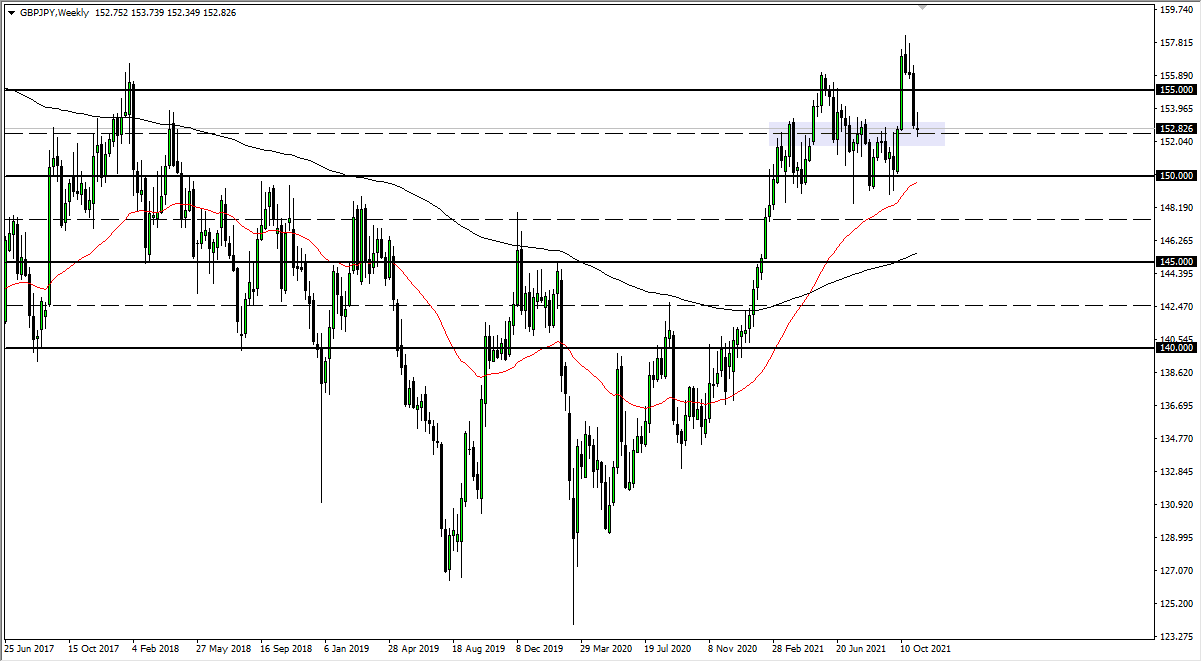

GBP/JPY

The British pound initially tried to rally against the Japanese yen last week but gave back the gains to crash into the ¥152.50 level. This is an area that would continue to be very supportive, but it is worth noting that the British pound has struggled across the board. With the Bank of England now dovish, it should continue to weigh upon the pound in general. That being said, though, the GBP/JPY is likely to be a little bit more sluggish than some of the other British pound-related pairs, simply because the Japanese yen is so weak itself. I would anticipate that rallies are going to continue to be sold into as we try to get down to the ¥150 level.

