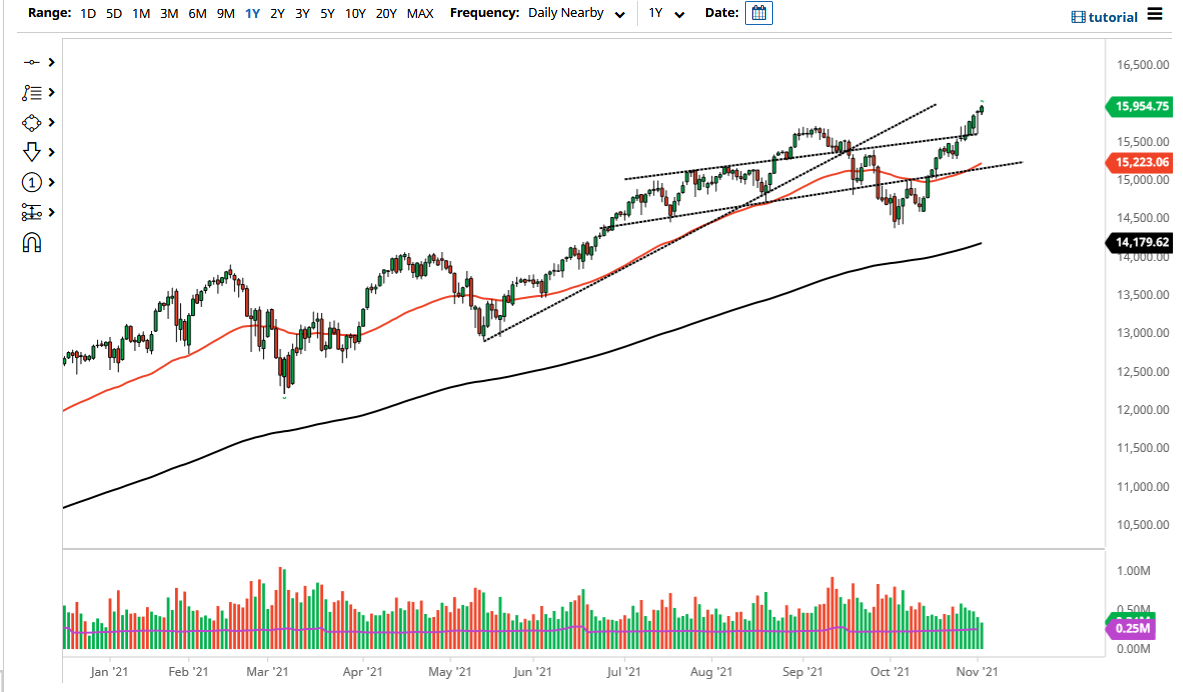

The NASDAQ 100 rallied a bit on Tuesday to test the 16,000 region. At this point, it is probably only a matter of time before the market continues to go even higher, as we have been in such a bullish run. We are in the midst of earnings season, so that does suggest that perhaps we could get a few catalysts here and there. It should be noted that the candlestick for the trading session on Monday was very bullish, and we have broken above there. Ultimately, I do think that this is a market that will go much higher, perhaps reaching towards the 16,500 level rather quickly.

Looking at this chart, I think it is only a matter of time before buyers would come in and pick up dips, with the 50-day EMA underneath offering a bit of a “floor in the market” closer to the 15,225 level. The NASDAQ 100 has been extraordinarily strong for some time, so I do not have any interest in trying to get too cute with this, especially as we continue to see a lot of volatility. After all, in the after hours, we could get some type of announcement when it comes to earnings that rocks the market, so you do not want to get too over-stretched. That being said, the market continues to see a lot of momentum, but that does not necessarily mean that we need to see it take off right away. We could get a little bit of a pullback only to offer value.

At this point, the 200-day EMA sits just below the vital 14,500 level, which for me is the absolute bottom of the uptrend. As long as we can stay above there, then I am still looking for buying opportunities, especially as a majority of the technology companies continue to show real gains. Remember, the NASDAQ 100 really should be thought of more or less as the “NASDAQ seven or so,” because it is just a handful of companies that push this market higher. It is all the usual “Wall Street darlings” including Tesla, Microsoft, and Amazon that matter. Everybody else is all but an afterthought, so I do not bother paying too much attention to them unless they are all falling.