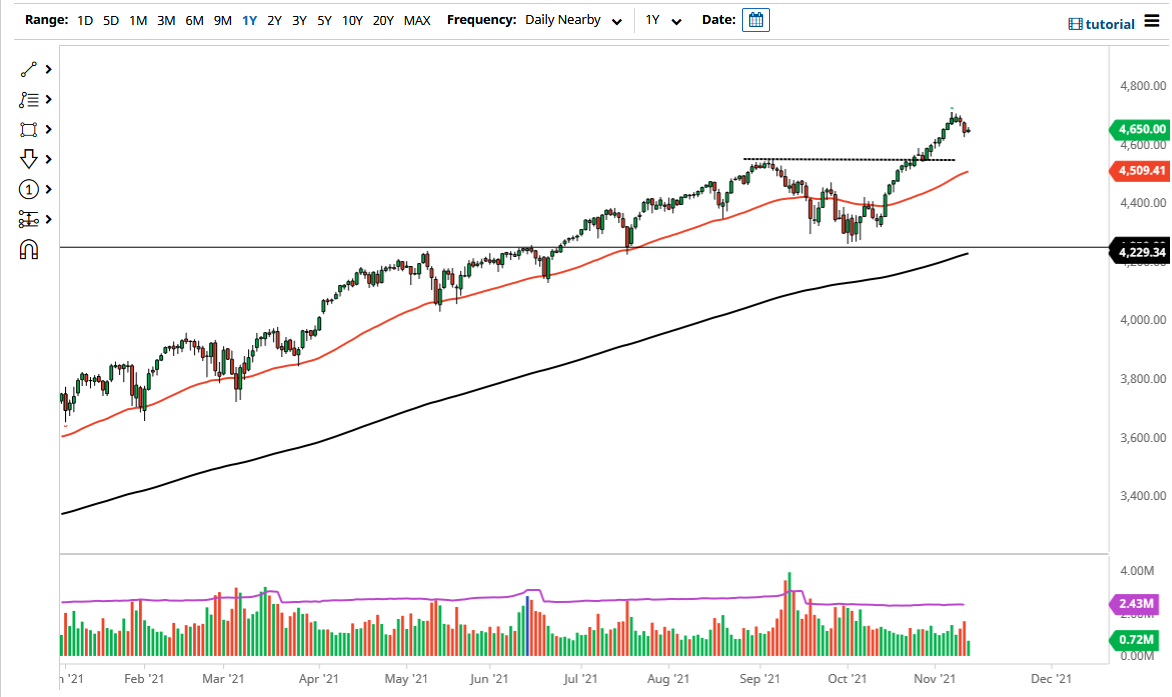

The S&P 500 went back and forth during the trading session on Thursday, as we have stabilized near the 4650 handle. This is a good sign, because quite frankly the market had fallen rather hard on Wednesday. Nonetheless, this is a market that has been a bit overdone for a while, so at the very least a little bit of a pullback would make a certain amount of sense. Beyond that, you could be looking at a potential sideways move, both of which could help alleviate some of the pressure from the parabolic attitude that we have had.

The market could have further to go to the downside, so quite frankly the fact that we stabilized it is the first thing you needed to see, but at this point I still believe that we are far so overdone that we need to find a little bit of value going forward. Underneath, the 4600 level is an area that could see a certain amount of support, right along with the 4550 handle which was the previous highs. The 50 day EMA is reaching towards that level as well, so I do think that it is only a matter of time before value hunters come back into the S&P 500.

Interest rates are rising in America, so that could create a little bit of a drag on the stock market, but quite frankly we are nowhere near having interest rate high enough to make stocks unattractive, so I do think that the market will continue to find plenty of buyers. If we do break down from here, the absolute “floor the market” is near the 4250 handle. The 4250 handle is the most recent swing low, so a break down below that would be extraordinarily ugly. It also matters that the 200 day EMA is sitting there, so I think there should be plenty of buyers in that region.

The market does tend to be impulsive, but at this point in time it is very likely that we would see plenty of people willing to take advantage of it once it gets cheap, but at this point in time we are not at a cheaper level, so keep that in the back of your head. To the upside, I believe that we will eventually go looking towards the 4800 level, possibly even the 5000 level.