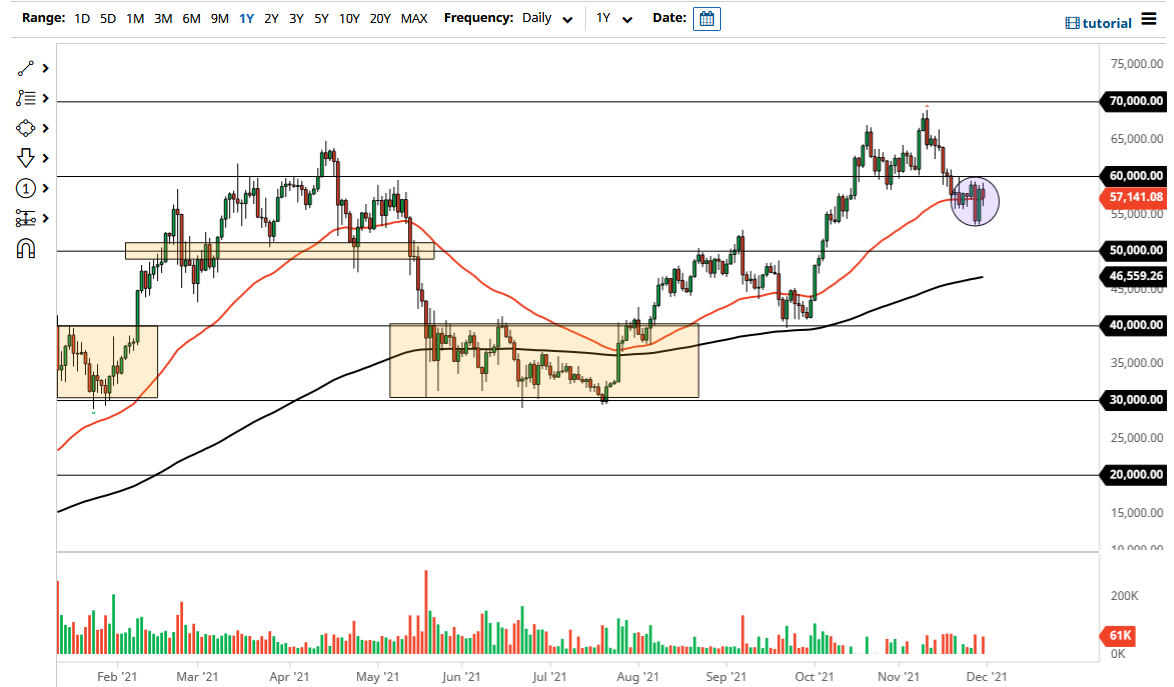

The Bitcoin market went back and forth on Tuesday as the US dollar shot straight up in the air. Quite frankly, the market is likely to see a lot of back and forth in this area, because the 50-day EMA is something that a lot of technical traders pay attention to in the crypto markets. Keep in mind that the market has been very noisy over the last couple of days, but even with a sharp move higher in the US dollar, Bitcoin has remained steadfast. In fact, some of the losses have been recovered in order to form a bit of a hammer.

The $60,000 level above is a large, round, psychologically significant figure that of course will attract a certain amount of attention in and of itself and has been resistance over the last couple of weeks. I do think that we will try to get above there, and if we do, that could open up a big move to the upside. The Bitcoin market has been very bullish until the last couple of weeks, and one could look at this through the prism of a simple pullback in what has been a strong move.

Underneath, the $55,000 level should offer plenty of support, as it has caused the market to bounce recently, and is a large, round, psychologically significant figure as well. In fact, $55,000 has been important a couple of times, so I think that is probably the short-term floor in the market as far as the consolidation is concerned. As long as we stay above there, I think this market looks very strong. If we do break down, then the $50,000 level will be worth watching, because the 200-day EMA is reaching towards that area as well. That being said, I do think it is only a matter of time before Bitcoin rallies, either simply slicing through the $60,000 level, or pulling back towards one of those couple of support levels. I have no interest in shorting Bitcoin anytime soon, and I am not even looking for the downward setup. The Bitcoin market still has much further to go, despite the fact that we have run into a little bit of trouble over the last couple of weeks.