The Japanese yen is stable against many major currencies, including the US dollar and the euro. Since the beginning of this week’s trading, the USD/JPY has declined, as a result of which it tested the 112.72 support level, its lowest in a month, and settle near there for a while, waiting for the announcement of US inflation figures and the number of US weekly jobless claims. The Japanese yen held steady, despite officials downgrading the country's economic outlook for the first time in more than two years.

Earlier this week, Japan's Cabinet Office downgraded its view of economic conditions after its record measure fell to its lowest level in more than a year. In September, the Coincident Index, which monitors a series of economic metrics such as exports and factory production, fell to 87.5, down from 91.3 in August. The Leading Economic Index, which forecasts the direction of the economy, also fell to 99.7 in September, down slightly from 101.3 the previous month.

Both represent the third consecutive monthly decline amid the ongoing turmoil caused by the coronavirus pandemic. However, new infections have fallen over the past month, falling to a seven-day average of just over 600. In total, Japan has recorded 1.72 million cases, with 18,306 deaths.

"It appears that automakers have bottomed out production cuts by November and ramped up production towards the end of this fiscal year (in March), but downside risks from the supply chain will continue to demand attention for some time," a government official told a news conference. But the government is not giving up. Japanese Prime Minister Fumio Kishida and his government are expected to announce $265 billion in economic stimulus, most of which will be financed through debt. However, since part of the stimulus and relief efforts will include cash assistance, experts are concerned that families will bring in money rather than spend it.

Meanwhile, the Japanese bond market was mostly in the red, with the benchmark 10-year bond yield dropping to 0.052%. Three-month bond yields fell to -0.1%, while 30-year yields fell to 0.681%.

Fumio Kishida is scheduled to be re-elected as Japan's prime minister on Wednesday after passing the first major test of his leadership in the recent elections. Elected just over a month ago, Kishida called a snap election in which he secured enough seats in the 465-member lower house - Japan's most powerful bicameral parliament - to maintain freedom to pass legislation through parliament. He sees the October 31 victory as a voter mandate for his weeks-old government to deal with the pandemic-stricken economy, anti-virus measures and other challenges.

In Parliament's first session since the election, Kishida is scheduled to be re-elected and then his second government to be formed within a month by reappointing most of his ministers. In a formality earlier on Wednesday, Kishida's first cabinet resigned en masse.

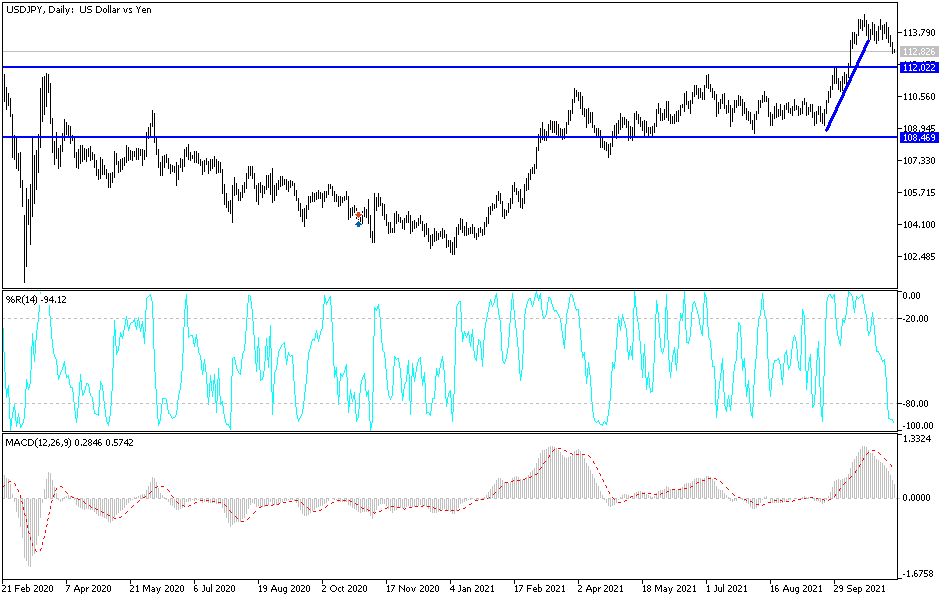

Technical Analysis

On the daily chart, there is a clear break of the general trend and its transformation into a bearish one as investors continue to flee from risk and turn to the yen as a safe haven. The bears are now targeting the 112.20, 111.45 and 110.70 levels. I still prefer to sell the currency pair from every ascending level and the 114.00 resistance will remain vital for the bulls to have a stronger control of the trend.

The US dollar pairs will be affected today by the announcement of US inflation figures through the readings of the consumer price index and the number of US weekly jobless claims.