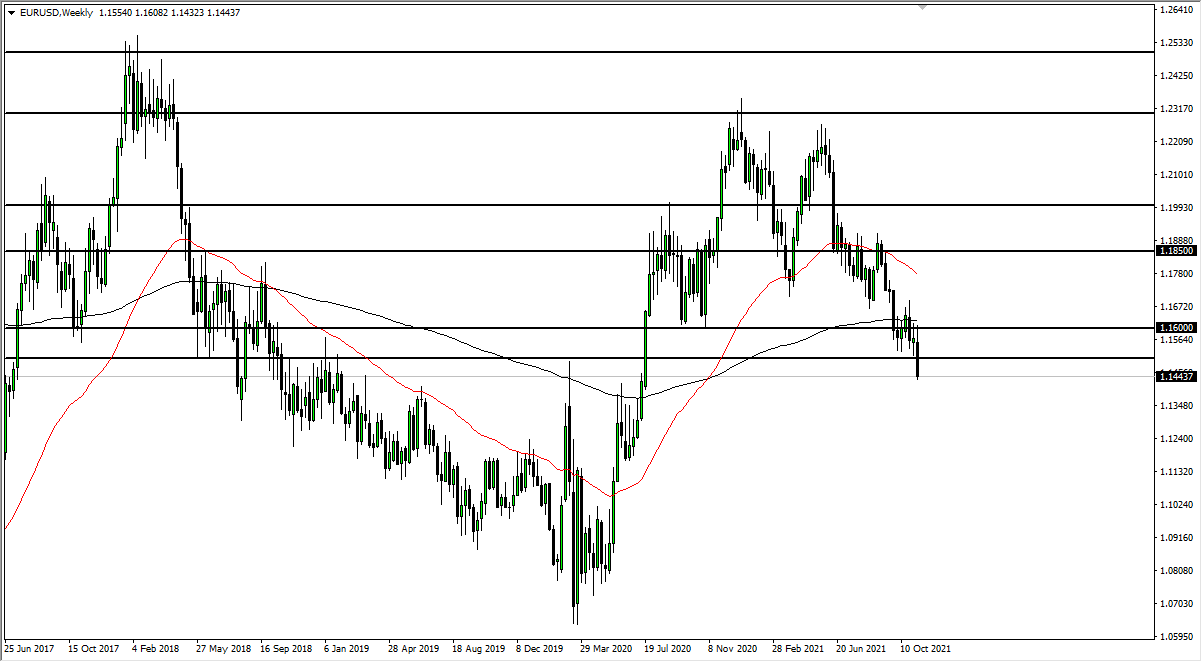

EUR/USD

The euro initially tried to rally to break above the 1.16 level during the week, but then collapsed as yields in America spiked. At this point, it is also worth noting that the interest rate differential between Germany and the United States should continue to see more of a spread, and that should continue to weigh upon the euro in general. With this being the case, in the fact that we broke down below the 1.15 handle, I do anticipate that the euro will eventually reach down to much lower levels, perhaps down to the 1.1250 level.

