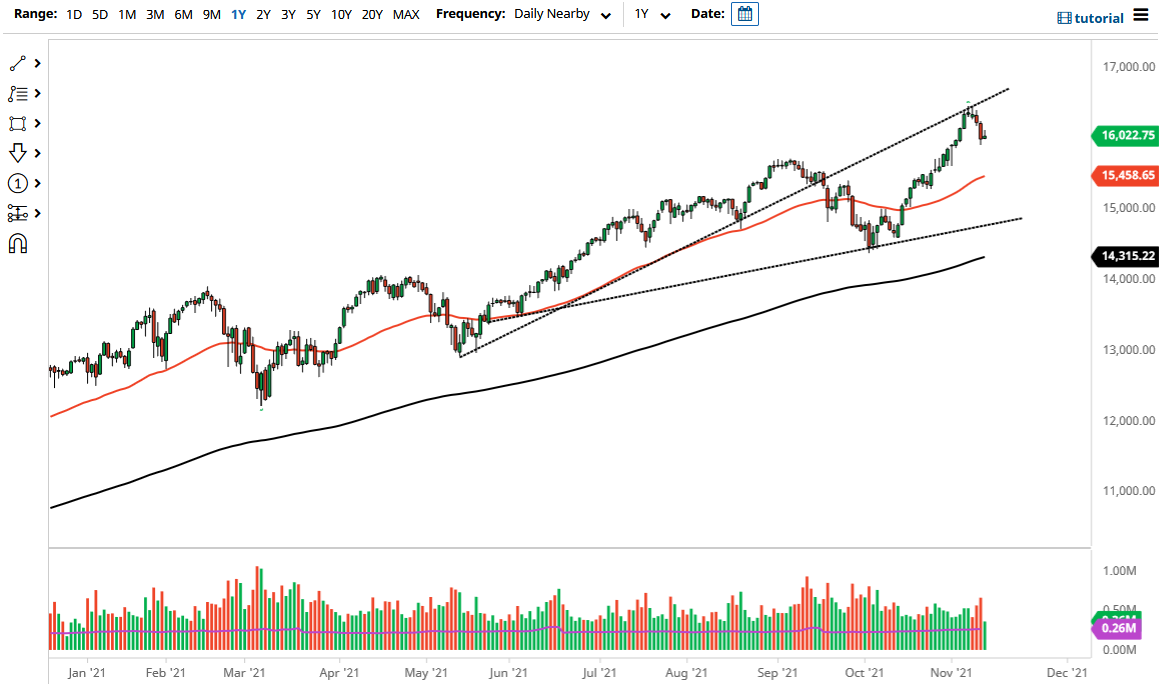

The NASDAQ 100 has bounced ever so slightly during the trading session on Thursday as the 16,000 level looks to be somewhat supportive. With that being the case, it is very likely that we will continue to see this market trying to recover. Nonetheless, we could drop even further before finding a bit of value, with my first area of real interest at the 15,750 level. Regardless, I have no interest in shorting this market as the NASDAQ 100 is very volatile, typically with volatility looking towards the upside.

The 50 day EMA is sitting at the 15,460 level and continues to go much higher. You can see that we had previously tried to break above the previous uptrend line, and it did of course offer a little bit of market memory. I do believe that eventually we will see plenty of buyers, but I would love to see this market pull back even further before I got involved. The market had gotten way ahead of itself for some time, and I do think that is something that you need to keep in the back of your head.

The “floor the market” is probably closer to the 15,000 level, which is 1000 points below where we are right now. Nonetheless, the market cannot be sold regardless, but if we did break down below the 15,000 level, then I might be willing to buy puts. This is a good way to limit the damage that can be done by trying to short an index that is so highly manipulated by the Federal Reserve and of course the overall Wall Street narrative. That being said, the strengthening US dollar may actually offer a little bit of support for the NASDAQ 100, because people will start to look for growth oriented stocks if they have to worry about trying to find something to be inflation. You should also keep in mind that the move by Tesla over the last couple of days has been a major weight around the neck of this index, as it is not a equal weighted index. It only takes a handful of stocks to move this market, so you have to keep in mind that you have to pay attention to all the usual “Wall Street darlings.” The markets are highly influenced by all of the best known names.