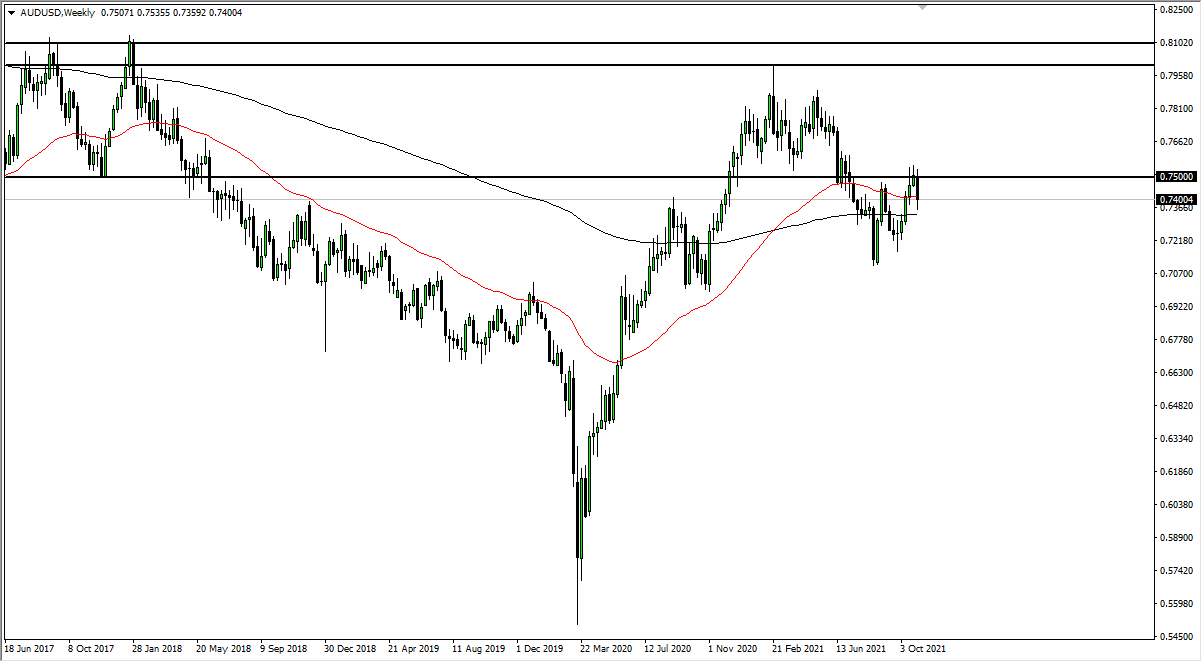

AUD/USD

The Australian dollar fell significantly during the course of last week, but on Friday turned around to show signs of life. The daily candlestick on Friday ended up forming a bit of a hammer, and I think we will probably get a bit of a bounce in this pair. The US dollar looked as if it was on its back foot heading into the weekend, so I think we are going to see US dollar weakness across the board, even if it would only be for a short-term move. The Australian dollar might be a perfect place to play that trade.

