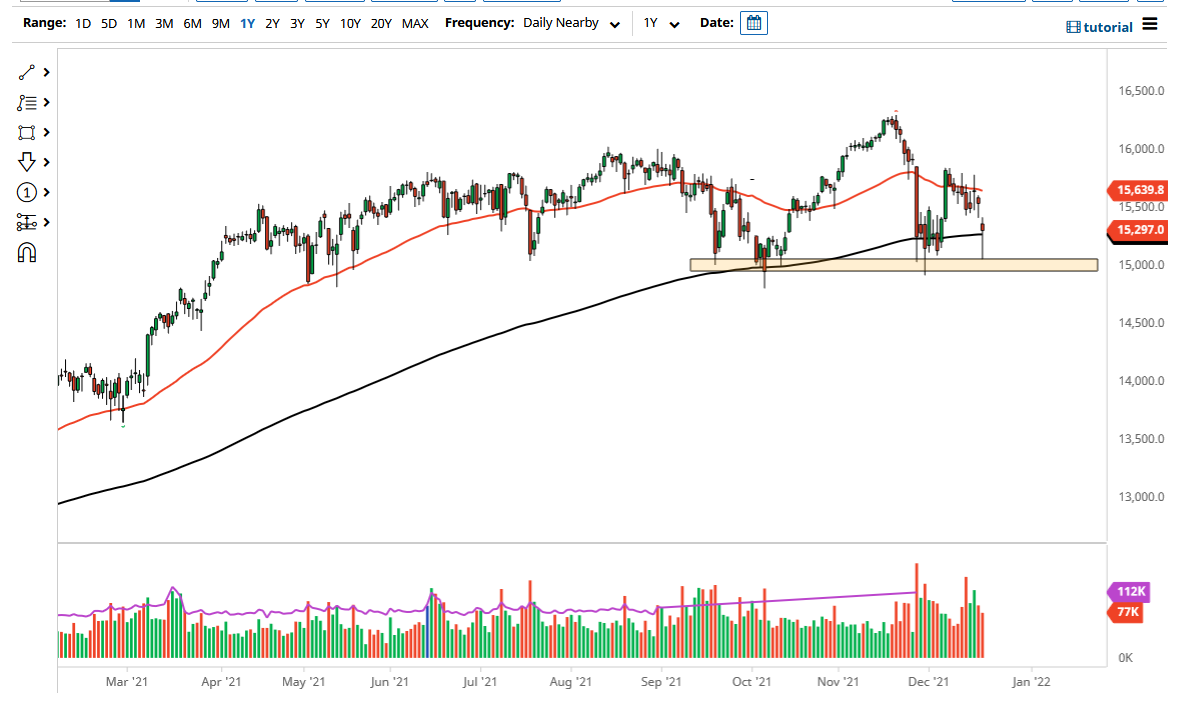

The DAX Index gapped lower to kick off the session on Monday and then absolutely cratered. We ended up falling all the way towards the €15,000 level before turning around, and at the end of the day ended up forming a bit of a hammer. That being said, the gap above should offer a significant amount of resistance, so I think that if we continue to rally from here, then it is likely that we will see a reason to start selling sooner or later. The 50 day EMA currently hangs at the €15,639 level and is drifting lower.

When I look at this chart, I think that there is probably a lot of negativity just waiting to happen, as exhaustion will probably come back into the picture. The rally that we got later in the day is encouraging, but we still have a lot of work to do in order to change the overall attitude of this market. The market breaking down below the €15,000 level could open up the possibility of a move down to the €14,000 level, which would be a major move lower. On the other hand, if we were to break above the €15,750 level, then we could go to the all-time highs again.

Keep in mind that a lot of money flows into the DAX first when it comes to the European Union, as the German index represents the largest amount of trading capital and liquidity, as well as the largest economy on the continent. As Germany goes, so goes the EU and therefore that makes the DAX important to pay attention to. In other words, if this thing can stabilize, then you will see indices across the continent stabilize. However, if the DAX were to fall through the €15,000 level, a lot of the smaller indices would be falling apart rather quickly, which is the real trade when it comes to shorting Europe.

In general, this is a market that I think will continue to be noisy, but that is more than likely going to be due to the end of the year type of situation and a lot of concerns that perhaps Germany could be heading into a recession. While that is a little bit early of a call, it certainly looks as if Germany is slowing down a bit.