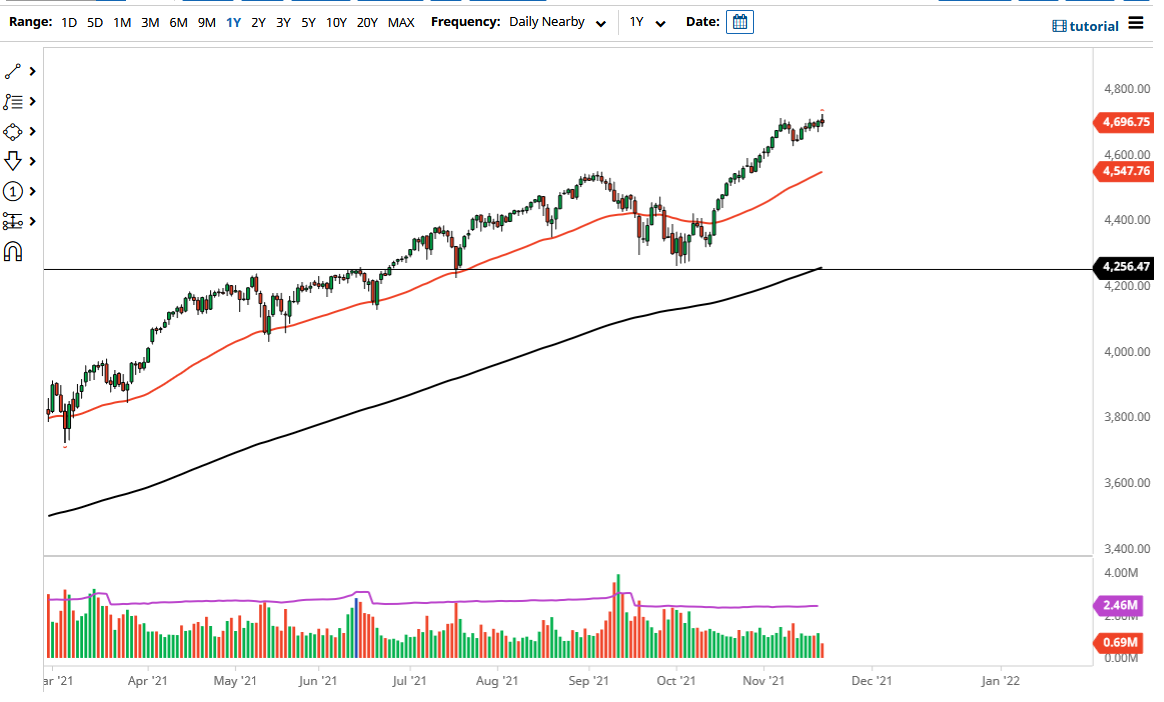

The S&P 500 went back and forth on Friday, essentially going nowhere. This suggests that perhaps we are going to continue to take a little bit of a breather at the moment, but that is not necessarily a bad thing considering just how strong this move to the upside had been. With that in mind, I think we are looking at a scenario in which any dip will probably be bought into in order to find value. The very bottom of the market is probably closer to the 4250 handle, and at this point we are nowhere near it. Because of this, I think any dip between now and the end of the year is going to end up being thought of as a buying opportunity, as it has been for much of the last 13 years.

Although the Federal Reserve has announced that it is tapering its bond purchase program, the reality is that it is still very loose from a historical standpoint, and its balance sheet will continue to grow. As long as that is going to be the case, the S&P 500 should rally quite a bit as well, as there is a huge correlation between the two things happening at the same time. The flow of money is a bigger driver than anything else, but it should be noted that the earnings season has been relatively strong for Wall Street, so that of course helps the situation as well. That being said, it should be kept in the back of your mind that what happens on Wall Street has absolutely nothing to do with the economy in the real world.

The 4700 level being purist is a good sign, but at this point in time I think we could pull back to 4600 rather easily, and that would only represent a buying opportunity. The “Santa Claus rally” is in full effect, as money managers try to chase down returns that they may or may not have made for the year. The last thing they want to do is underperform a key benchmark, so they have to buy every dip going forward. Other traders know this, so they will do the same. I think it is only a matter of time before we go looking towards the 5000 level, but that might be early next year.