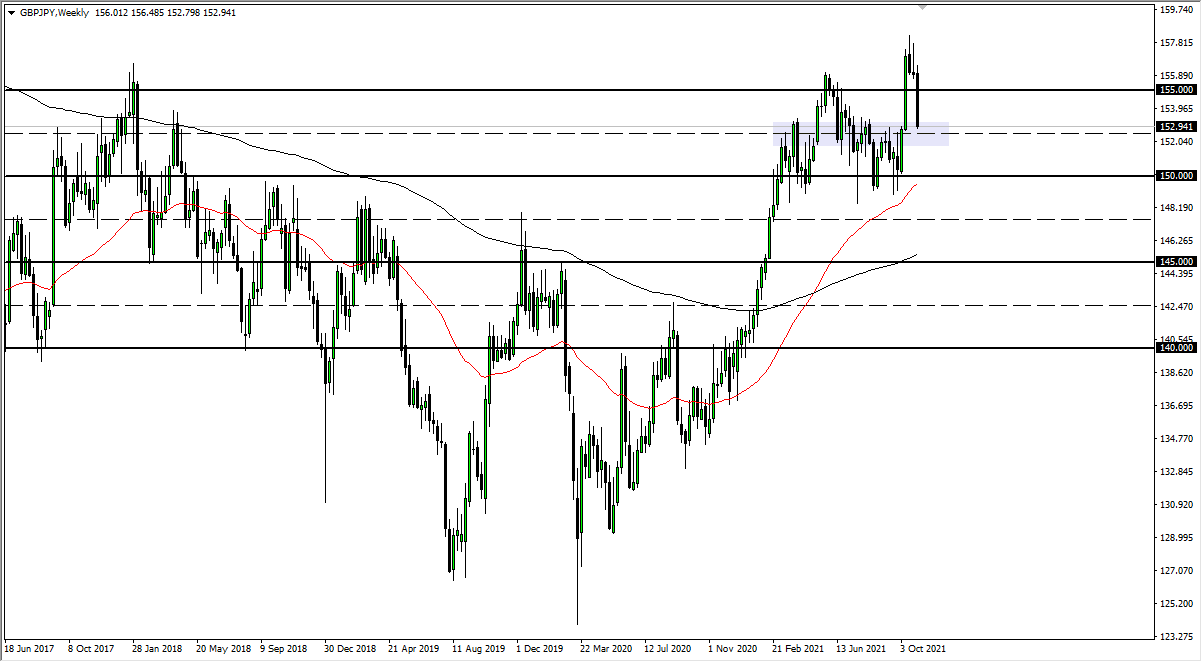

GBP/JPY

The British pound got absolutely crushed last week after the Bank of England decided not to taper its bond purchasing program. The pound fell all the way down towards the ¥153 level, which suggests that we probably are going to test the purple box that I have on the chart, which should be supportive. Between here and the ¥152 level, I would anticipate some type of bounce, and if we do get that bounce, I think it could be a nice buying opportunity. If we break down below the ¥152 level, then we go looking towards the ¥150 region.

