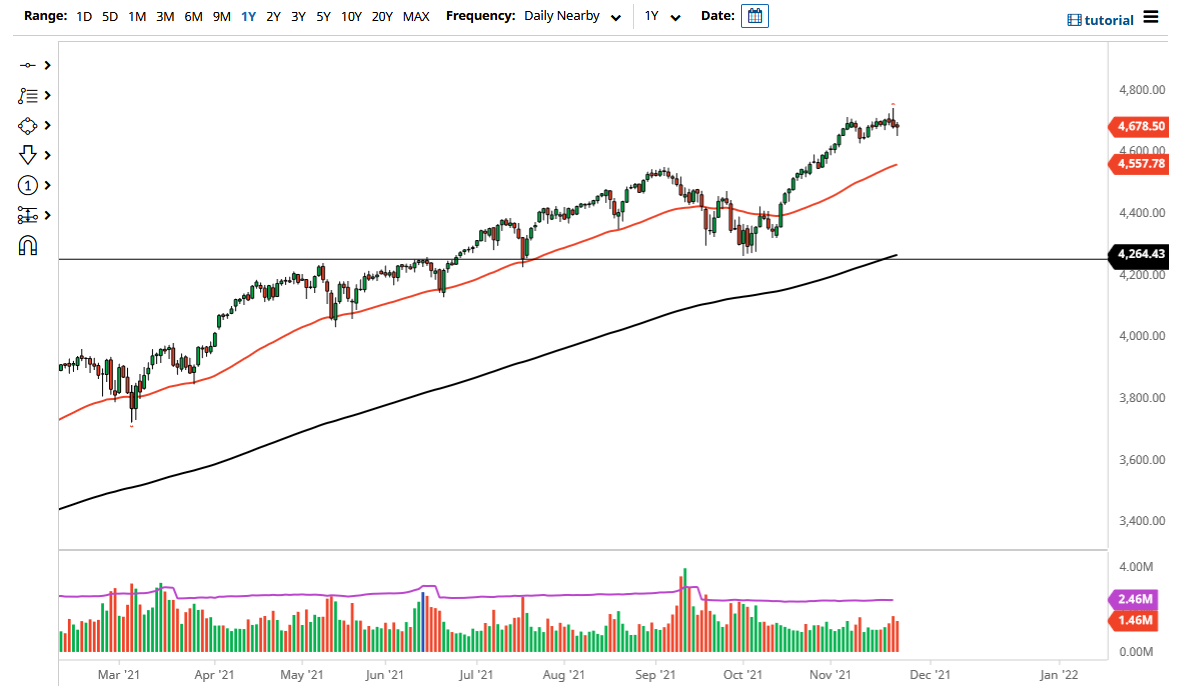

The S&P 500 fell a bit on Tuesday to reach down towards the 4650 level, before we see buyers come back in and pick this market up. Ultimately, they ended up forming a bit of a hammer, which is a bullish sign, so I think it is only a matter of time before we continue to push to the upside. This makes sense considering that we are still looking at this as a “buy on the dips” type of situation. The 4600 level will offer a certain amount of psychological support, especially as the 50-day EMA is reaching towards it.

When you look at this chart, you can see that we have been consolidating in a bit of hesitation and where it has been a very strong move to the upside. It is very difficult to imagine a situation where you can start shorting this market. After all, we have the “Santa Claus rally” heading into the end of the year, as money managers have to make up for missed opportunities, or worse yet, negative returns. Ultimately, the 4800 level is a target over the longer term, and after that then you start looking towards the 5000 level.

The overall attitude of the market has been bullish for quite some time, and this has been the case since the Great Financial Crisis for the most part. After all, the Federal Reserve will do everything they can in order to lift the markets if they fall too much. Recently, we have even had a few scandals involving Federal Reserve members day trading the markets! In other words, if the market is rigged to go to the upside, there is no point in trying to fight it. In fact, the indices are designed to go higher, due to the fact that they are not equally weighted. There are only a handful of stocks that move these indices, so as long as you are paying intention to the “Wall Street darlings” such as Microsoft, Apple, and the like, you get a general idea as to where this market is going to go. Regardless, the reaction later in the session on Tuesday suggests that we are going to go higher.