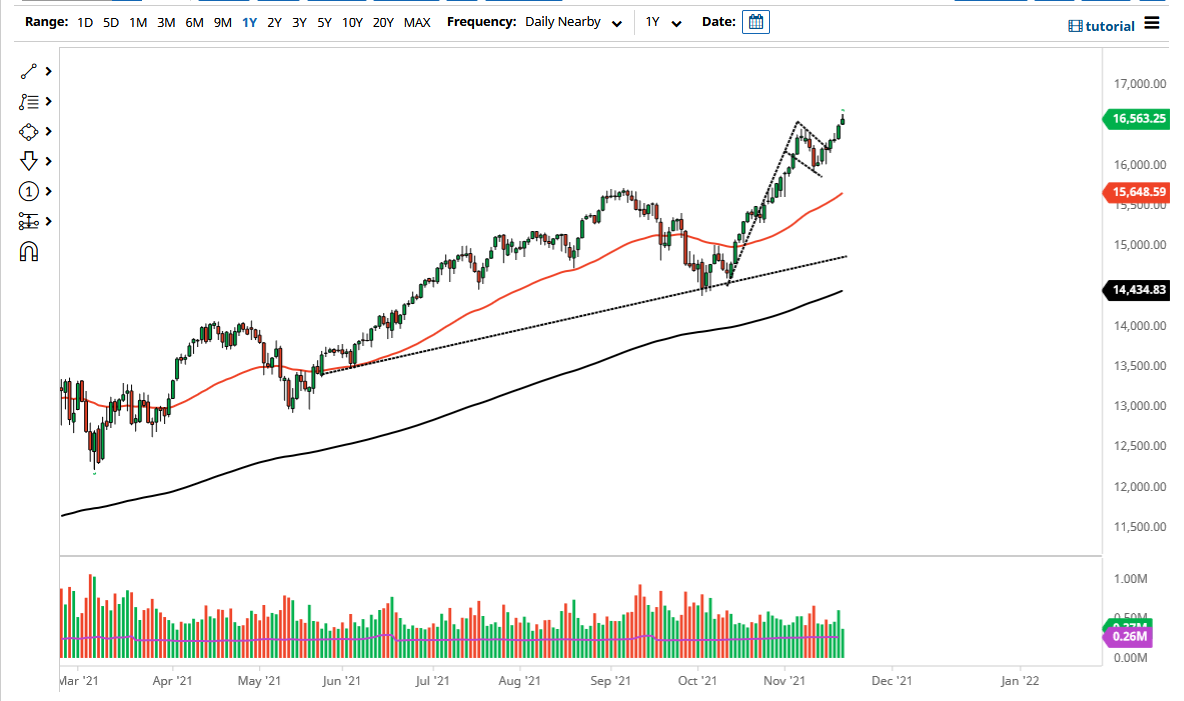

The NASDAQ 100 rallied a bit on Friday, heading into the weekend on a good foot. With this being the case, the market is likely to continue see buyers underneath, as we have broken above the top of a bullish flag. Given enough time, I do think that we will find plenty of support extending lower, at least to the 16,000 level.

While we did give back some of the gains late in the day, the reality is a lot of traders probably needed to get flat heading into the weekend, and it is rare that you see a candlestick close at the very top or bottom of the range heading into the weekend, so this is not a huge surprise at all. Nonetheless, the overall attitude of this market is very bullish, and I look at any pullback as a buying opportunity. Conversely, we could break above the top of the candlestick, and that should send this market much higher, perhaps kicking it into top gear.

We have the “Santa Claus rally” this time of year, as money managers try to catch up to their benchmarks. Those who have underperformed for the year have to buy every dip, and most people know this. Because of this, even those who have not struggled this year will continue to buy dips also, in order to continue making even more money. In other words, there is a bit of a protective put in place this time of year in most circumstances.

The bullish flag that I have marked on the chart measures for a move to the 18,000 level given enough time, but you can see that the market has already broken above the top of the flag, and it certainly shows nothing in this chart that suggests we cannot continue to rally. I think that as long as we can stay above the 50-day EMA, you have a good shot at going higher on any bounce. The market will continue to follow just a handful of stocks as it typically does, due to the fact that it is not equally weighted. In other words, if Tesla, Microsoft, and others like that rally, this market will as well. As Tesla has been recovering, I think that will cause a little bit of momentum to pick up.