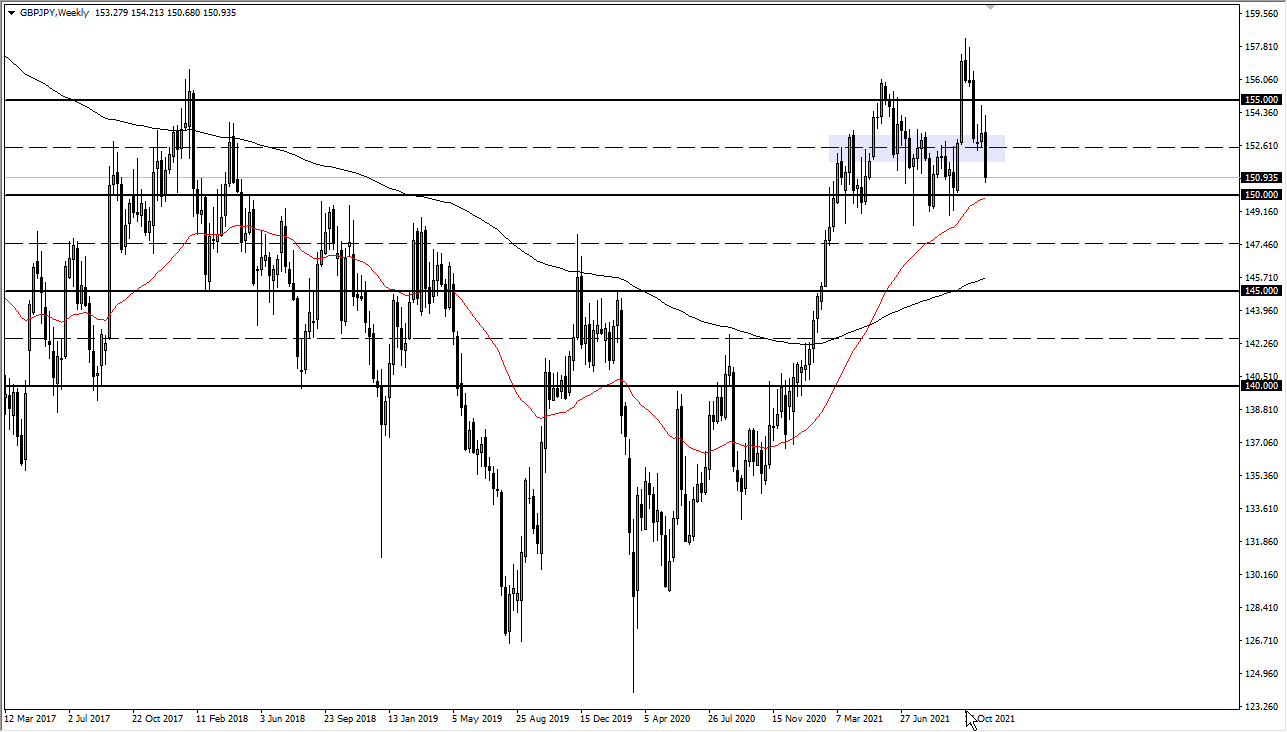

GBP/JPY

The British pound initially tried to rally last week but then collapsed on Friday as we saw a major “risk off move” around the world. The new coronavirus variant coming out of South Africa has people selling anything remotely close to being risk-related. It is worth noting that the market breaking down the way it has does suggest that we have momentum to the downside, but at this point we need to break through the ¥149 level to truly fall apart.

