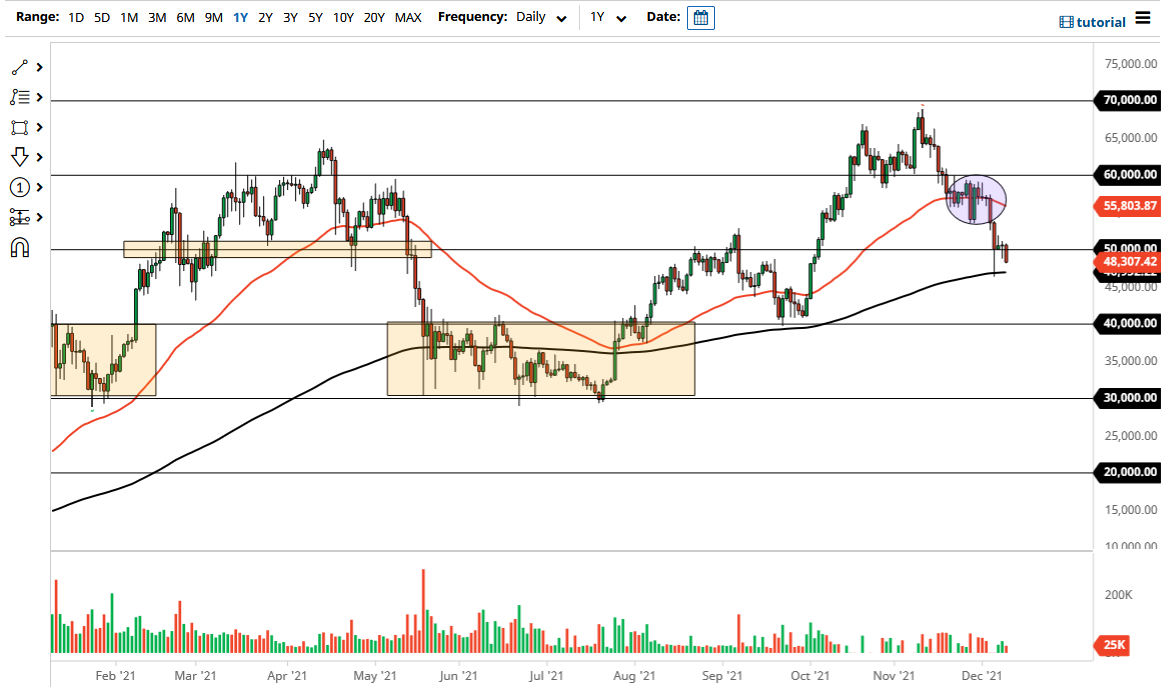

The Bitcoin market continues to underperform a lot of other crypto assets, breaking below the $50,000 level. At this juncture, it looks as if the 200 day EMA is the destination, an area that had been visited previously. At this point, if we can fall below that indicator, I think we have further to go. Bitcoin has not been acting very well, even as other crypto markets have been doing fairly well. Nonetheless, if Bitcoin really starts to selloff, this could have a drastic effect on other crypto in general.

The 200 day EMA is a longer-term technical indicator that a lot of people pay close attention to, so obviously it would catch my attention if we breakdown through it on a daily close. At that point, the $45,000 level is more than likely going to be the initial target, followed by the $40,000 level. The $40,000 level will catch a lot of attention, but it is probably worth noting that it was also the top of a previous consolidation area, which will attract attention in and of itself. Ultimately, this is a market that I think might be due for a little bit more of a correction, based upon the fact that we are closing at the very bottom of the range. In and of itself, that can be thought of as a very negative turn of events, so pay close attention to if this market breaks down, because you will not necessarily just be trying to get rid of your Bitcoin, you may be trying to get rid of several other crypto markets.

On the other hand, if we turn around and take out the $51,000 level, then I think it is more likely than not we go higher, perhaps opening up a recovery towards the 50 day EMA. While I do think that is a very real possibility, the reality is I think we probably have a little bit of a pullback ahead of us in the short term. Do not get me wrong, I am not suggesting that you should short this market, just that you probably will get a better price over the next couple of weeks. After all, almost everybody anticipated the Bitcoin would rally into the end of the year. When that happens, typically the exact opposite ends up being true.