For three weeks in a row, the USD/JPY has remained stable around the 114.00 resistance, near a 3-year high, amid strong expectations of a tightening of the US Federal Reserve's policy. The currency pair closed the week's trading stable around the 113.96 resistance level, amid cautious and important anticipation for Forex traders and US dollar pairs, as the US Federal Reserve will announce an update to its monetary policy and economic expectations, which pave the way for raising US interest rates.

On another note. Japanese Prime Minister Fumio Kishida's ruling coalition is expected to maintain a majority in parliamentary elections, but will lose some seats in a setback for his weeks-long government grappling with the coronavirus-hit Japanese economy and regional security challenges, according to opinion polls. Together, Kishida's Liberal Democratic Party (LDP) and its junior coalition partner Komeito are expected to win 239 to 288 seats in the 465-member House of Representatives, the strongest of Japan's bicameral parliament, a public broadcaster NHK poll showed.

According to forecasts, the Liberal Liberal Party alone was expected to win 212-253 seats, while Komeito would win 27-35 seats. Their combined seats will exceed the parliamentary majority of 233 - a loss from 305 seats previously. Kishida, 64, was elected prime minister on October 4 after winning the leadership race in his ruling party and dissolving the House of Representatives just 10 days after taking office. Conservative Party leaders saw him as a safe successor to the status quo of Yoshihide Suga and his influential predecessor Shinzo Abe.

US consumers slowed their spending to just 0.6% in September, in a warning sign for an economy still in the grip of the pandemic and a prolonged bout of high inflation.

Meanwhile, the key inflation gauge that the Fed is closely watching rose 4.4% last month from a year earlier — the fastest such increase in three decades. Wages, a key component of inflation, also jumped 0.8% - double August's gain and a reflection of workers' growing ability to force desperate companies to fill a near-record number of available jobs. A separate report on Friday showed wages jumped 1.5% in the three months to September, the most in 20-year records.

The sharp rise in prices, partly due to lack of supplies, has put an increasing burden on American households. For months, annual inflation has remained well above the modest annual rates of 2% or less that prevailed before the pandemic recession. The US economy, while growing, continues to be hampered by COVID-19 cases and persistent supply shortages. The government estimated the US economy slowed sharply to a 2% annual growth rate in the July-September period, the weakest quarterly growth since the recovery from the pandemic recession began last year.

For the July-September quarter as a whole, consumer spending, which fuels about 70% of overall economic activity, fell to an annual growth rate of just 1.6%. This was a significant decrease from the previous quarter.

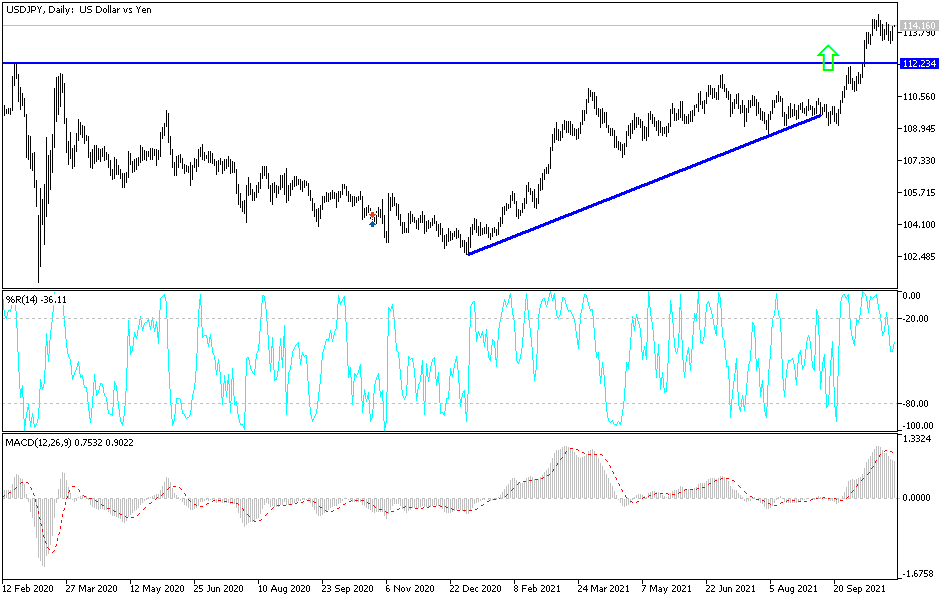

Technical Analysis

On the daily chart, the general trend of the USD/JPY is still bullish, and with stability above the 114.00 resistance the path is paved for stronger upward breakouts that may bring the pair towards the resistance levels 114.75, 115.60 and 116.30. This is especially true if the market's expectations of raised interest rates are met. On the downside, breaking the 113.00 support motivates the bears to launch and change the direction of the pair, which is still bullish.

Today, the dollar will be affected by the announcement of the ISM Manufacturing PMI.