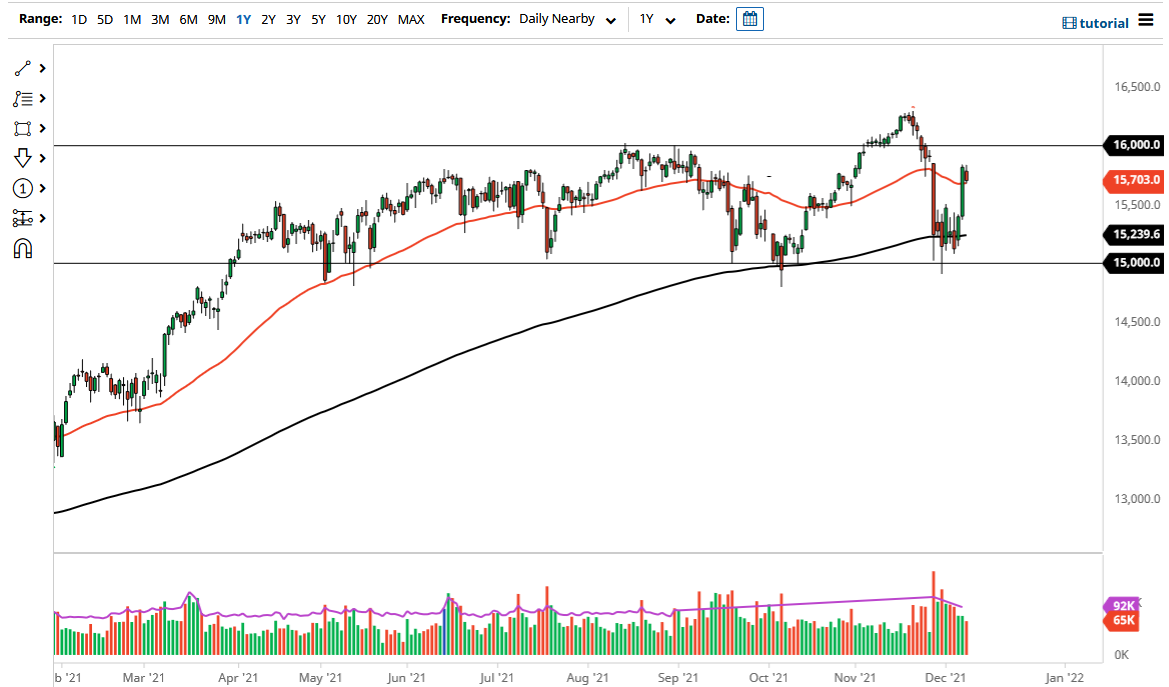

The DAX Index rallied a bit to kick off the day on Wednesday but gave back gains rather quickly. Nonetheless, we stopped at the 50-day EMA which does suggest there is a little bit more in the way of staying power to this move to the upside than initially thought. With that being said, if we can break above the €15,844 level, which is the high of the last two candlesticks, then the market is likely to go higher and reach towards the €16,000 level.

The €16,000 level will be an area worth watching, mainly due to the fact that it has been important more than once. Beyond that, it is also the top of the recent consolidation, so breaking out of that would be a good sign. It would almost certainly send the market looking towards the €16,250 level, and then perhaps even higher towards the €16,500 level.

On the other side of the coin, if we break down below the 50-day EMA, I suspect that the DAX will go looking towards the €15,500 level for support, an area that I think you would probably have to pay close attention to. The market continues to see the DAX through the prism of growth, and whether or not the European Union will continue to grow going forward. The market does look very likely to see a more “back and fill” type of scenario, but I do not have any illusions of this market breaking down. At this point, I believe that the 200-day EMA will be a significant support level as it sits just above the crucial €15,000 level. It is not until we break down through all of that that I would be concerned about the DAX, and at that point in time we would probably see massive selling around the world, not just in Germany. The market certainly seems more likely than not to favor the upside, so I look at any pullback as potential value in a market that has been strong for quite some time. The volatility that we have seen continues to be a major issue, but I do believe you have to look towards the upside due to the fact that all indices around the world continue to get a boost from loose monetary policy, especially in the European Union.