Today’s AUD/USD Signals

Risk 0.75%

Trades must be entered before 5pm Tokyo time Friday.

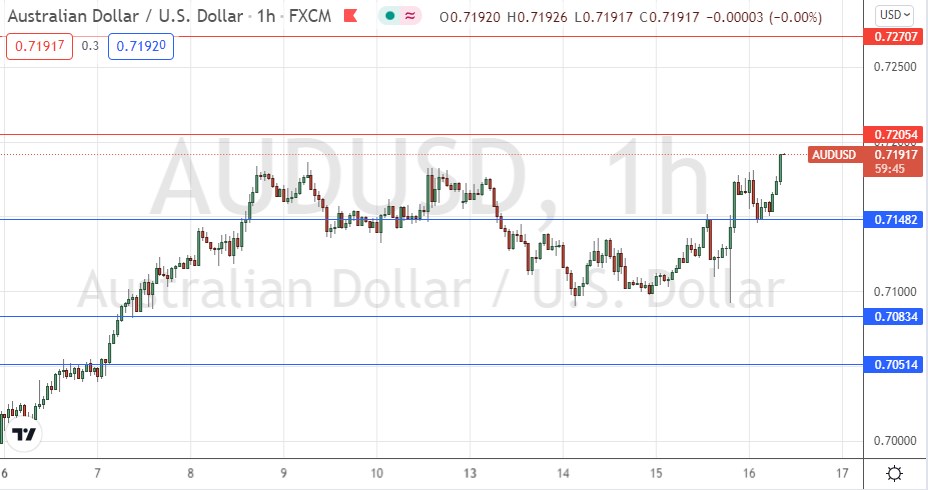

Short Trade Ideas

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7205 or 0.7271.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7148 or 0.7083.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

Yesterday’s FOMC release finally provided some direction and healthy volatility in the Forex market, after several days in which most currency pairs, including this one, moved little and just traded sideways. Although the contents of the release (speeding up tapering so it ends in March and signalling three rate hikes during the remainder of 2022) were not a surprise, the confirmation of this path seems to have cleared the way for a rise in riskier assets such as the Australian dollar and a drop in the US dollar, although this may be much to do with the US Dollar Index reaching a strong overhead technical resistance level.

We also saw stronger than expected employment data released in Australia just a few hours ago, in which the unemployment rate came in at 4.6%, much better than the 5% rate which has been expected. This may have helped boost sentiment in favour of the Australian dollar a little.

The technical picture is bullish, as we see the price moving strongly higher to reach its highest level in three weeks. However, there is a key resistance level close by overhead at 0.7205 and this is likely to be today’s pivotal point. If the price can get established above 0.7205, it is likely to continue ascending to reach at least 0.7250 by the end of this week, and maybe even 0.7271.

Alternatively, if the price reaches 0.7205 and makes a bearish reversal there, this could be an attractive short trade entry signal. The best time to look for these trading setups will be around the start of the today’s New York session.

There is nothing of high importance scheduled today concerning either the AUD or the USD.