Bearish View

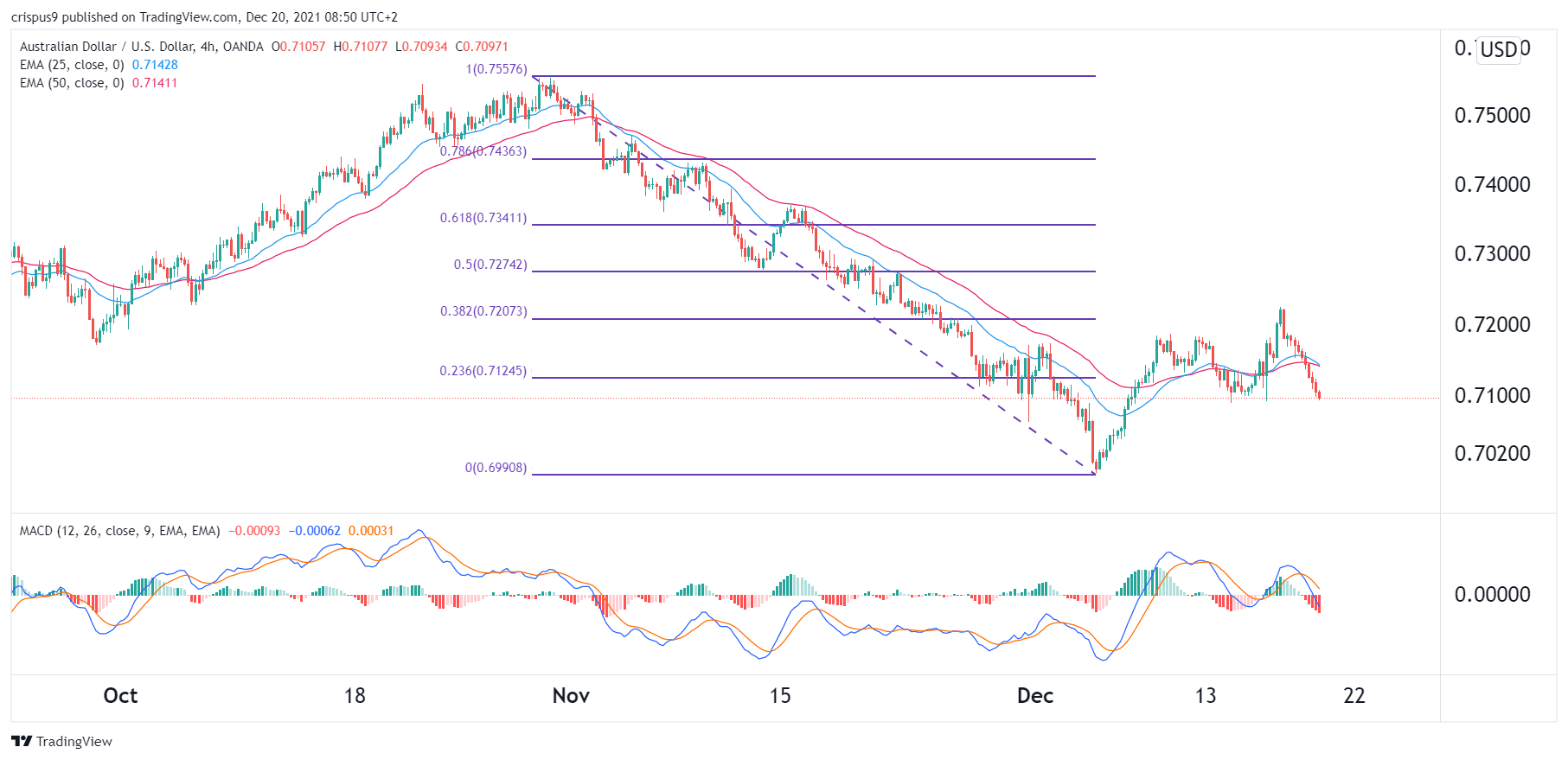

Sell the AUD/USD and set a take-profit at 0.7050.

Add a stop-loss at 0.7200.

Timeline: 1-2 days.

Bullish View

Set a buy-stop at 0.7150 and a take-profit at 0.7250.

Add a stop-loss at 0.7050.

The AUD/USD retreated in the morning session on Monday as investors reflected on the recent interest rate decisions by the Federal Reserve and the Reserve Bank of Australia (RBA). The Omicron variant is also affecting the pair. It is trading at 0.7125, which is slightly below this last week’s high of 0.7225.

RBA and FOMC Decisions

The key driver for the AUD/USD is the recent interest rate decision by the Fed and the RBA. Two weeks ago, the RBA made its decision. The bank predicted that the Australian economy will continue doing well in the coming year.

It also warned that the Omicron variant would pressure the economy. The bank then decided to leave interest rates unchanged and then continue with its quantitive easing policy. On Tuesday, the RBA’s minutes will shed more light about its policy and what we should expect in the coming year.

The Fed, on the other hand, concluded its meeting last week. In it, the bank decided to leave interest rates unchanged. It signalled that it will implement three rate hikes in 2022, higher than what analysts were expecting. Some analysts expect that the first interest rate hike will come as soon as March.

Most importantly, the Fed decided to tweak its quantitative easing (QE) program. It decided to double the amount if taper to about $30 billion. It expects that that it will end the QE program in March next year.

Therefore, with the Fed and RBA decisions done, this week’s economic numbers will have minimal impact on the pair. That’s because the market participants already know what the banks will do. Some of these numbers include the US GDP, consumer confidence, and existing home sales data.

AUD/USD Forecast

The AUD/USD has been in a strong bearish trend in the past few months. The pair managed to decline from 0.7555 in September 29th to about 0.7000 this month. This is about a 7% decline and is mostly because of the strong US dollar amid an expectation of a hawkish Federal Reserve.

The pair has bounced back and is currently trading at 0.7125, which is about 2% above the lowest level this month. It has moved back to the 23.6% Fibonacci retracement level. Also, the pair has moved slightly below the middle line of the Bollinger Bands while the Relative Strength Index (RSI) has declined slightly.

Therefore, there is a likelihood that the pair will keep falling as bears target the oversold level. This will see it retest the key support at 0.7050.