The catalysts for the USD's gains have been increasing, and they all come down to one thing: the approaching date of raising US interest rates. This was, of course, the main factor in the rally in the USD/JPY towards stronger ascending levels. The resistance level of 114.96 is the highest in more than three years. The pair is stable near it as of this writing, awaiting any news.

Many Americans have taken a darker view of the economy as inflation worsens. But so far, they seem no less willing to spend freely on retail - an encouraging sign for the important holiday shopping season. Buoyed by strong employment, healthy wage gains and big savings stemming in part from government stimulus checks and other amenities, Americans increased their spending in retail and online stores last month. Some of the increase reversed the effect of higher prices, and there were signs that Americans were starting to look for cheaper options.

However, the October gains announced by the government yesterday were strong enough for most economists to expect a jump in holiday shopping by a record amount this year.

The data also illustrates a major factor behind supply-chain backups that have left dozens of ships waiting to unload at US ports: Americans buy a massive amount of merchandise, from appliances to electronics to furniture. Retail and food service sales were up 16.3% from a year ago. This is a record high except for several months during the spring when federal stimulus controls caused a sharp rise in spending.

For its part, the US Commerce Department said that retail sales jumped from September to October by 1.7%. It was the biggest monthly gain since March and rose 0.8% from August to September. The surge occurred as retailers faced a host of challenges. Many had to raise wages sharply to find and retain workers, thus increasing labor costs. Some are scrambling amid crowded supply chains to keep their shelves full.

However, there are signs that rising US inflation is starting to affect the shopping patterns of some consumers. Walmart executives said grocery sales rose sharply in the fall, partly reflecting purchases by some shoppers who were shocked by price hikes elsewhere. Customer traffic increased by 5.7%.

Technical Analysis

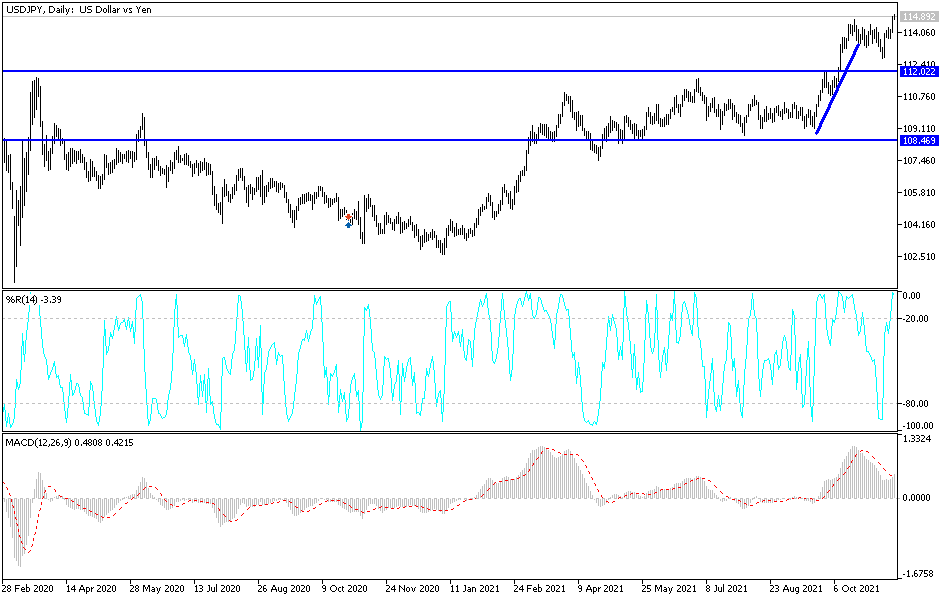

On the daily chart, the general trend of the USD/JPY is still bullish, supported by stability above the 114.00 psychological resistance. Currently the closest bullish targets are 115.20 and 116.00, especially if the statements of US monetary policy officials are in favor of raising US interest rates. The recent gains pushed some technical indicators towards overbought levels, while others have the opportunity for more gains before reaching those levels. On the downside and for the same time period, there will be no reversal of the general trend without moving below the 112.00 support, otherwise the general trend will remain bullish.

The USD/JPY currency pair will be affected today by risk appetite, as well as the release of US housing numbers, building permits and housing starts.