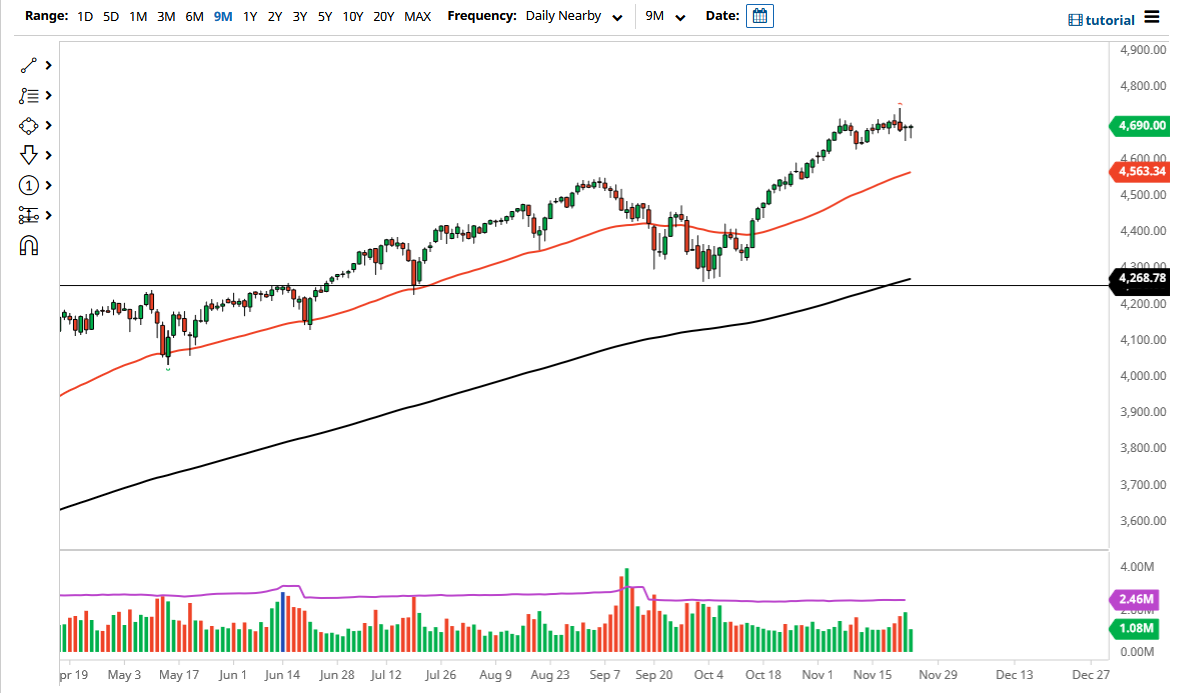

The S&P 500 fell a bit on Wednesday but has recovered quite nicely to form a bit of a hammer. This follows a hammer during the Tuesday session, and suggests that perhaps we have quite a bit of buying pressure underneath. This makes sense considering that the market tends to have the so-called “Santa Claus rally” this time of year, when money managers jump into the marketplace in order to catch up to benchmarks that they need to keep up with by the end of the year. In other words, there are a lot of desperate people out there trying to make money.

Keep in mind that the Thursday session is Thanksgiving, so the underlying index was closed. Unfortunately, some CFD traders get into trouble on these days, because they do not know what they are doing. Futures markets will have some limited electronic trading before and after what would normally be the open pit session, so there will be movement, but it might be rather erratic. After that, Friday ends up being roughly half of the day in New York, so that also causes some issues. In that scenario, you are much better off waiting to see whether or not anything shakes out over the next couple of days.

One thing is for sure: the fact that we ended up forming a bit of a hammer for the session does bode well for the future, as it shows that traders are more than willing to jump on any hints of value and are comfortable going into what is essentially a four-day weekend. If that is the case, then they clearly do not see any major issues out there that could cause problems with their portfolio. That is a good sign that there are plenty of value hunters out there, and there are no real fears of a breakdown. The VIX had gotten ahead of itself for a while, but it now appears that it is calming down as well, so that is also a good sign. We have essentially been consolidating for two weeks to digest the previous gains, and now it looks like it is only a matter of time before we go looking towards 4800 just above.