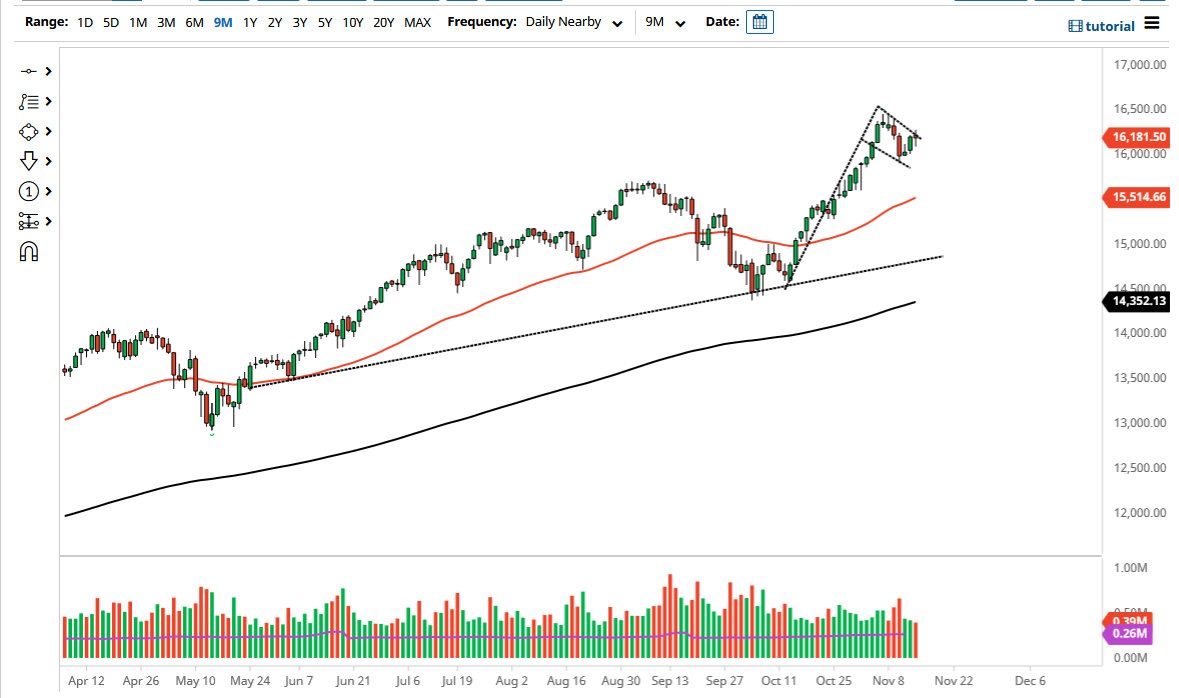

The NASDAQ 100 has initially pulled back on Monday but has seen enough buying pressure to turn things around and show signs of life. By doing so, it looks as if we are going to continue to try to break above the top of the bullish flag, which is the same pattern that I see in the S&P 500. This is a market that I think will go much higher given enough time.

Keep in mind that Tesla was a major contributor to the breakdown, but the rest of the stock market seems like it is doing fairly well. As long as that is going to be the case, the NASDAQ 100 might be a bit sluggish, but over the longer term it is likely that we will continue to go higher. The size of the flag could go in the favor of traders to go looking towards the 18,500 level above. The 50-day EMA underneath is near the 15,500 level and is curling higher. Because of this, the market is likely to continue to see plenty of value hunters.

The uptrend line now coincides roughly with the 15,000 level below, which suggests that we have a bit of support coming into the market, and it is likely that we will continue to see that as the “floor in the market” going forward. The NASDAQ 100 is driven by just a handful of stocks, so it does not surprise me at all that the massive selloff in Tesla has had such a negative effect. The candlestick for the trading session on Monday was a bit of a hammer, so if we can break above the top of it it likely will open up the possibility of a much bigger move. On the other, if we break down below the bottom of it, then it is likely we would go looking towards the bottom of the bullish flag being formed. Either way, I think that pullbacks are going to be short-term at best, so I do not have any interest in trying to short this market. The NASDAQ 100 continues to outpace many of the other indices that I follow, and I think that is probably going to be a reccurring theme over the next several weeks.