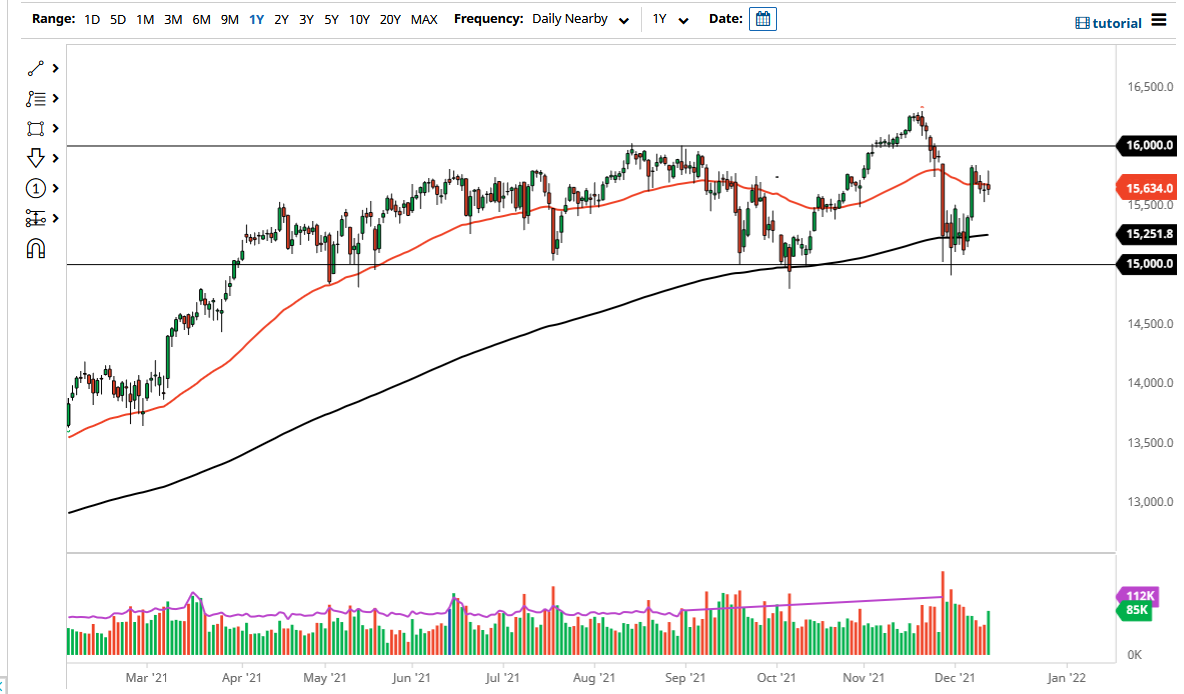

The DAX Index rallied significantly on Monday to kick off the week on a bullish foot but found trouble at the €15,800 level to turn things around and form a shooting star. We are currently sitting around the 50 day EMA, which is essentially flat. Because of this, I think it is probably only a matter of time before we would see a return to the norm, meaning that we are essentially in the midst of a “mean reversion market.”

This time of year does tend to be pretty illiquid, so it is not necessarily a scenario where I would expect to see big moves, at least not without some type of catalyst. When you look at the chart, you can see that we are forming a little bit of a bullish flag, which of course is a good sign, but at the same time it is obvious that we are struggling to go further. If we can break above the highs of the big green candlestick from last week, then we could go looking towards the €16,000 level. The €16,000 level would be a large, round, psychologically significant figure, and an area that has already seen more noise in the past.

To the downside, if we were to break down below the bottom of the hammer from the trading session on Friday, then it is possible that we could go lower. At this point, the market more than likely would go looking towards the 200 day EMA which is currently at the €15,250 level. That obviously would be a negative turn of events, so I do not think it will happen easily. The market will almost certainly be more likely than not to go sideways, as we are trying to figure out the longer-term move. The longer-term move could be a scenario where we have to wait until after New Year’s to get a definitive move or answer. Nonetheless, at the very least I think we are probably looking at the market through the prism of a sideways market with more of a upward type of attitude. I do not expect to see the market do much over the next couple of days, but obviously anything is possible.