The S&P 500 rallied a bit on Tuesday to reach towards the 4700 level. Now that we are starting to break above there, is very likely that we are going to continue to see buyers jumping in this market in order to get much higher. At this point time, the market is likely to see a bit of “FOMO”, due to the fact that the end of the year is rapidly approaching, and a lot of fund managers will have to chase returns in order to show decent gains to their benchmarks. This is quite often described as the “Santa Claus rally”, which is a real phenomenon, especially during years when the market has been so strong.

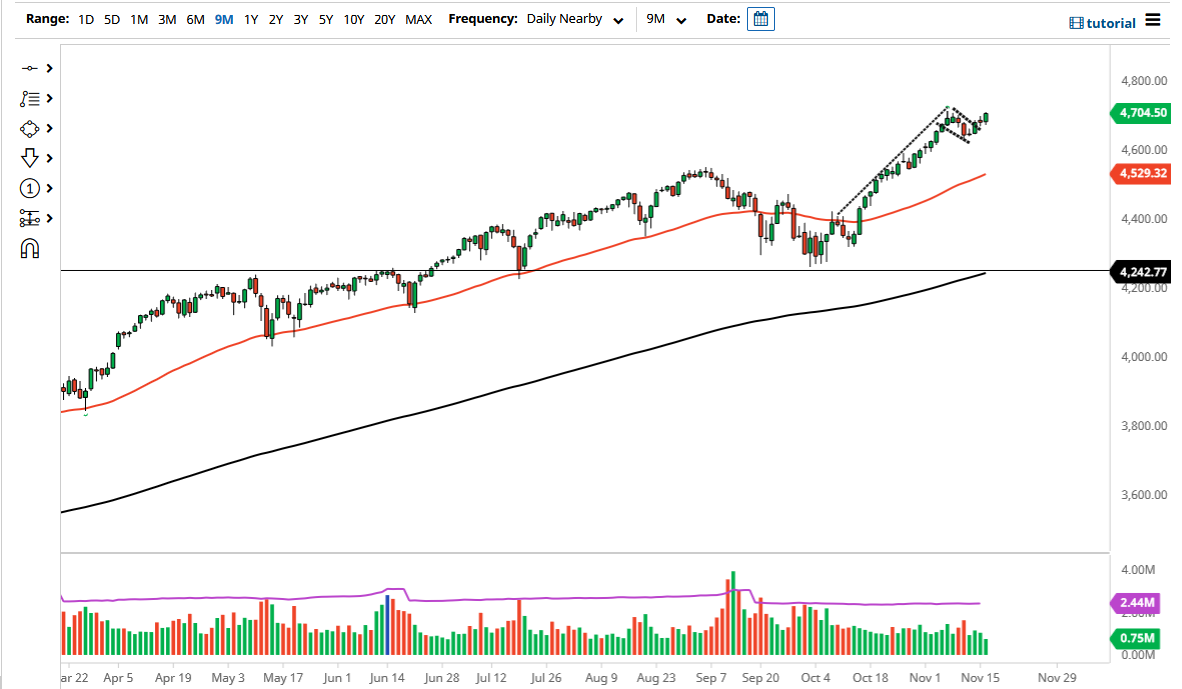

When you look at the chart, you can easily see there is a bullish flag that suggests we are going much higher. In fact, due to the measured move I would anticipate that the S&P 500 is probably going to go looking towards the 5000 level by the time this has played out. Because of this, I think that any time we get a short-term pullback, it will be a buying opportunity, and the 50-day EMA currently sitting at the 4530 level offers your next support level, assuming that we can even break down below the 4600 level on any pullback.

Earnings season has been relatively decent, and that should continue to propel this market higher as well, so I do not have any interest in shorting anytime soon. In fact, if you have been reading my articles at DailyForex, you know I never short US indices, because central banks are far too manipulative these days. Yes, the Federal Reserve is going to taper, but it will not hesitate to save US stock markets, as we have seen them do multiple times over the last 13 years, since the Great Financial Crisis. I know it is a bit of a cynical way to look at markets, but the one thing that you need to take away from this article is that markets have actually nothing to do with economic reality, and anybody who has tried to play stock markets due to what is going on in the economy has been taken to the woodshed for several years.