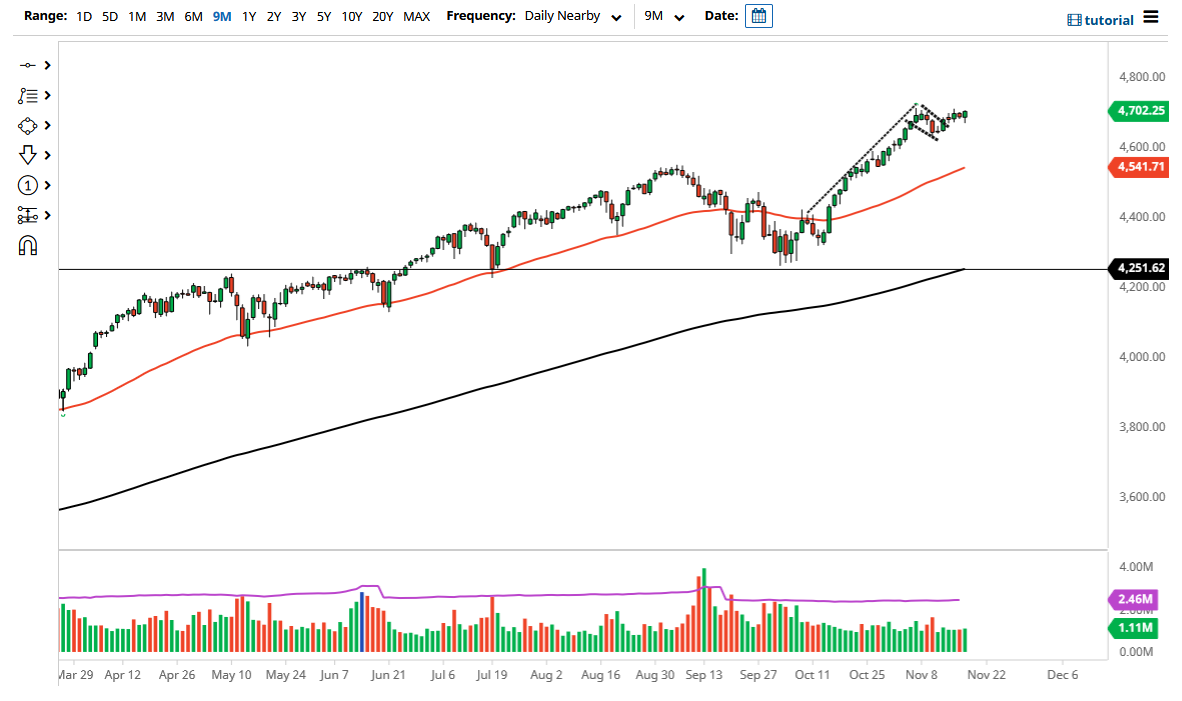

The S&P 500 has pulled back a bit during the course of the trading session on Thursday to show signs of weakness but found enough support at 4665 to turn things around and show signs of strength again. This market is likely to continue to go much higher, as we are broken above the bullish flag that recently had formed. The measured move suggests that we could go to the 5000 handle, which of course is a large, round, psychologically significant figure. All things been equal, the market is likely to continue to see a lot of buyers as we have a major “Santa Claus” rally just waiting to happen.

The “Santa Claus rally” of course is a well-known phenomenon at the end of the year as the fund managers out there that have not kept up with the markets will have to buy every dip in order to pad their results for the year. That being the case, the market is likely to continue to see plenty of buyers underneath that could come into the picture and pick up value every time it happens. The 50 day EMA of course is an area that would attract a lot of attention, as it is sitting at roughly 4540. With this being the case, the market is likely to continue to find plenty of people underneath willing to pick this market up. To the upside, the 4800 level would of course be an area that could cause some issue from a psychological standpoint, and we may get a little bit of profit-taking there.

We have been getting quite a bit of noisy behavior in general, and therefore it is likely that we will continue to see volatility come into the picture, but one thing I think you cannot do as per usual is to short this market. Perhaps at this point in time you should look at the 4250 level as the absolute “floor the market”, so it is almost impossible to get negative on this market. If we do turn around and see this is a market that starts to selloff, I might be a buyer of puts, but that is as far as I would take it.