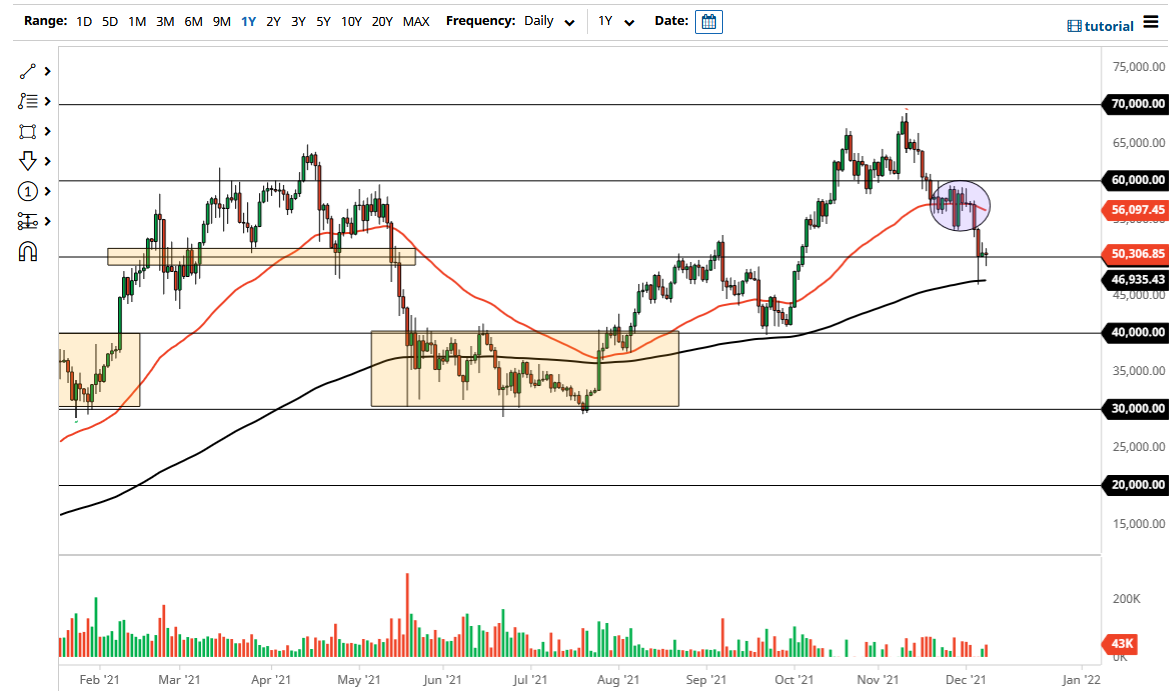

The Bitcoin market dipped ever so slightly on Wednesday but found support underneath to turn things back around. What is interesting is that we are hanging about the $50,000 level, which is a large, round, psychologically significant figure, and an area that has attracted quite a bit of attention in both directions. Furthermore, it is also worth noting that just two days ago we had plunged towards the 200-day EMA before bouncing to show signs of life.

The candlestick from the Wednesday session looks a bit like a hammer, just as the Tuesday candlestick ended up forming a bit of an inverted hammer. In other words, we are seeing confusion and getting ready to form a little bit of a tight range of consolidation hovering right above the $50,000 level. This tells me is that the market is stabilizing and getting ready to make a bigger move. It looks as if the buyers are trying to support Bitcoin in this area, which makes sense considering we been in an uptrend for so long.

If we can break above the top of the inverted hammer, then it is likely that we will continue to go higher, perhaps reaching towards the 50-day EMA which sits just underneath the $57,000 level. If we can break above there, then the market is likely to go looking towards the $60,000 level next. On the other hand, if we were to turn around and break down below the 200-day EMA, then the market could come undone rather quickly, perhaps reaching $40,000 in the blink of an eye. Nonetheless, Bitcoin has been strong for quite some time, and we have had a nice pullback, so I think a lot of value hunters are going to continue to come back into the crypto markets, with Bitcoin being the first place they head towards. The market is going to continue to be very noisy, but at the end of the day I do not see this market breaking down. If we broke down below the $40,000 level, we may have to reassess the situation, but right now it does not look likely to happen. I think there will be plenty of dip buyers out there as we continue to see plenty of longer-term adoption.