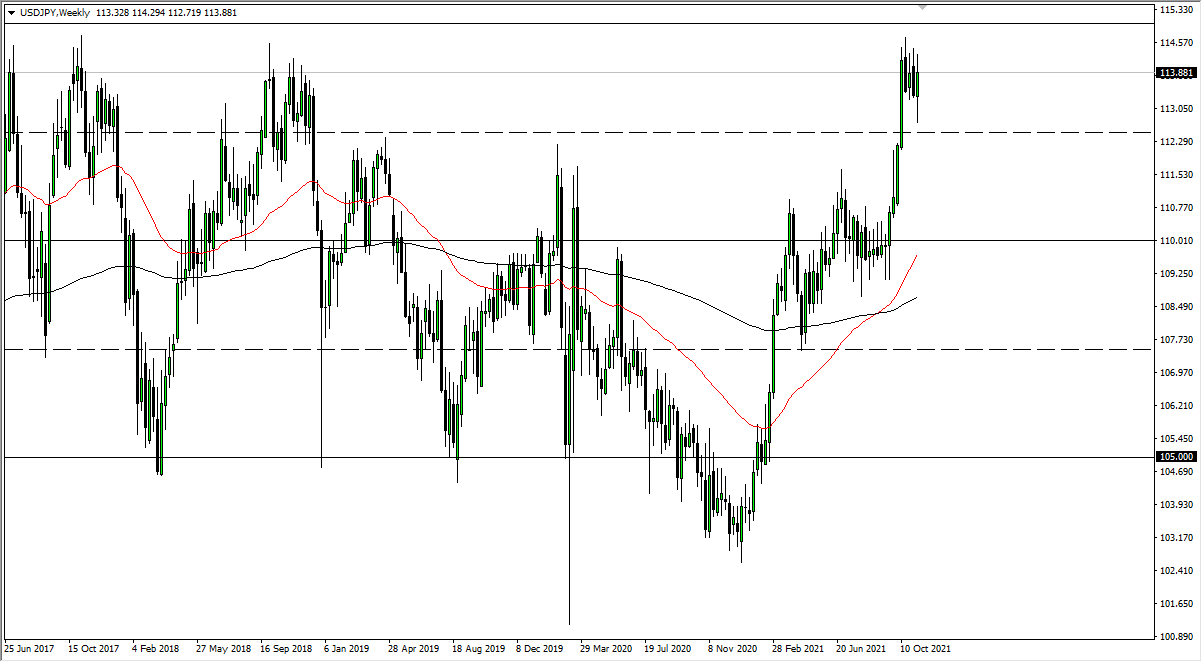

USD/JPY

The US dollar had initially fallen pretty hard during the course of the week but found enough support underneath to turn things around and show signs of life again. We reached towards the crucial ¥112.50 level, but then turned around to rally quite significantly. By the end of the week, we ended up staying within the flagging pattern that we have been in for a while. At this point, I think this remains a “buy on the dips market” going forward. The ¥115 level above is a major resistance barrier that must be acknowledged. Anything above there could open up a longer-term “buy-and-hold” scenario.

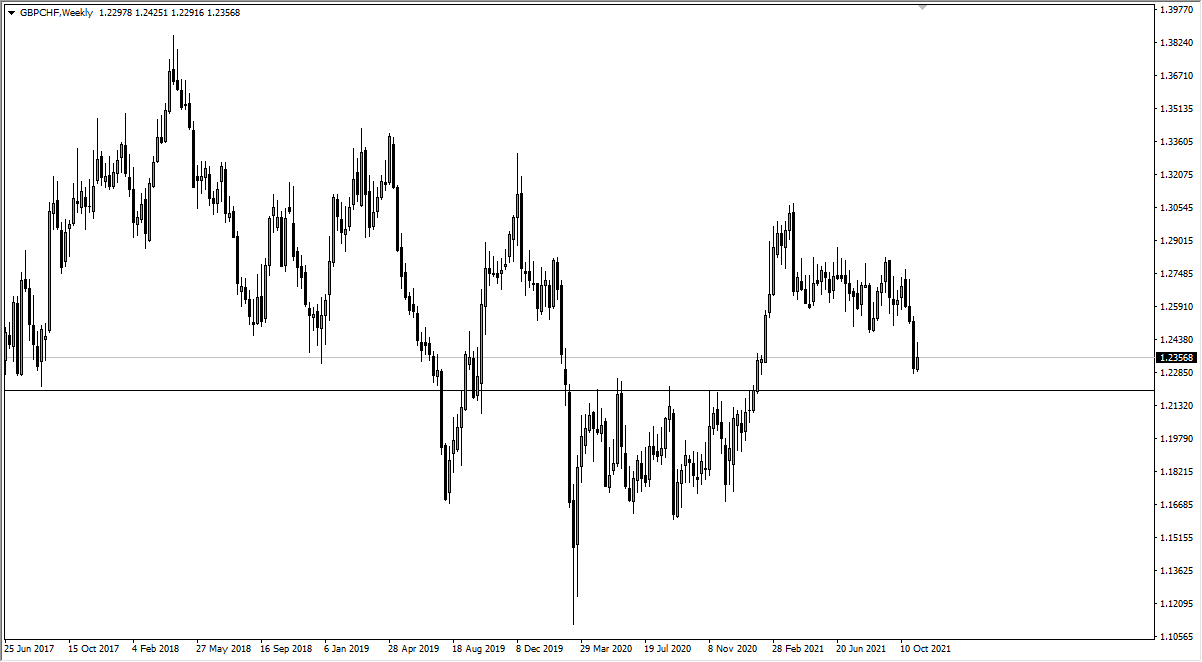

GBP/CHF

The British pound initially tried to rally against the Swiss franc but gave back gains during the course of the week to close near the 1.2350 level. At this point, it looks like we are still trying to make a move towards 1.22 handle, so I like the idea of shorting this market on little rallies that show signs of exhaustion. Ultimately, if we can break down below the 1.22 handle, we could see a move towards 1.18 level.