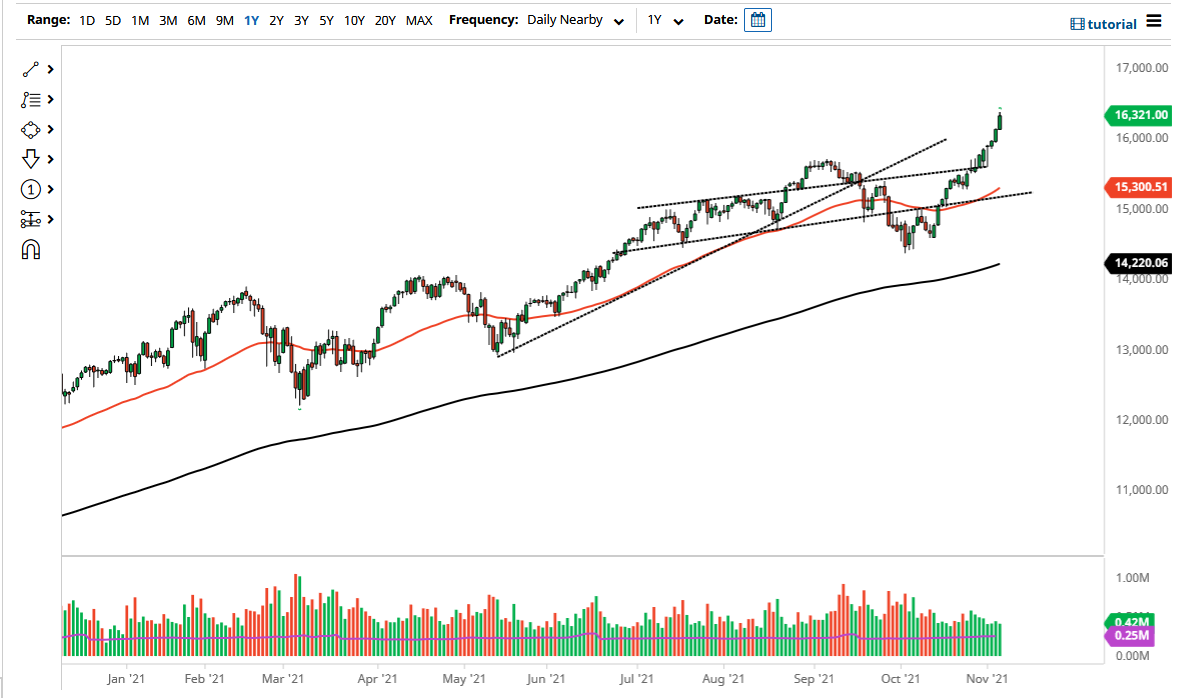

The NASDAQ 100 has gone a bit parabolic over the last couple days, as the Federal Reserve is now out of the way. That being said, we have crossed the 16,300 level, and the NASDAQ at this point is getting a bit too expensive for me to get excited. Quite frankly, I have no interest in shorting this market, but we are in the stratosphere at this point in time, so we do need to see a little bit of pullback. At this point, a pullback is desperately needed, and I think is likely to happen. Underneath, the 16,000 level will of course be a support level as it has been an area of short-term noise, but it is also a large, round, psychologically significant figure.

Underneath there, we have the previous uptrend line which sits at about 15,600, and then the 50 day EMA that is at the 15,300 level and rising at this point in time. At this point, I think any pullback will be thought of as a buying opportunity based upon value more than anything else.

The size of the candlestick is very bullish but at the end of the day I think you also have to look at this through the prism of the longer-term, as we continue to see plenty of buyers. Ultimately, their only a handful of companies that move the NASDAQ, and that is essentially what you need to be paying attention to more than anything else. Keep in mind that the “Wall Street darlings” such as Tesla, Microsoft, and Amazon all have an extraordinarily overweight effect on this market. In other words, it is only a handful of stocks you need to pay attention to.

Any pullback at this point in time will more than likely be bought into because the market is starting to go a bit parabolic, which means that risk appetite has shot through the roof yet again. This is a market that does tend to move rather quickly, so unless we see some type of blockbuster type of jobs number, I anticipate that you are best waiting to see whether or not there is a pullback that you can take advantage of. To simply buy at this level is not only chasing the trade, but it is flirting with pain for too much for a market that eventually needs to find gravity.