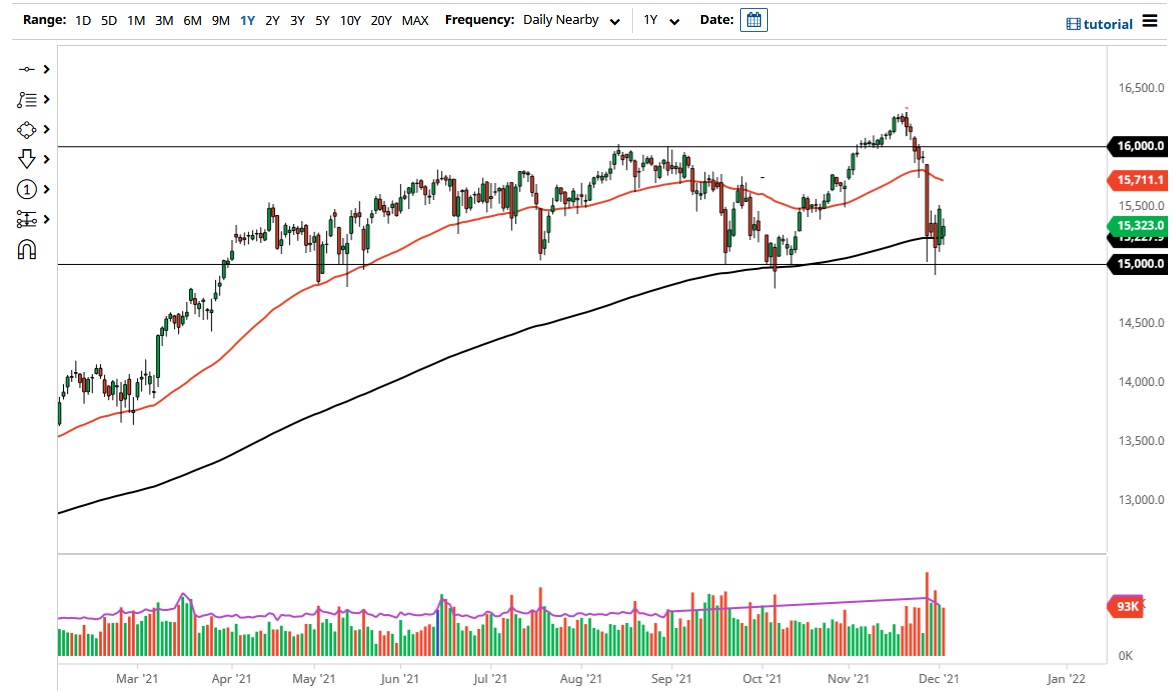

The German index continues to bounce around the 200 day EMA as we have seen a lot of consolidation in this general vicinity. The 200 day EMA is obviously an indicator that a lot of technical traders will jump on, as it continues to be an area that longer-term traders pay close attention to. Furthermore, when you look at this chart, you can see that we have gone back and forth just above the €15,000 level, an area that obviously would be somewhat attractive for traders as well.

When you look at this chart, you can see we are trying to build a bit of a basing pattern, and if we can take out the €15,500 level, I think it is very likely that we go looking towards the €16,000 level again. Ultimately, the market will have to decide whether or not the lock down situation in Germany is going to roll over the cliff, or if we are going to turn around and rally. At this point, the reaction has been somewhat positive, so one would have to think it is probably only a matter of time before we grind higher. After all, we had recently sold off quite drastically only to go sideways, which is the first step in getting things turned around.

That being said, if we were to break down below the €14,900 level, then it could send this market much lower, perhaps down to the €14,000 level. The DAX is going to be just as sensitive to risk appetite as many other indices, despite the fact that Germany is considered to be the “blue-chip index” of the European Union. A cheap euro certainly helps the idea of exports, which the DAX is full of when it comes to large multinational corporations.

One thing is for sure, if the DAX sells off again, nothing good could happen to other indices such as the IBEX, MIB, and other smaller indices on the continent. If this market does rally, those very same indices will be where traders look to next in order to find some type of return. As things stand right now, we have pulled back to a serious support level, and so far, it seems to be doing its job. It is a little early to call it a victory, but it certainly is starting to act like the buyers are willing to step in.