The West Texas Intermediate Crude Oil market has essentially gone nowhere during the trading session on Thursday, which of course makes quite a bit of sense considering that the day was Thanksgiving in the United States, which of course is a major holiday and therefore keeps a bit of a lid on how much momentum there could have been. After all, the liquidity and the trading hours available would have been much less than usual, so I would not read too much into the candlestick from the day.

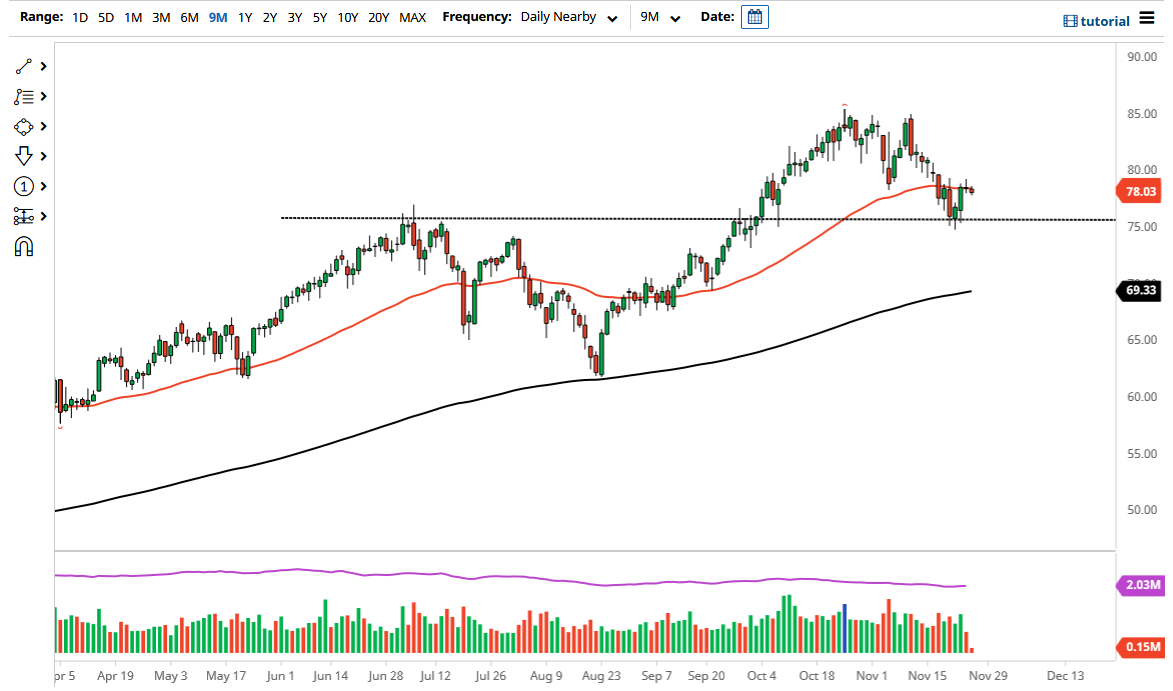

It is worth noting that we have stalled and the 50 day EMA, but we also did that during the previous session and that is why I look at this as a potential matter worth looking at. Dips at this point in time should continue to find plenty of support though, and I do believe that the $75 level will offer a relatively significant amount of support. After all, it is a large, round, psychologically significant figure and an area where we had pulled back from previously.

Now that the SPR release has been announced, traders can focus on the fact that it was only two and half days’ worth of petroleum in the United States, and although there are other countries looking to get involved, at the end of the day it will be interesting to see what OPEC does. It is very possible that OPEC may choose to slow down the increase in oil production as a result, in order to keep prices elevated. Furthermore, demand continues to pick up and it makes quite a bit of sense that we would see prices continue to rise. After all, we had been locked down for about a year and the lack of production had been taken offline. Now that everybody is looking to get back to work, it certainly makes quite a bit of sense that the demand will overwhelm the supply, and lease for the time being. When I look at this chart, I believe that dips will continue to offer plenty of buying opportunities, but if we do break above the $80 level, then it is likely that we will see momentum come back into this market in order to push towards the $85 level longer-term. It is also worth noting that the negative correlation to the US dollar has dissipated a bit.