The Bitcoin market rallied initially on Monday, but then turned around to show signs of weakness. That being said, the market is still seeing a lot of back and forth, and it will be interesting to see how Bitcoin behaves over the next couple of weeks due to the fact that people will be paying close attention to the holidays more than trading anything. That being said, it is worth noting that 80% of Bitcoin has never been sold, meaning that most people who are in this market tend to hang on to the asset.

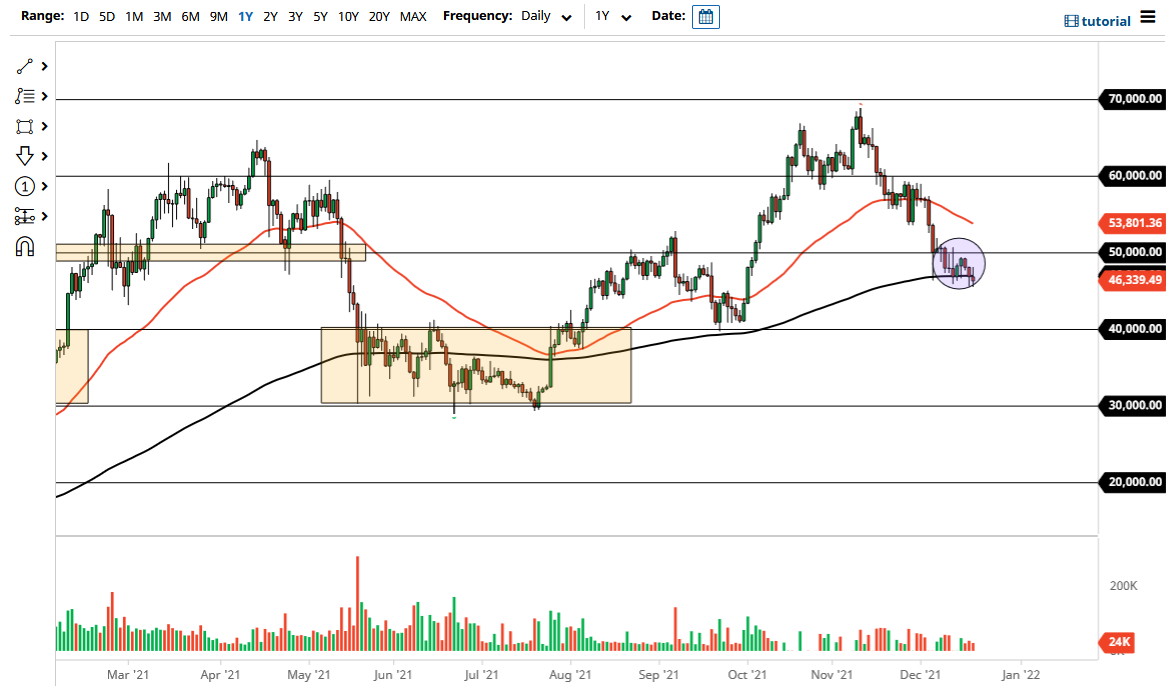

It is because of this that I find it very difficult to short Bitcoin, but I do recognize that you could see a significant selloff. However, if you been trading in crypto for any significant amount of time, you know this is the case. The $45,000 level should continue to offer relative support, and then after that you be looking at $40,000. The $40,000 level has seen quite a bit of action in the past, so it does make sense that it could offer a buying opportunity.

On the other hand, if we were to turn around and break above the $51,000 level, I would anticipate seeing a huge amount of money flowing into this market due to the fact that it would get a sudden melt up type of vibe. Between now and then, I think you will see a lot of back and forth trading, and therefore I think what you have here is a potentially explosive set up later down the road. I think a lot of money will probably flow back into the crypto markets after New Year’s Day, and although I recognize that Bitcoin looks horrible at the moment, I am not worried about the longer-term attitude of this market. In fact, I will be looking to build up a bit of a position on dips. That being said, I am not willing to jump into the market with a huge position, because I think I have plenty of time over the next couple of weeks to get involved. Keep in mind that the overall attitude of this market tends to be erratic, so just about the time when you think the whole things over with, we turn around and take off again.