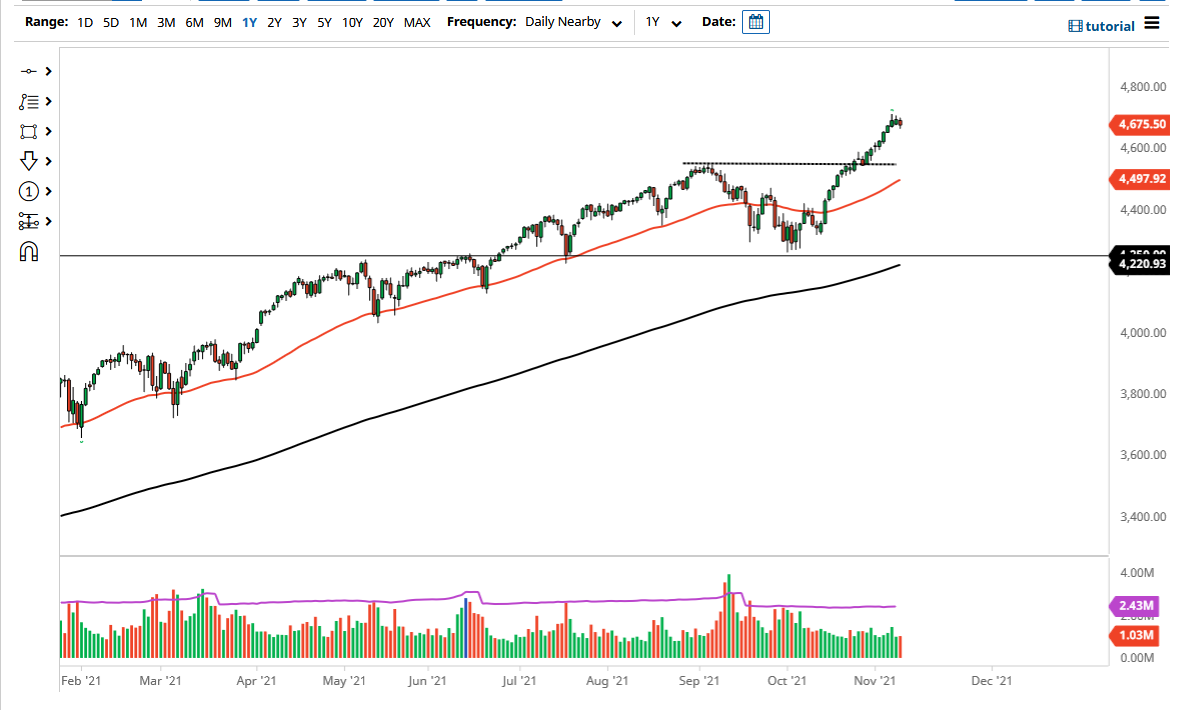

The S&P 500 pulled back just a bit on Tuesday as we may have gotten a bit over-extended finally. At this point in time, I think that the S&P 500 pulling back a couple of percent might be the best thing that could happen. After all, the market continues to see a lot of bullish pressure, but quite frankly you cannot go straight up in the air forever. If you are watching the markets in general, you know that we had gotten far ahead of ourselves, and I have even mentioned that over the last couple of days. Because of this, this was somewhat anticipated and now I will simply wait for a bit of an offer of value.

That offer of value will be due to a pullback, and I think the 4600 level would be a very interesting area to get involved. Furthermore, we have the 50-day EMA sitting at the 4500 level and sloping higher. I do believe that a breakdown below 4500 would be a bit difficult, but it is not impossible. After that, then we have the 4250 level, which is where the 200-day EMA currently sits, but perhaps more importantly, we have seen a lot of support and buying pressure in that general vicinity. If we were to break down below there, I think that is something rather ugly, but at this point it is roughly an 8% correction, so I think it would attract a lot of attention.

If we were to turn around and break to the upside, then we will almost certainly go looking towards the 4800 level, but this is not my preferred move. In fact, I believe that it is likely that we will either pull back significantly, or simply kill time by going sideways. That is fine, because the biggest thing that we need to do is not continue to go straight up in the air. If you do see that happen, it is very likely that it could end up being something along the lines of a “blow off top”, which is something that would scare a lot of the bullish traders. This is a market that is simply doing what markets do, digesting the massive gains after those moves. Ultimately, I will be looking for a supportive daily candlestick to get long again.