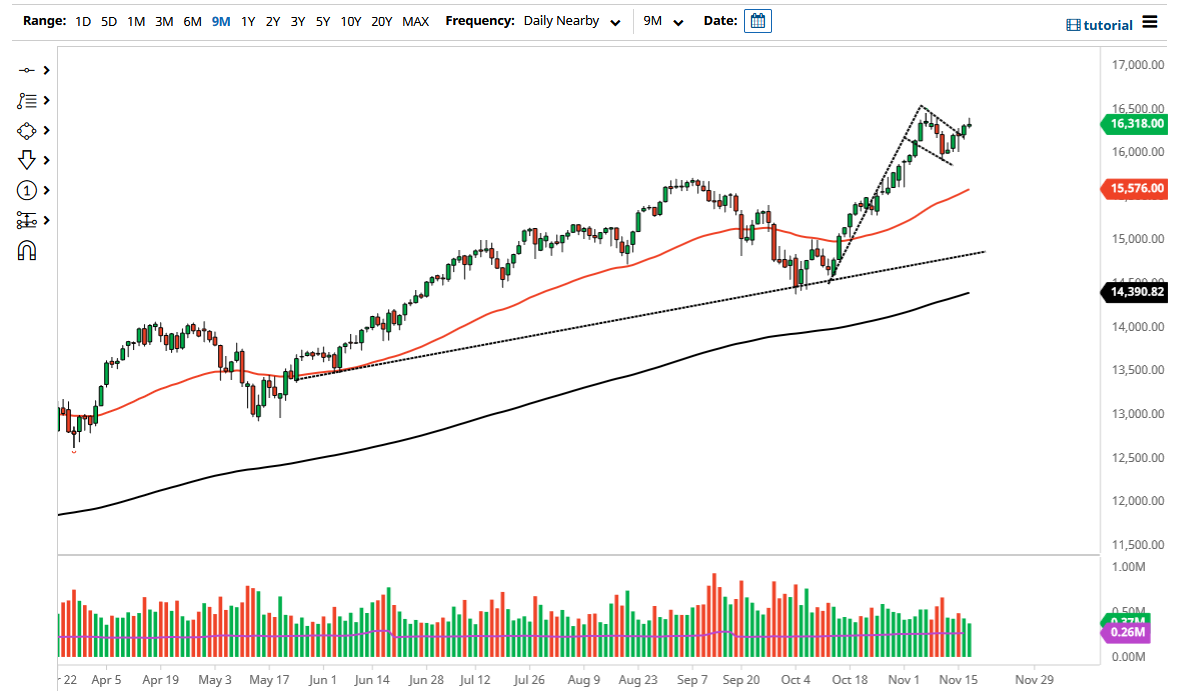

The NASDAQ 100 initially rallied on Wednesday but gave back the gains in order to show signs of weakness. Ultimately, this is a market that had recently broken out of a bit of a funk, which ended up forming a bullish flag. Because of this, the market is likely to continue to see reasons to go higher given enough time. The measured move of the flag is an attempt to get to the 18,000 handle. The 16,500 level above continues to be crucial, so I like the idea of taking advantage of dips as value. The market should see plenty of support all the way down to at least the 50-day EMA at the 15,575 level.

The candlestick for the day is a shooting star, so it does not necessarily suggest that we are ready to rip to the upside, but obviously short-term pullbacks should continue to show signs of value that people are willing to take advantage of. Because of this, the market is likely to be more of a “buy on the dips” situation going forward, as we continue to see plenty of buyers every time there is a little bit of value. Ultimately, this is a market that I think will show itself to be very bullish over the longer term, and as traders trying to make up for their lack of gains for the year, I think the next couple of weeks will be very bullish overall. After all, it is only realistically the “NASDAQ 7” or maybe a little bit more, as it is just a handful of stocks that make up a huge portion of the index, so it is likely that we will continue to see an overreaction to such things as Tesla, Microsoft, and Google. As long as those stocks go higher, it is only a matter of time before the market then goes much higher. I will not short this market, as the Federal Reserve does everything it can to keep Wall Street positive over the longer term. With this, you should look for buying opportunities and take advantage of them as they occur. We may get one over the next couple of days but at this point it looks like we are simply spinning our wheels trying to find some type of momentum.