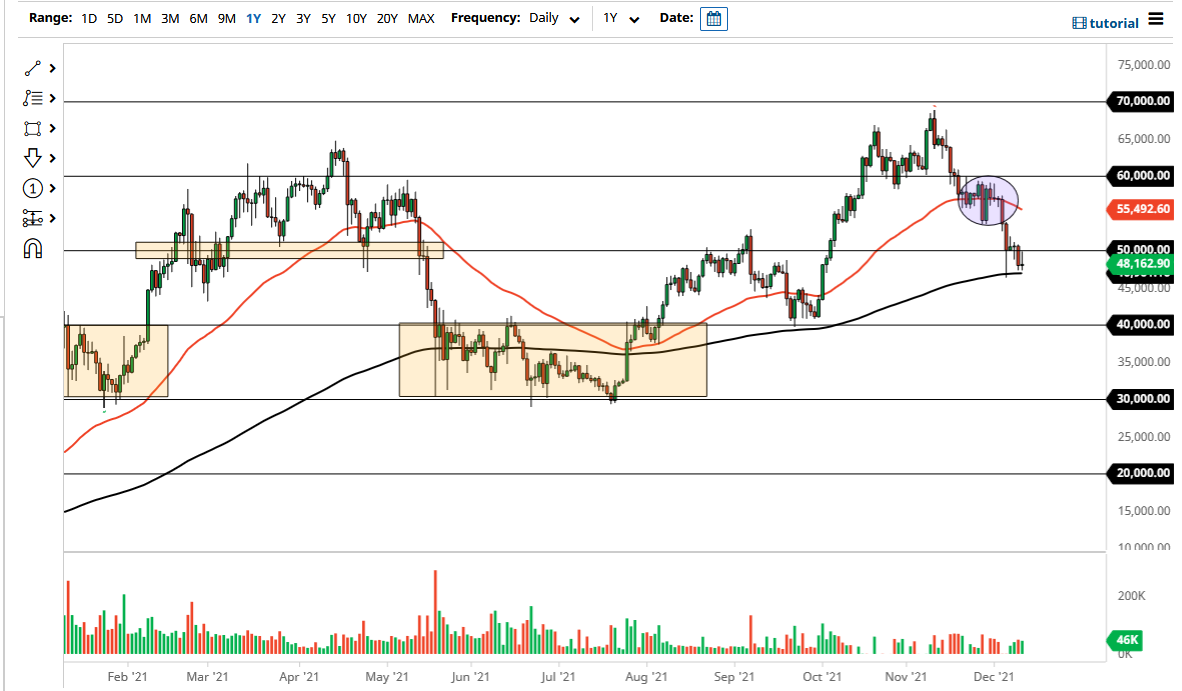

The Bitcoin market initially tried to rally on Friday but gave back gains as we continue to see crypto get hit right along with everything else. The crypto market is much more volatile than other markets, so it should not be a huge surprise to see what has happened. The market is likely to continue to pull back just a bit, but the 200 day EMA could offer a bit of support.

The market breaking above the top of the candlestick for the day would not only allow Bitcoin to break above $50,000 and go higher, but the market could also very well recapture the 50 day EMA. It would be a significant break of short-term resistance as we sold off so hard during the Friday session. The market participants will continue to pay close attention to not only the 200-day EMA, but also the $45,000 level, which has been important. If we break down below there, then the market is likely to go looking towards the $40,000 level given enough time, but I also believe that the market will continue to find plenty of buyers on dips regardless. Bitcoin is being adopted at a faster rate than originally anticipated, and that will continue to drive the value higher.

Furthermore, as we go into next year there should be a lot of institutional investors getting involved, as it was more or less a second half of 2021 phenomenon. With that being the case, the market is likely to continue seeing noisy behavior, but I look at these dips as necessary, because the adoption of Bitcoin continues to be in its early stages, so it is not going to be a straight and smooth path higher. The fact that we are down about 20% really is no different than any other time. At this point, I think if we simply are patient enough, we should get a nice signal to get long again. Shaking out all of the weak hands might have been necessary, and we will see whether or not the longer-term trend can reassert itself.