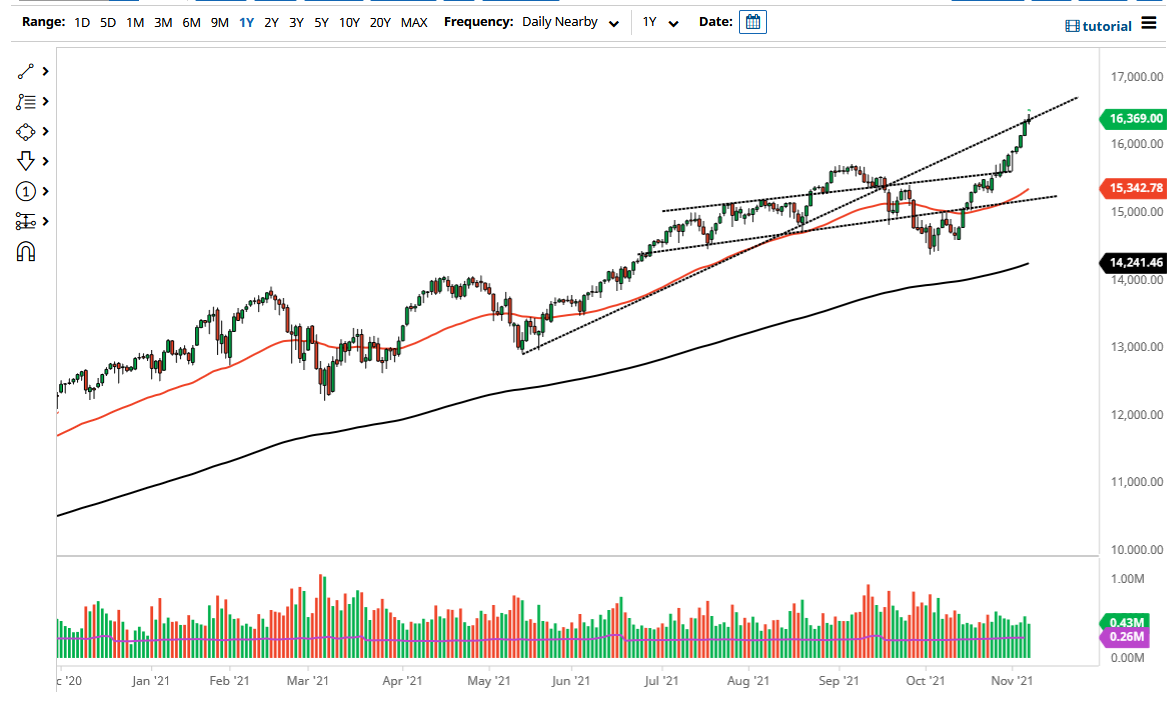

The NASDAQ 100 initially shot higher on Friday, but as you can see, we have given back quite a bit of the gains. The 16,500 has offered quite a bit of resistance and I think we could get a little bit of a pullback. Quite frankly, the pullback would be a good thing, due to the fact that we had gotten far too ahead of ourselves. Yes, this is a very bullish market, but it does not necessarily mean that we need to get to 20,000 overnight.

At this point in time, I believe that any pullback will be thought of as a potential buying opportunity, especially near the 16,000 level. If we break down below there, then it is likely that we go looking towards the 15,500 level. The support level right around the 15,500 figure should be interesting, especially now that the 50-day EMA is racing towards it. Pullbacks should be thought of as buying opportunities, as this is a market that is likely to see plenty of buyers every time it offers a little bit of “value.”

If we break above the top of the shooting star for the session on Friday, we could get a little bit of a “blow off top.” That being said, I do not like that option, because it could lead to a much bigger pullback. The market is likely to see a “buy on the dips” attitude, and I am much more comfortable trying to find some type of value in a market that has chosen not to recognize gravity. Eventually, gravity will reassert its effect, but I do not think that we will break down. In fact, the 15,000 level underneath would be a major area of support, so if we were to break down below it, that would be very negative. Nonetheless, I think that is nothing close to being possible, and if it did, I would be a buyer of puts more than anything else. Looking at this chart, we have not had a red candle in several weeks, so we desperately need to print at least one, if not a couple so that we could see some type of normalcy heading back into the markets. I suspect the beginning of this week could be a bit of a pullback, and then perhaps buyers could get involved late.