Since last week, there have been sell-offs in the USD/JPY amid the return of an appetite for safe havens, including the Japanese yen. At the end of last week’s trading, the pair fell to the 113.58 support level before closing trading around the 114.00 psychological resistance level. On the other hand, the US dollar is rising as renewed fears of COVID-19 in Europe and a decline in the Dow Jones Industrial Average encourage investors to engage in buying traditional safe assets. Accordingly, the dollar continues to maintain its impressive streak of gains in 2021, rising against several major currencies.

The biggest story happened in the financial markets last Thursday night and Friday morning: US President Joe Biden's social policy and climate change bill. The Congressional Budget Office (CBO) released its analysis of the legislation, warning that it would add nearly $400 billion to the federal deficit. The administration said it would cost taxpayers nothing, but the nonpartisan group disagreed with that assessment.

Moreover, if many of the program's policies, such as the comprehensive preschool and children's tax credit, are extended after five years, those expenditures could add up to $2.5 trillion to the national debt. In addition, there are billions of additional debt service payments.

Last Friday morning, the Building Back Better Act (BBBA) passed in the House of Representatives, with one Democrat vote against it. The bill now moves to the Senate and officials hope to implement it before Christmas. It is unclear whether the Democrats have enough votes in the Senate to get the legislation approved as the main opponents are Senator Joe Manchin (D-WV) and Senator Kirsten Senema (D-AZ). The next major focus for financial markets could again be the debt ceiling. As Ipek Ozkardeskaya, Senior Analyst at Swissquote, said in a research note:

“The United States has a problem other than just the energy crisis, it's the debt problem. US Treasury Secretary Janet Yellen is now warning that the US could default by December 15th if politicians do nothing about the debt ceiling. The last deadline is related to the commitments of the infrastructure bill recently signed by Joe Biden, which would require the Treasury to transfer an amount as good as $118 billion to the Highway Trust Fund with the risk that the Treasury will run out of cash after a transfer of this large size.”

The US Dollar Index (DXY), which measures the performance of the US currency against a basket of six major competing currencies, has risen to 95.87, and the index is preparing to achieve a weekly gain of 0.8%, in addition to its rise since the beginning of the year 2021 to date by about 6.6%.

Technical Analysis

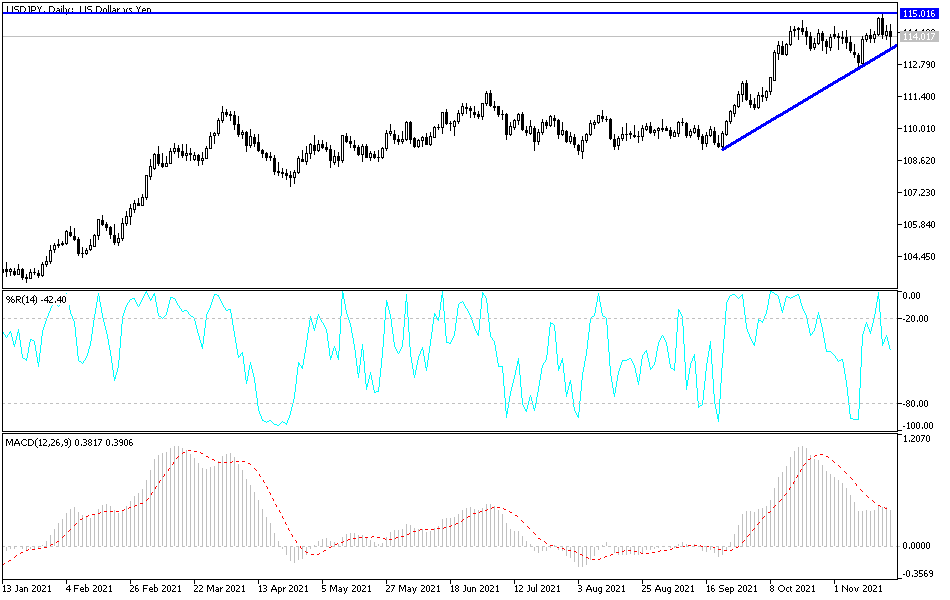

Despite the recent sell-offs, the general trend of the USD/JPY pair is still bullish, especially if the bulls continue to maintain the psychological resistance of 114.00 as is the case now. The US dollar pairs this week are awaiting US economic releases, which will have a strong impact on the performance of the USD/JPY, as well as risk appetite. Stability above the 114.00 resistance will increase buying towards the resistance levels 114.65, 115.20 and 116.00, moving the technical indicators towards strong overbought levels.

On the downside, and according to the performance on the daily chart, the bears changed the direction to the downside, moving towards the support levels 113.25 and 112.00.