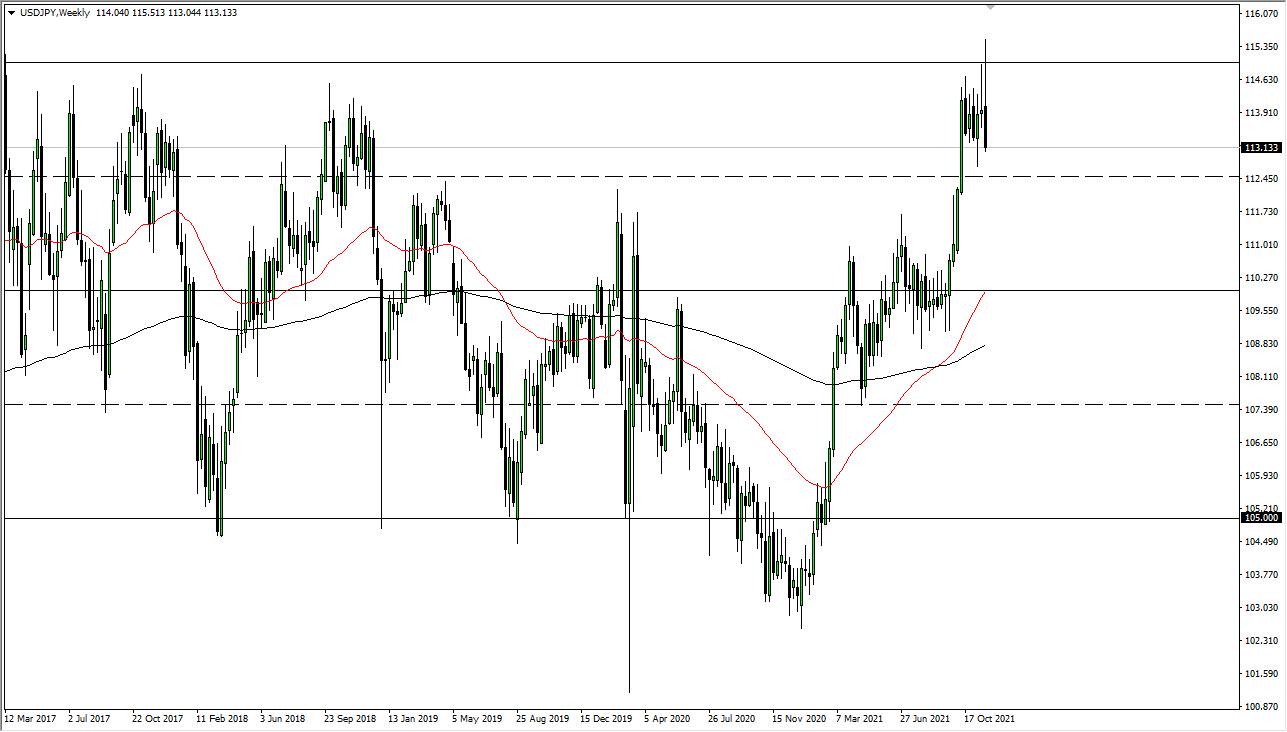

USD/JPY

The US dollar initially rallied last week but had an absolutely brutal Friday session. This was in reaction to the negativity coming out of South Africa, and the possibility of further lockdowns. This had a major “risk off” attitude coming into the market, and I think it does make sense that we would break apart here. If we can get down below the ¥112.50 level, this is a market that has further to go, perhaps reaching down to the ¥110 level. If we do turnaround at this point in time, I would expect more consolidation than anything else. Unfortunately, weekend news is probably going to be the main driver.

