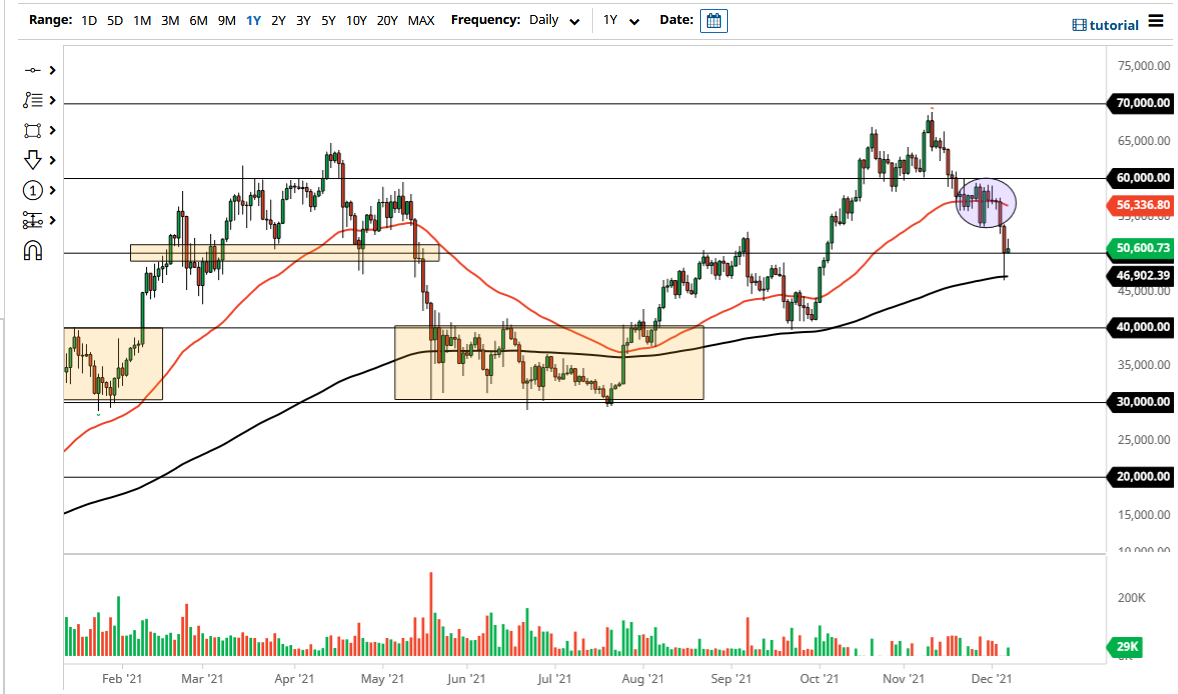

The Bitcoin market rallied a bit on Tuesday but gave back the gains to form a bit of an inverted hammer. That being said, the market looks as if it is hanging about the $50,000 level, perhaps trying to determine whether or not it has enough momentum to go higher. Regardless, I do not have any interest in shorting Bitcoin anytime soon, especially as not only do we have the $50,000 level, but we also have the 200 day EMA sitting just below that could come into the picture.

Bitcoin is a market that you do not want to be short of anytime soon, but you look for dips to offer a bit of value. Whether or not we can hang on to the $50,000 level may make a significant amount of difference, and as long as we can stay above there, then I think the Bitcoin market will be very bullish. Even if we were to break down below there, then we have the 200 day EMA sitting just below the $47,000 level. As long as we stay above that, then we are still technically in an uptrend.

It is not until we break down below the $45,000 level that I become somewhat concerned with the Bitcoin market. The $40,000 level underneath would be the initial target, and any breakdown below that level could open up massive selling. After all, the Bitcoin market is known to have a massive selloff from time to time, but throughout its history those have always been nice buying opportunities, if you are someone that is looking at the longer-term picture. I do not have any interest in trying to short Bitcoin, but I do recognize that you do not necessarily want to jump back into this market with both feet. With the volatility in this market, you want to jump into it very slowly, adding as your position works out. In general, this is a market that continues to see a lot of noisy behavior, but that is nothing new for Bitcoin. Quite frankly, this is one of those deals where the farther it falls, the more interested I get in owning it. A 20% drop is fairly common in Bitcoin, so it is not quite the same psychological damage that you see in other assets such as stocks.