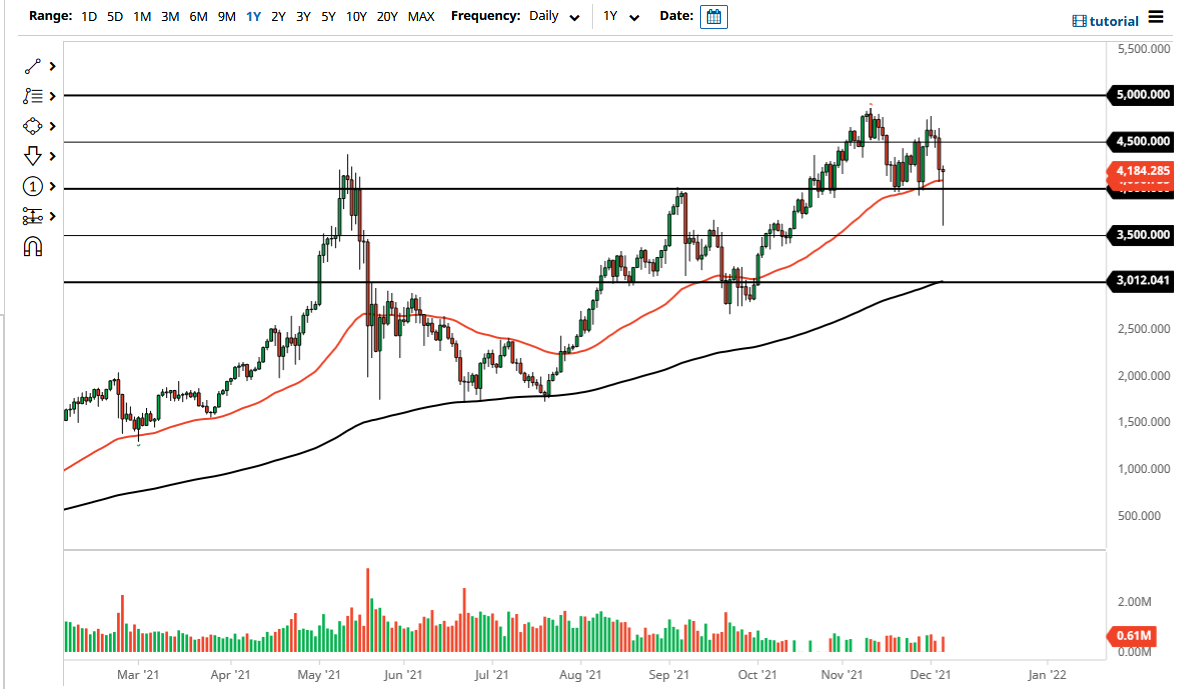

The Ethereum market was all over the place throughout the weekend, as it sold off just like Bitcoin did. That being said, we have turned around to show signs of life and it looks as if the market is going to continue to see plenty of buyers on dips. There was a bit of a flash crash, but you can see that we have now recaptured the $4000 level, the 50-day EMA, and now look very likely to threaten $4200.

Full disclosure: I am a longer-term holder of Ethereum, and I do think that it has much further to go over the longer term. That being said, it is very noisy, so it makes quite a bit of sense that we would see the occasional selloff like we had over the weekend. This is a market that looks as if it is going to continue to see a lot of volatility, but that is nothing new for a crypto trader. The fact that we turned around the way we did tells me that there are plenty of people out there willing to buy each dip. The fact that we turned around as quickly as we did also tells me that we are going much higher over the longer term.

To the downside, we would need to take out the $3500 level to look even remotely bearish at this point. I think it is more likely that we take out the $4500 level to the upside than break down like that. If we do, then I think it opens up the door to a $5000 print. That will be a very important psychological level, but I think at the end of the day it will be just that - psychological. After all, we saw the same thing when Bitcoin broke above the $20,000 level and there was a bit of hesitation for a while. However, once we broke above that level, the market really took off for Bitcoin and as a result, I think we are about to see the same thing in Ethereum. Granted, I do not use leverage when it comes to this particular asset, and I can wait if I have to in order to find gains. If we are all over the place, I will simply buy on dips. It is not we break down below the $3000 level that we could enter “crypto winter.”