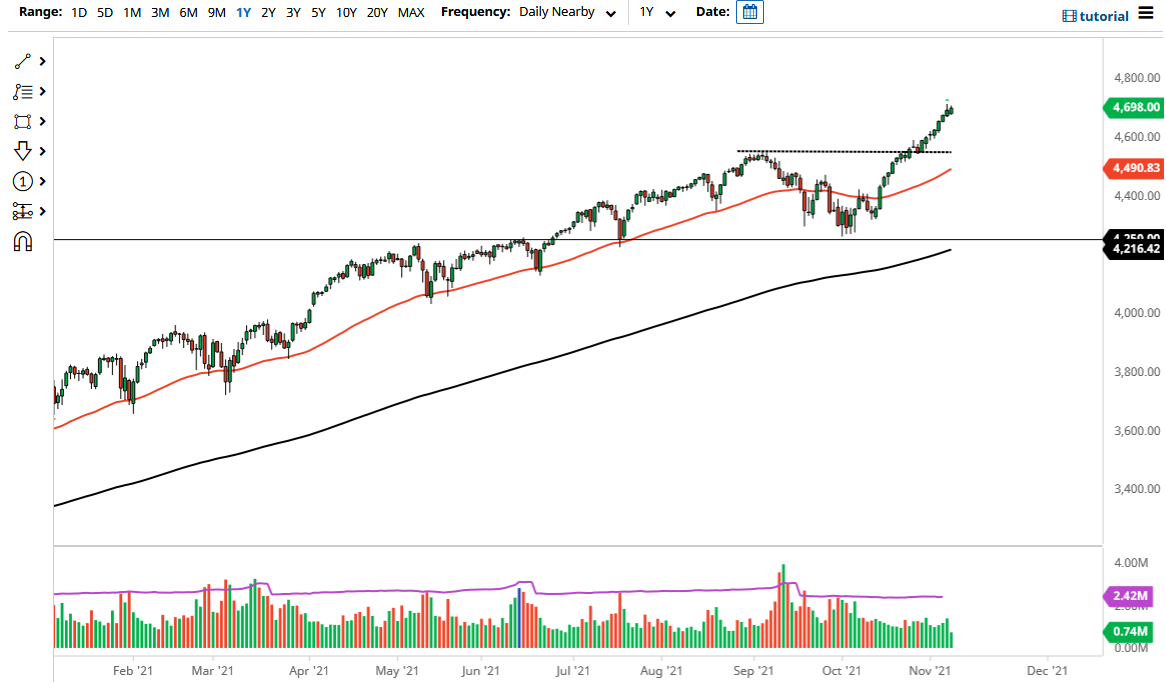

The S&P 500 has shown itself to be bullish yet again on Monday, but I am a bit concerned about the overall attitude of the market as it has been straight up in the air for a while. In other words, this is a market that is probably overbought on just about any metric you use. Nonetheless, you clearly cannot be a seller, as it has been so strong. I believe that the 4600 level underneath should be a significant amount of support, and then the 4550 level that was the previous high.

Looking at this chart, the 50-day EMA is also starting to race towards the 4500 level, an area that will attract a lot of attention. When you see this market act the way it has, quite often you will get a significant pullback, and at this point I would like to see about 5%. Nonetheless, I am not going to short this market, because anytime you have tried to short this market over the last 13 years, it has been a gamble to say the least.

Looking at this chart, it is not until we break down below the 4250 level that I would be concerned about the overall trend, which is roughly a 10% drop. That is a typical correction based upon Wall Street definitions, so I would be all over this market on any sign of support after that type of move. Furthermore, we also have the 200-day EMA coming into the picture there as well, so it all ties together quite nicely. If we break above the highs of the Friday session, we could go much higher, but that could end up being a bit of a “blow off top.”

I am not willing to buy this market anymore, at least not until we get some type of clarity, and I think you need to find value to get that clarity. Yes, we are in the midst of earnings season and it is likely that we will see plenty of noisy behavior, so you need to be cautious but look for signs of support after pullbacks in order to take advantage of any fluctuations in this market. Markets do not go in the same direction forever, so please keep that in mind.