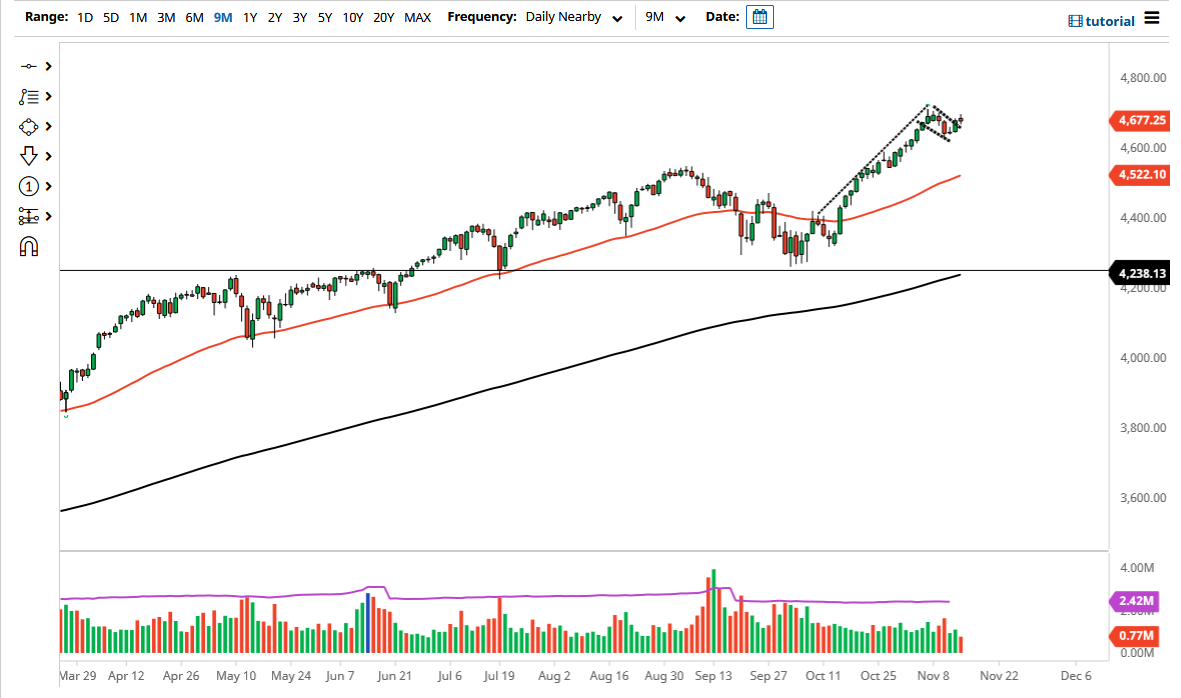

The S&P 500 went back and forth on Monday to show signs of hesitancy, but perhaps more importantly, it showed signs of support at the previous downtrend line of the bullish flag. The bullish flag is something that I have been paying attention to for a while now, so it is reassuring that we have seen a bit of stability here. At this point, if we can break above the top of the candlestick for the trading session on Monday, then it is likely that we could go much higher. This is a market that should go looking towards the 5000 handle, but that is obviously a longer-term target more than anything else.

The 4600 level underneath is supportive, and as long as we can stay above there, I believe that the market will go higher. Furthermore, the 50-day EMA is sitting above the 4500 level and continuing to go higher. The market is likely to continue to see a lot of noisy behavior if we do pull back, but we are in the midst of earnings season and so far, it has gone well. As long as that continues to be the case, then I think the S&P 500 will continue to grind to the upside. This does not necessarily mean that we will not have the occasional pullback, but those pullbacks should be thought of as buying opportunities. I do not short US indices as you know, due to the fact that the Federal Reserve meddles in the market anytime there is a significant pullback.

Underneath, the 4250 level is the “floor the market” from what I can see, especially as the 200-day EMA currently sits right there as well. If we were to break down below there, then I might be a buyer of puts, but that is about as bearish as I would get. At this moment, I think that is very unlikely to happen, so I like the idea of buying short-term pullbacks that show signs of a bounce or some type of hesitation to go lower. The market also will be a beneficiary of the “Santa Claus rally” that tends to happen every year. I believe this market is one that will eventually reach higher levels over the next couple weeks.