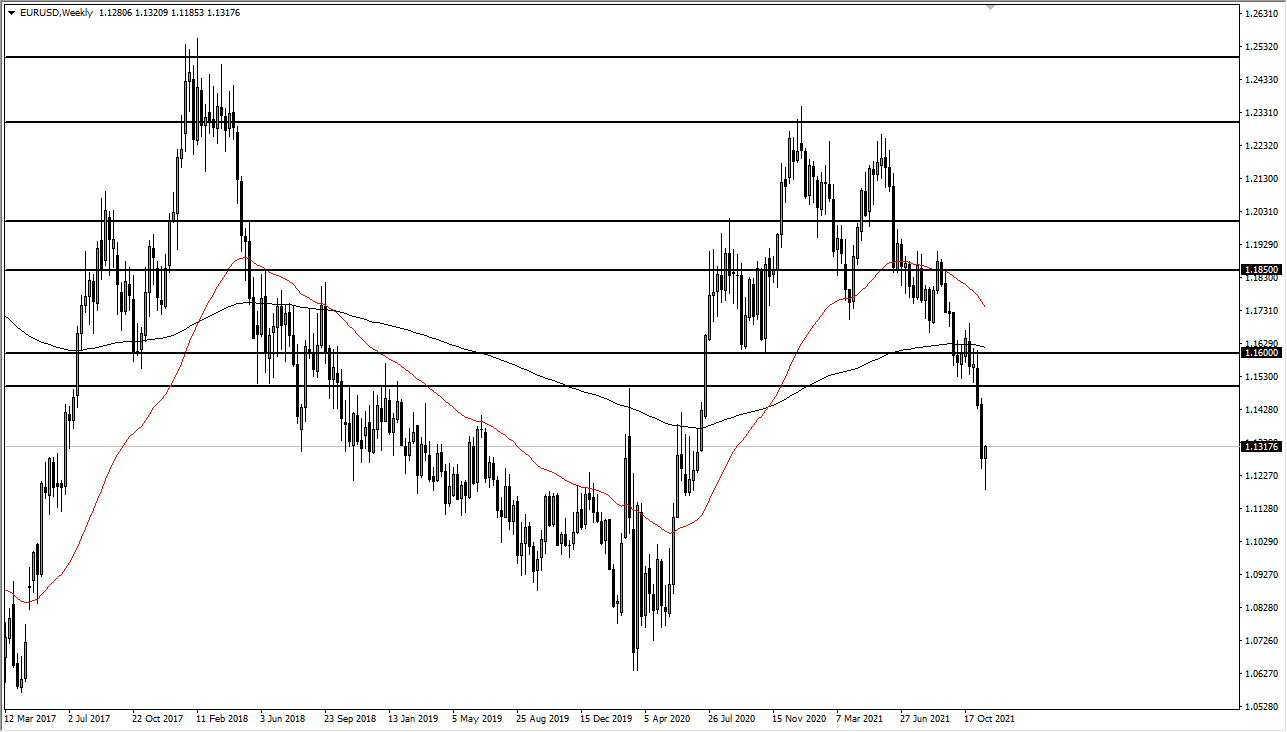

EUR/USD

The euro fell rather hard last week, reaching down towards the 1.12 level. However, we have recovered completely to form a massive hammer. This suggests to me that perhaps we have gotten a little bit ahead of ourselves, so it makes sense that we would get a little bit of a bounce. The “ceiling in the market” at this point seems to be near the 1.15 handle, and I think that is where we will try to get to in the short term. However, if we were to turn around and break down below the bottom of the candlestick, then the euro breaks apart to reach down towards the 1.10 level.

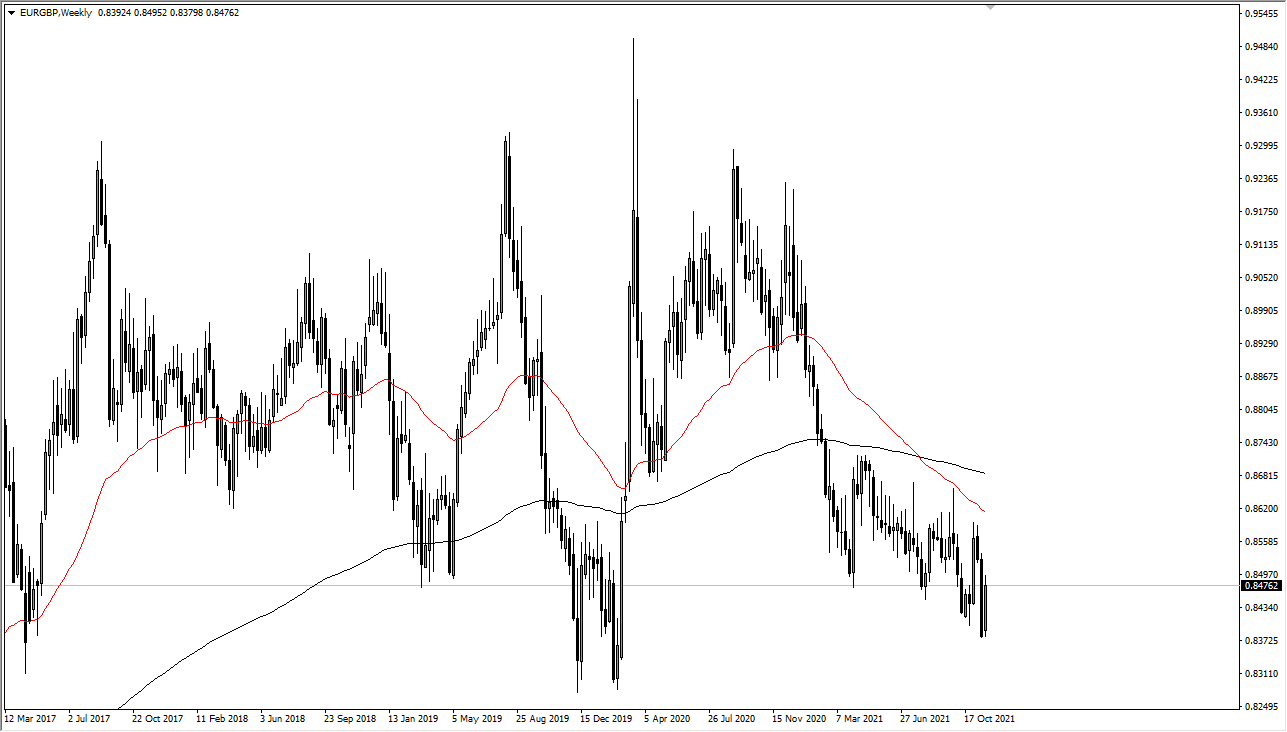

EUR/GBP

The euro rallied quite significantly against the British pound last week, but I still see a lot of resistance above, especially near the 0.8550 level. Because of this, a short-term rally is possible, but I do think it is only a matter of time before the sellers come back in and push this market lower.