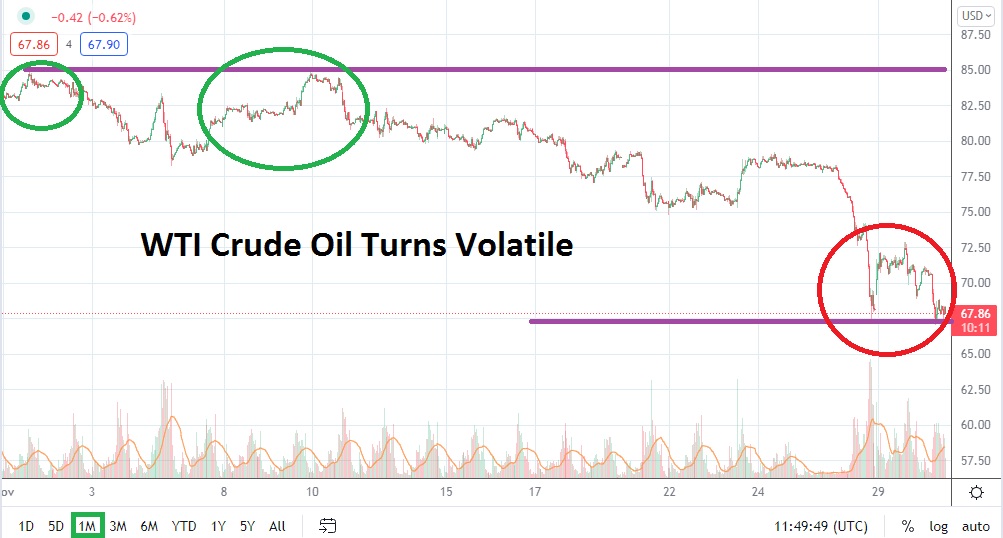

WTI Crude Oil achieved a high of nearly 85.00 USD on the 10th of November. The high for the commodity was actually made in October when a value of nearly 85.40 was briefly tested on the 25th. As of this writing WTI Crude Oil is below 70.00 USD, and is actually trading close to the 68.00 level. Fast conditions are volatile and this is largely due to a massive wave of nervous trading which has been generated in the commodity due to the new coronavirus worries.

After reaching its apex level in late October, WTI Crude Oil continued to test its higher price range in early November, but as of the 10th of the month a reversal lower began to ensue. However, the price velocity within the commodity had been rather polite, while achieving a low of nearly 74.60 on the 19th of November. By the 24th of November the commodity had risen slightly in value again and was trading above 79.00 USD, and all looked relatively sedate regarding technical trading conditions.

Things changed quickly on the 25th of November when news started to be published and heard regarding the coronavirus variant Omicron becoming a potential threat. Fears regarding global economic implications quickly hit WTI Crude Oil and volatile trading swiftly had an effect. On the 26th, oil dropped from nearly 78.00 USD per barrel to almost 68.00. And that is where the price largely trades now. Support levels are being tested as WTI Crude Oil challenges lows not experienced since the second week of September.

If the current support levels prove vulnerable there is reason to suspect WTI Crude Oil could try to move towards values which saw prices between 61.00 and 65.00 USD in the third week of August. Speculators have an important decision to make, certainly they can try to establish positions which seek short term gains by using stop loss and take profit orders. However choosing a direction is a very dangerous task due to the amount of nervous sentiment which exists.

After recovering from extreme lows during the height of coronavirus fears in 2020, WTI Crude Oil does not seem as if it can possibly fall to those absurd lows. Traders will need to remain cautious and logical. The ability to separate noise from reality and bona fide expectations may be able to help traders make profitable decisions in December. While the short term fears regarding Omicron are loud, speculators need to ask if WTI Crude Oil can withstand the nervous frenzy and if the global economy can remain durable.

WTI Crude Oil Outlook for December

Speculative price range for WTI Crude Oil is 58.00 to 82.00 USD.

Support for WTI Crude Oil appears rather strong near the 66.00 level, but if it falters because of nervous selling it is possible the 60.00 USD value could be tested. Traders who believe the global commodity market will remain nervous may believe selling the commodity makes sense, but they are urged not to get over confident, because if a reversal higher develops it could be rapid. Vital support for WTI Crude Oil appears to be the 58.00 USD mark, if this level proves weak it would be rather surprising to many and mean fears regarding the new variant of coronavirus have grown louder.

If a trader has the stomach for a contrarian endeavor, now may be the time to pursue upwards momentum. Cautious traders may want to see further downside trading take hold and support levels below to be tested first.

Aggressive traders may feel that any price below 67.00 USD for WTI Crude Oil means it is oversold under the present global economic situation, and that demand will simply not disappear abruptly like it did in the ‘first days’ of coronavirus fear when the oil market actually went negative. It may take a lot of nerve, but buying WTI Crude Oil while using solid stop loss orders may prove to be profitable for traders who believe higher values will develop in December as nervous conditions ease.