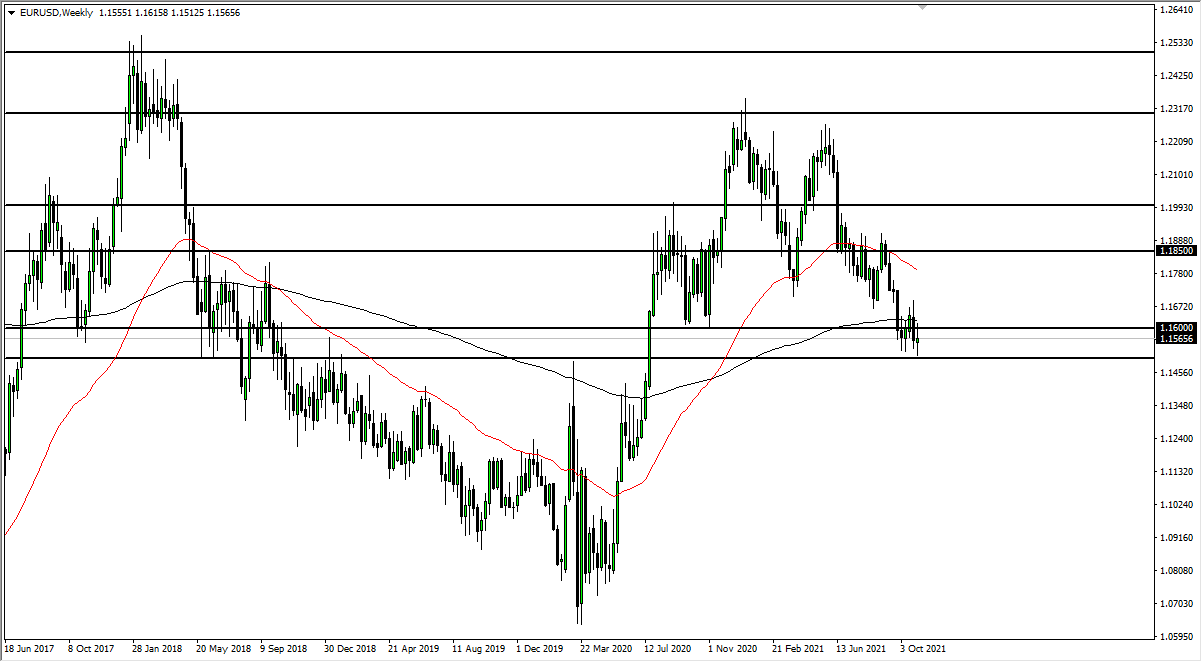

EUR/USD

The euro was all over the place last week to form a bit of a neutral candlestick. I believe we will probably continue to see a lot of that sideways action, but if we turn around and break above the 1.16 level again, then I think the market may try to recover. This will be all about the US dollar, and not necessarily the euro itself. I do anticipate that the euro is going to be very noisy, and I think short-term traders will continue to bounce this thing around between 1.15 and 1.16 before making a much longer-term move.

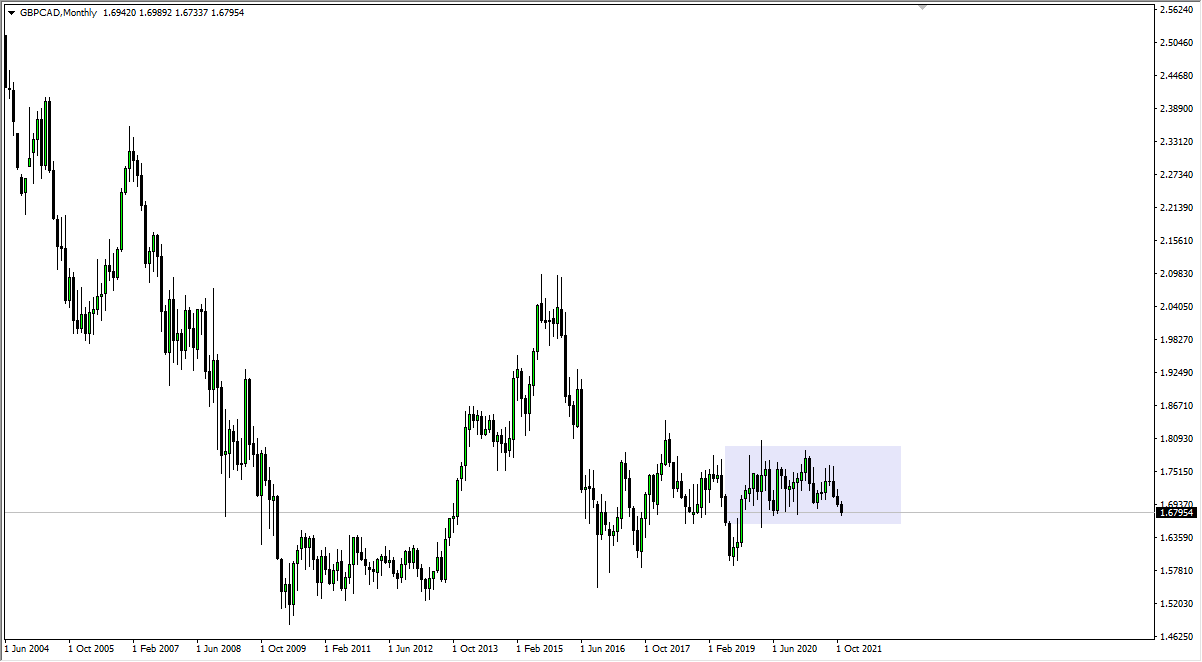

GBP/CAD

The British pound fell a bit against the Canadian dollar last week, as the Bank of England punting of tightening worked against the value of sterling. That being said, we are getting very close to a support level, so if we can turn around and take out the 1.6850 level to the upside, we may reenter the overall consolidation range that extends all the way to the 1.80 level. If we break down below the 1.16 handle, then this is a market that could drop rather significantly.