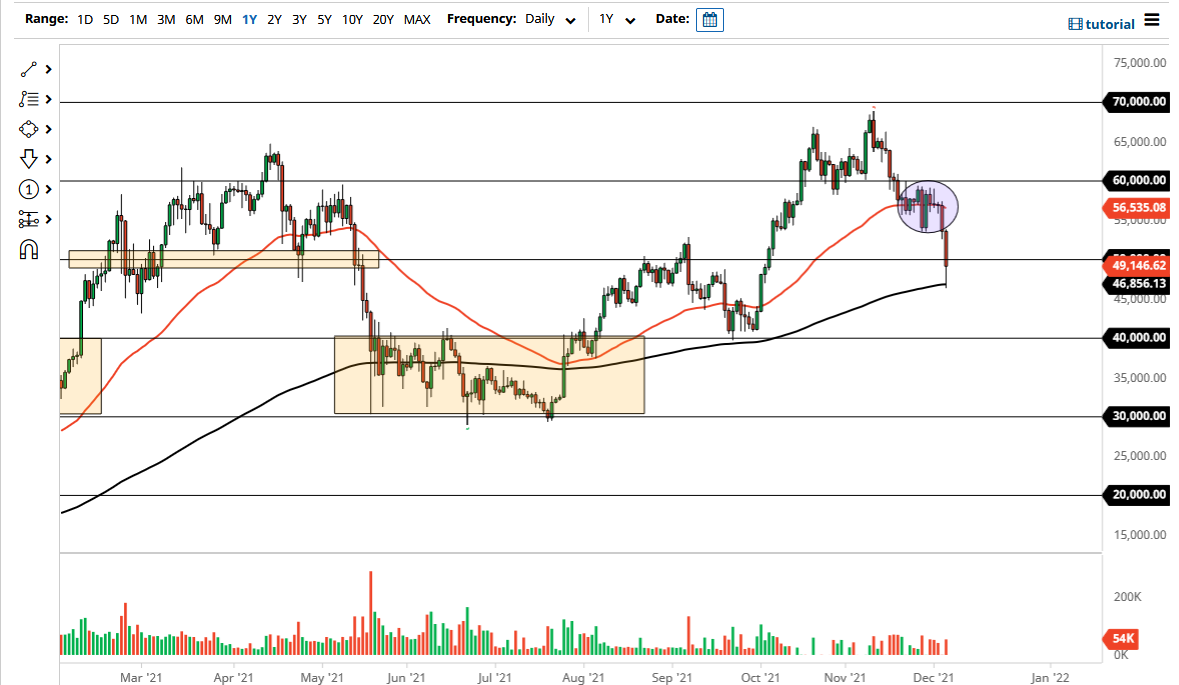

The Bitcoin market broke down significantly over the last couple of days, crashing all the way to the 200-day EMA which is closer to the $47,000 level. That being said, we have recovered quite a bit over the weekend and now are threatening the $50,000 level. The question now is whether or not we can get above that level. I think we will, but that does not necessarily mean we will do it right this second. I think we will continue to see plenty of buyers out there on dips, as the ETF flows will have quite a bit to say as they are more of a retirement asset than simple trading.

It is possible that some of what we had seen over the last couple of weeks has been larger funds taking profits, because quite frankly they had to. There have been pretty significant losses in other markets, so they may had to have close out the big winners in order to take care of the big losers. This happens all the time, because large funds do not trade in any one particular asset, unlike a lot of retail traders, so it is a bit of a disconnect for retail traders to think along those lines.

If we do break down below the 200-day EMA, then it is very likely we would go looking towards the $40,000 level. I would imagine that $40,000 would bring in a lot of money, because that is “Bitcoin at a bargain.” Anything below there would kick off a major route in this market and could send the entire crypto markets crumbling as Bitcoin is the big leader. Interestingly enough, Ethereum has stood its ground fairly firm during the trading session, and that could be a bit of a “heads up” as to what will happen with Bitcoin given enough time. Typically, if Bitcoin sells off it will take everything down with it. That has not necessarily been the case if you look around, as there are some markets in the crypto sphere that are starting to differentiate themselves. Nonetheless, I have no interest in shorting this market and I do think that eventually we will find enough momentum to turn things around and go back towards the highs. With this, I am slowly building a position.