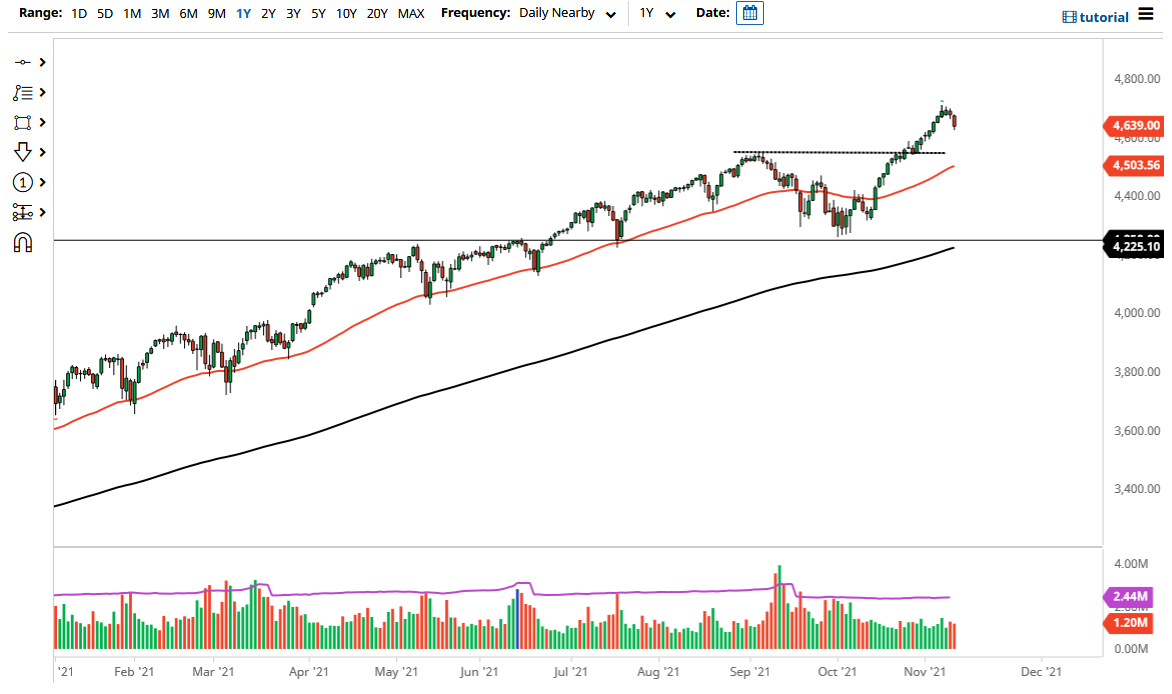

The S&P 500 got crushed after the worst 30-year bond auction in history took the headlines in the United States. At this point, the market had been a little bit overextended anyway, as the market had not printed a red candlestick for nine days in a row, and only one during the previous three weeks. We had gone sideways over the last couple of sessions, so now it looks like we are trying to figure out whether or not we need to go lower to find support. I suspect at this point we are more than likely to find plenty of support underneath, and it makes sense that the market will go looking towards it. The 4550 handle offers the “floor in the market” going forward, and I do think that the 200-day EMA hanging around that area does suggest that we would probably have even more interest in that area.

As long as we can stay above the 4250 level, then I think of this as a market that is still very much likely to find buyers and stay in an uptrend, but I think that the market is going to see this as a scenario where you simply look at this as a “buy on the dips” scenario going forward. The S&P 500 has been that way for what seems like a lifetime, as the market struggles to sell off more than about 5% these days.

With the liquidity that is being pushed into the stock market, it is not a huge surprise to see that we have seen the market go higher over the longer term. That being said, the 30-year bond auction during the session was the worst of all time, so it is not a huge surprise to see that interest rates rose due to the fact that people are demanding more for loaning the US government money. Nonetheless, we are starting to see interest rates rising across-the-board, so that does suggest that perhaps traders are starting to look at the possibility of getting more of a return for holding paper than taking the risk of the stock market on hand. With this being the case, I do think that we have a couple of days’ worth of selling, but I am not willing to short this market, rather I'd be looking to pick up value at lower levels.