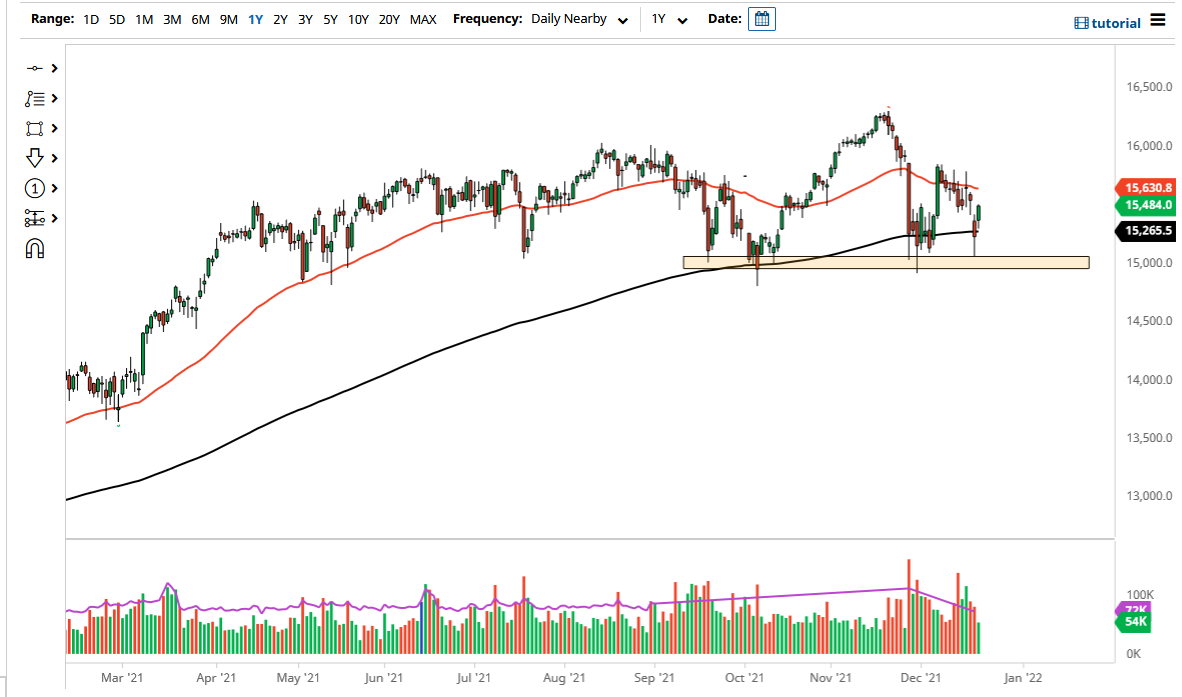

The DAX rallied significantly on Tuesday, as it looks like we are hell-bent on trying to fill the gap from the Monday session. We are pretty close to it, so I think it is probably only a matter of time. The question now is whether or not we can continue to go higher from here? The 50-day EMA currently sits at the €15,630 level and is drifting lower. Because of this, I think there is plenty of resistance above that could come into the picture.

On any signs of exhaustion, I anticipate that you could probably put on a short-term selling position, but I would not get married to it. This is only because of the lack of liquidity and reasoning to put a bunch of money on between here and the end of the year, but markets still move so you can take advantage of them. As long as you are careful with your position size, you can trade the market back and forth and take advantage of the overall sideways nature of the markets in general. The DAX is somewhat elevated due to the fact that the €15,000 level underneath has been massive support, and at this point in time I think it makes sense that we will continue to see a lot of noisy behavior, especially once we get to that area.

If we were somehow to break down below that support level near the €15,000 level, then it would be extraordinarily negative for the DAX, and almost certainly send this market down towards the €14,500 level, maybe even followed by the €14,000 level. That being said, I am not looking for some type of major meltdown, but I do recognize that we could see a lot of chop going into New Year’s Day.

The real move will more than likely come after traders get back to work next year, so the next two weeks should be approached with a lot of caution and small trading positions because when there are not that many traders involved in the market, you have to worry about some type of news event sending the market haywire as there will be as many people there to absorb order flow.