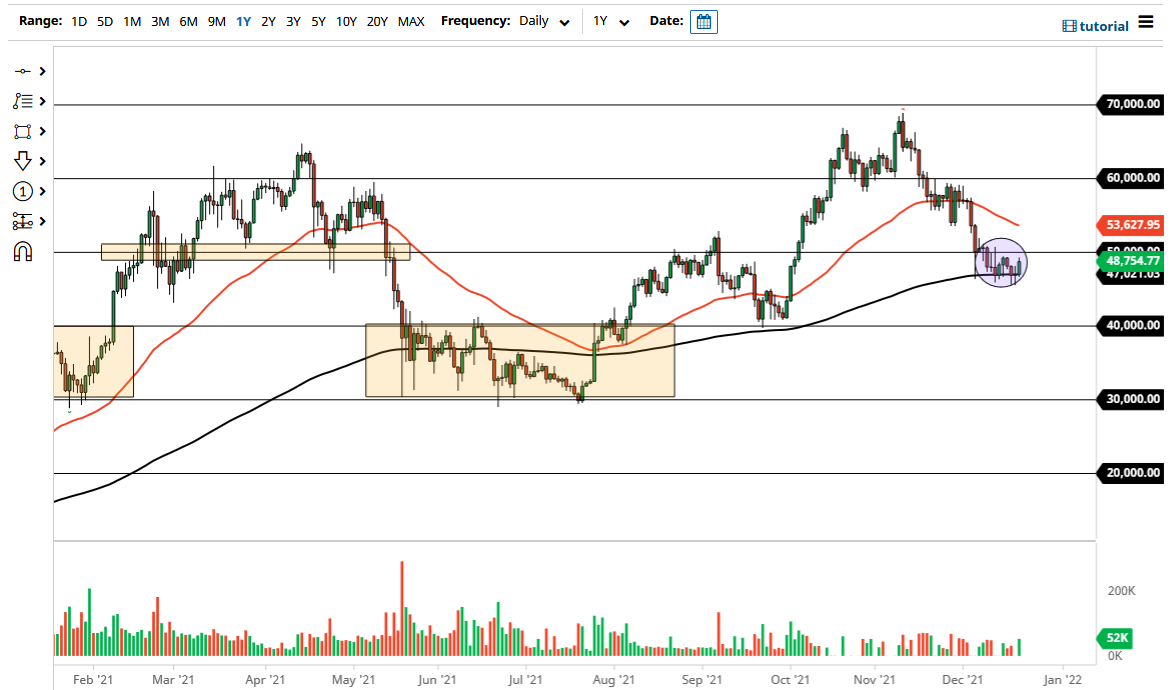

The Bitcoin market bounced significantly on Tuesday as we have used the 200-day EMA as support again. This is an area that has been important more than once, and now that the Bitcoin market looks like it is threatening the $50,000 level, it might be the beginning of a recovery. Quite frankly, this is something that we had been waiting for, as the market has been grinding sideways after pulling back quite significantly.

If we can take out the $50,000 level, it is very likely that more money will flow into the market, having the market reach towards the 50 day EMA next. Breaking above that level then allows the market to go looking towards $60,000 again. Traders have been waiting for some type of “melt up” at the end of the year, and it certainly looks as if we are trying to make that happen.

Underneath, the lows at the $46,000 level have held quite nicely, and it is worth noting that cryptocurrency in general has done fairly well during the session. If we continue to see a lot of momentum coming into the market, then it is likely that we will see big moves, especially once we get into the less liquid time during the Christmas weekend. As liquidity becomes an issue, it will take less to move the market. This is a market that I think is trying to build up a basing pattern, and that is the first step to recovery. This has been a significant pullback, but it certainly looks as if we are finally starting to see signs of hope. The 200 day EMA is an indicator that a lot of people pay close attention to, so it does make sense that buyers have stepped in.

If we do break down below the $46,000 level, I suspect that the $40,000 level will be a major floor in the market, and if we were to break down below there it would be disastrous for Bitcoin. I do not see that happening, and the fact that I am starting to see people talk about the imminent collapse of Bitcoin on social media tells me we are probably closer to the end of the selling than the beginning.