Jerome Powell was re-appointed as chairman of the US Federal Reserve for the next four years. The announcement by the US administration came as a catalyst for the continuation of gains for the US dollar against the rest of the other major currencies, and the USD/JPY continued its upward momentum to the 115.14 resistance level, its highest in five years, where it settled as of this writing. The pair may still maintain the pace of its gains ahead of tomorrow's trading session.

In a second term beginning in February, Jerome Powell will face a difficult and high-risk balancing act: US inflation has reached its highest level in three decades, causing hardship for millions of families, roiling recovery and undermining the Fed's mandate to maintain price stability. But with the economy still more than 4 million jobs below its pre-pandemic level, the Fed has yet to meet its other mission of maximizing employment.

Next year, the US central bank is widely expected to begin raising the benchmark interest rate, with financial markets pricing in at least two increases. And if it moves too slowly to raise interest rates, inflation could accelerate further and force the US central bank to take more aggressive steps later to rein it in, potentially causing a recession. However, if the Fed raises rates too quickly, it could stifle employment and recovery.

The Japanese yen advanced more than half a percent against other safe-haven currencies such as the US dollar and the Swiss franc on Friday as investors responded to the creeping spread of coronavirus cases on the European continent. So on Friday, Austria announced that it would return to a blanket "lockdown" and said it would try to make vaccination a legal requirement less than a week after trying to impose a national confinement on residents only who did not accept the offer of vaccination. This is only the latest European country to re-impose restrictions after the Netherlands and Czechoslovakia announced different responses over recent days, and it may not be the last either given persistent speculation that Germany may also opt for something similar over the coming weeks.

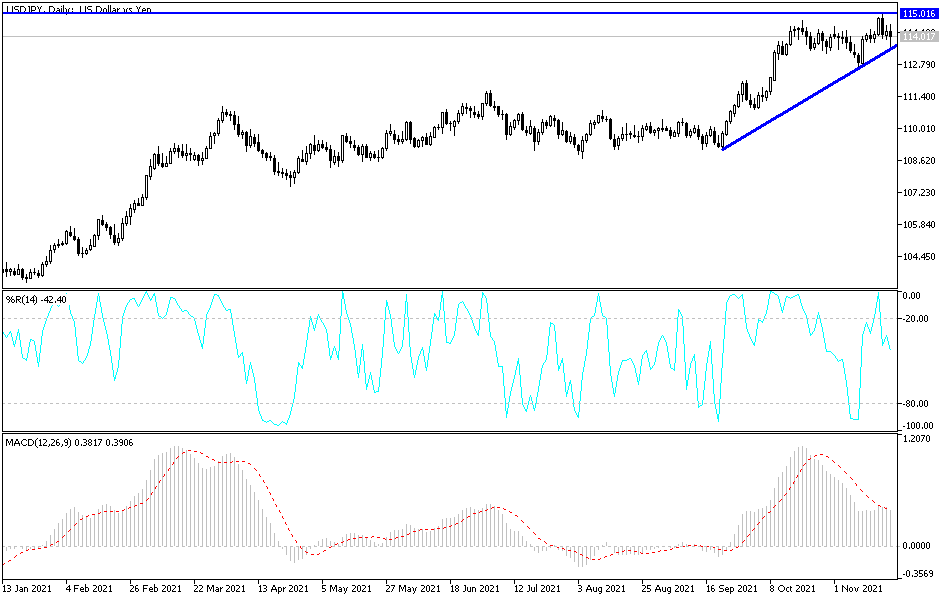

Technical Analysis

On the daily and weekly charts, the technical indicators have reached strong overbought levels after the recent gains of the USD/JPY, and accordingly, I expect profit-taking at any time. Currently, the closest resistance levels for the currency pair are 115.20 and 116.00. Even if there is selling, the general trend of the pair will remain bullish. Tomorrow's important US economic data will have a strong impact on the currency pair, and it may stick to its current gains in the meantime.

On the downside, the current trend will not be broken without breaking the 112.00 support, otherwise the general trend will remain bullish. The currency pair will be affected today by the risk appetite of investors, as well as the reaction to the announcement of the PMI readings for the US manufacturing and services sectors.