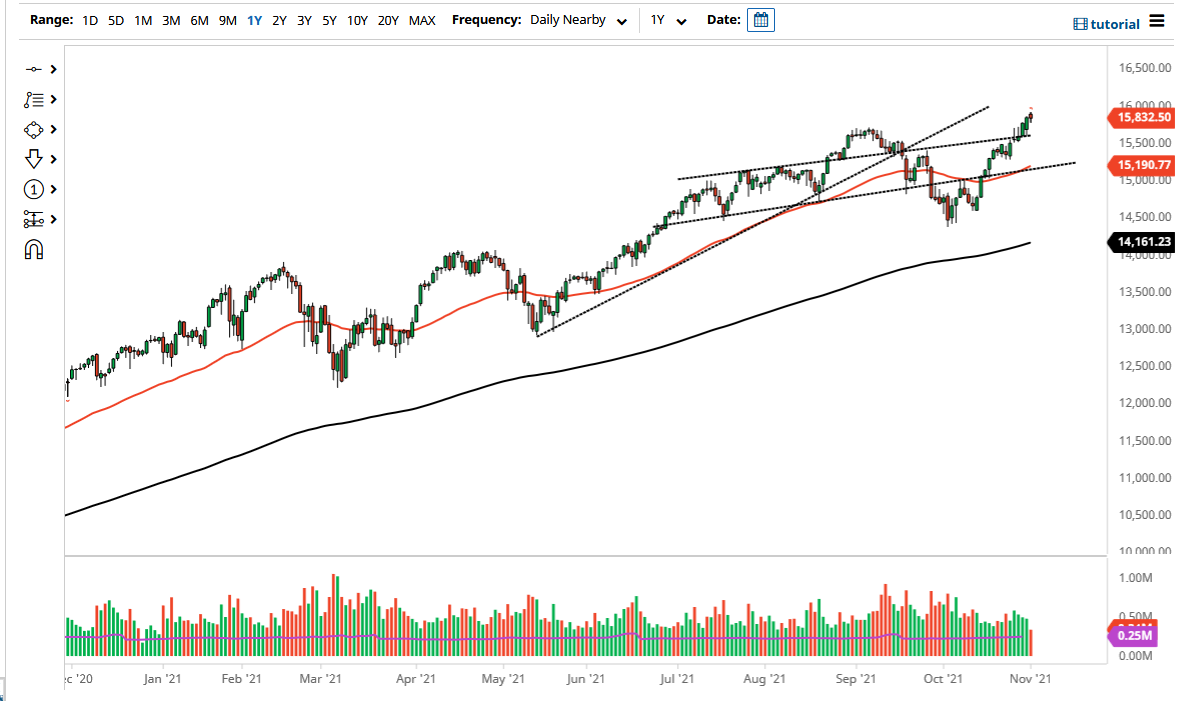

The NASDAQ 100 initially dipped just a bit on Monday, but then turned around to show signs of life again. At this point, the market looks as if it is ready to continue grinding away to the upside, with the 16,000 level being the next big figure that people are paying close attention to. The 16,000 level has a certain amount of psychology attached to it, but at the end of the day it is just that, a psychology-related number. In other words, there is no real reason to think that this market will fall apart.

At this point, the 15,500 level would be supportive, followed by the previous uptrend line which is basically where the 50-day EMA currently resides. In other words, there are multiple areas where value hunters may come back into this picture and try to pick up “cheap contracts.” We are in the midst of earnings season, and there are a lot of technology names out there getting ready to report, so that should continue to drive this market going forward. I think that ultimately, we have plenty of reasons to think that the market will do what it has done for the last 13 years or so. The buyers come back into this market every opportunity they get, and I think that will continue to be the case going forward.

It is not until we break down below the 14,500 level that I would consider buying puts, but we are so far removed from that happening that it is nothing worth suggesting anytime soon. With this being the case, the market is likely to see plenty of longer-term holders jumping into this market every time they get an opportunity to add to a position. With that being the case, I think we will go higher over the next several weeks, but we are a little extended and we may have to consolidate back and forth in order to digest some of the recent gains. At this point, it certainly looks as if there is nothing on this chart to suggest that we are going to fall, but markets do not go in the same direction forever, so it is obvious that we need to see a little bit of gravity re-enter the picture, but it should not be too bad.