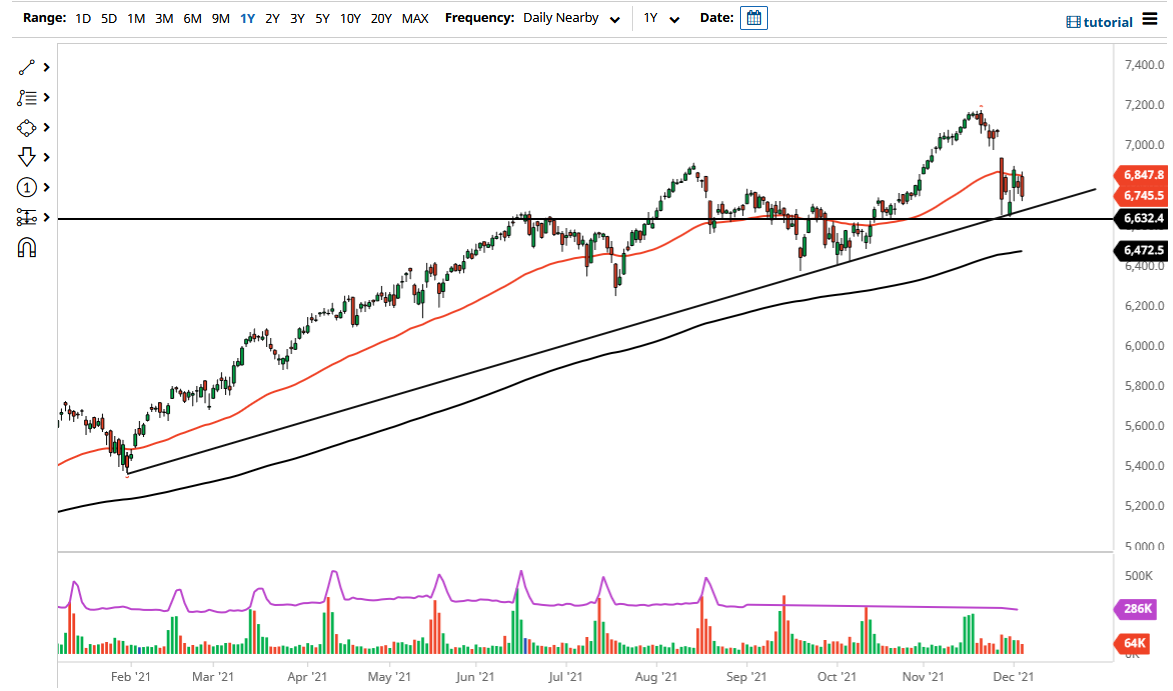

The CAC fell a bit on Friday, pulling back from the 50-day EMA as we continue to consolidate just above a major consolidation of support. At this point, it looks as if the 6850 level continues to be difficult, but we still have a gap above that needs to be filled. Because of this, from a technical analysis standpoint, it looks as if the market could go looking towards the gap given enough time, but we need to see some type of positive catalyst.

It is worth noting that the “confluence of support” underneath includes the 6600 level, but also the uptrend line that we have been following for quite some time. You could even make an argument for a potential symmetrical triangle, so that does suggest that the market is trying to figure out which way it is going. Keep in mind that France is moving right along with risk appetite in other indices, as they all fell on Friday. There was a major “risk off move” around the world, and I think that continues to be what we pay close attention to.

Looking at this chart, the 50-day EMA sits just above, and that is an indicator that you could use as a bit of a barrier to overcome in order to start buying. On the other hand, if we break down below the 6600 level, then it is likely that we could go looking towards the 200-day EMA underneath. The 200-day EMA is starting to resurface at the 6500 level, which of course is a large, round, psychologically significant figure. If we were to break down below that level, then you could start to see a major selloff at this point in time. The CAC is highly levered to luxury brands, so keep in mind that you need a “risk on” type of attitude to get excited. We need to see risk appetite return to multiple markets in order to see some type of move in the CAC to the upside. With this being the case, I think that this remains a “buy on the dips” scenario, but that does not necessarily mean that you need to jump in with both feet. A little bit of caution probably goes a long way.